Page 100 - SHB 2020 Issue 1

P. 100

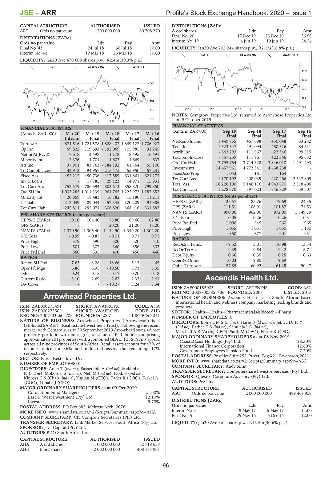

JSE – ARR Profile’s Stock Exchange Handbook: 2020 – Issue 1

CAPITAL STRUCTURE AUTHORISED ISSUED DISTRIBUTIONS [ZARc]

ART Ords no par value 200 000 000 80 708 270 A ord shares Ldt Pay Amt

Final No 20 17 Dec 19 23 Dec 19 56.98

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt Interim No 19 4 Jun 19 10 Jun 19 54.54

Final No 43 24 Jul 18 30 Jul 18 10.00 LIQUIDITY: Jan20 Ave 202 244 shares p.w., R2.1m(16.8% p.a.)

Interim No 42 19 Mar 18 26 Mar 18 10.00

SAPY 40 Week MA AWAPROPA

LIQUIDITY: Jan20 Ave 470 608 shares p.w., R2.4m(30.3% p.a.)

IIND 40 Week MA ARGENT

1156

1066

646

976

570

886

494

796

419 2015 | 2016 | 2017 | 2018 | 2019

NOTES: Gemgrow Prop er ties Ltd. renamed to Arrowhead Prop er ties Ltd.

343 on 9 October 2019.

2015 | 2016 | 2017 | 2018 | 2019

FINANCIAL STATISTICS

FINANCIAL STATISTICS

(Amts in ZAR’000) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16 (Amts in ZAR’000) Sep 19 Sep 18 Sep 17 Sep 16

Final

Final

Final

Final

Interim Final Final Final Final

Turnover 871 516 1 721 578 1 828 407 1 849 127 1 706 923 NetRent/InvInc 1 449 755 467 698 430 048 83 282

Total Inc

1 523 647

84 511

450 516

491 094

Op Inc 59 822 119 692 - 192 069 105 985 91 245

NetIntPd(Rcvd) 7 618 4 498 11 178 18 495 16 491 Attrib Inc - 843 293 111 967 422 346 99 515

422 346

TotCompIncLoss

95 682

111 967

- 857 259

Minority Int 2 376 1 701 1 602 1 669 637 Ord UntHs Int 7 795 764 3 714 528 3 846 010 1 491 493

Att Inc 37 901 83 763 - 184 192 61 764 55 100

TotCompIncLoss 42 912 94 957 - 215 475 55 950 57 231 Investments 14 457 961 4 772 341 4 438 238 - -

164

1 043

181

FixedAss/Prop

Fixed Ass 452 212 450 736 417 589 631 861 621 273

220 466

1 170 192

208 039

Inv & Loans - 17 785 29 123 14 971 15 931 Tot Curr Ass 16 226 100 5 146 116 4 943 670 2 517 805

Total Ass

2 518 406

Tot Curr Ass 752 579 786 594 803 613 858 820 799 850

Tot Curr Liab 1 278 570 397 023 746 829 659 507

Ord SH Int 1 035 285 1 014 139 961 745 1 222 972 1 187 652

Minority Int 20 859 18 483 16 782 15 180 11 211 PER SHARE STATISTICS (cents per share)

LT Liab 213 049 89 044 57 345 120 209 91 885 HEPS-C (ZARc) - 125.57 85.76 79.69 24.35

Tot Curr Liab 242 811 292 074 306 820 368 416 331 882 DPS (ZARc) 111.51 106.91 101.87 74.53

NAV PS (ZARc) 990.00 962.00 972.00 3 149.79

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 50.10 104.40 76.80 69.60 62.80 3 Yr Beta 0.05 0.26 0.26 0.51

960

945

965

DPS (ZARc) - - 20.00 21.00 18.00 Price Prd End 1 000 1 031 1 050 1 180

Price High

1 035

NAV PS (ZARc) 1 370.90 1 305.40 1 144.90 1 349.20 1 302.20

3 Yr Beta - 0.99 - 0.87 - 0.01 0.71 0.71 Price Low 850 377 901 951

RATIOS

Price High 579 590 500 520 510

Price Low 501 307 360 356 302 RetOnSH Funds - 9.52 3.01 10.98 13.34

Price Prd End 560 535 400 450 440 RetOnTotAss 9.39 9.54 9.42 6.71

0.63

0.25

0.66

Debt:Equity

0.35

RATIOS

9.69

9.80

Ret on SH Fnd 7.63 8.28 - 18.66 5.12 4.65 OperRetOnInv 10.03 60.92 61.29 50.47 -

OpInc:Turnover

57.85

Oper Pft Mgn 6.86 6.95 - 10.50 5.73 5.35

D:E 0.24 0.15 0.17 0.20 0.18

Current Ratio 3.10 2.69 2.62 2.33 2.41 Ascendis Health Ltd.

Div Cover - - - 10.27 3.24 3.34 ASC

ISIN: ZAE000185005 SHORT: ASCENDIS CODE: ASC

REG NO: 2008/005856/06 FOUNDED: 2008 LISTED: 2013

Arrowhead Properties Ltd. NATURE OF BUSINESS: Ascendis Health is a South African-based

international health and wellness company marketing leading brands and

ARR

ISIN: ZAE000275491 SHORT: AWAPROPA CODE: AHA products.

ISIN: ZAE000275509 SHORT: AWAPROPB CODE: AHB SECTOR: Health—Health—Pharmaceuticals&Biotech—Pharm

REG NO: 2007/032604/06 FOUNDED: 2007 LISTED: 2011 NUMBER OF EMPLOYEES: 0

NATURE OF BUSINESS: Arrowhead Properties (‘Arrowhead’) is a DIRECTORS: Bomela M S (ind ne), Harie B (ld ind ne), Jekwa Dr N Y

JSE-listed SA REIT (Real Estate Investment Trust). Following the recent (ind ne), Pather K S (ind ne), Sebulela J G (ind ne),

merger with Gemgrow, as at 30 September 2019 Arrowhead owns a direct Marshall A B (Acting CEO), Sardi M (CEO), Futter K (CFO)

property portfolio with an aggregate value of R11 billion comprising MAJOR ORDINARY SHAREHOLDERS as at 08 Nov 2019

approximately 201 properties with a combined GLA of 1 335 197m² spread Coast2Coast Holdings (Pty) Ltd. 28.30%

across all nine provinces of South Africa. Retail assets account for 47% of International Finance Corporation 12.60%

income, office for 36% and industrial assets the remaining 17% Government Employees Pension Fund 7.20%

respectively. POSTAL ADDRESS: PostNet Suite 252, Private Bag X21, Bryanston, 2021

SECTOR: Fins—Rest—Inv—Div

NUMBER OF EMPLOYEES: 0 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ASC

DIRECTORS: Adler T (ind ne), Basserabie A (ind ne), Makhoba COMPANY SECRETARY: Andy Sims

N (ind ne), Mokorosi S (ind ne), Nell M (ind ne), Noik S (ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Kinross G S (Chair, ind ne), Kaplan M (CEO), Kader R (COO), Kirkel A SPONSOR: Questco Corporate Advisory (Pty) Ltd.

(COO), Limalia J (CFO) AUDITORS: PwC Inc.

MAJOR ORDINARY SHAREHOLDERS as at 09 Oct 2019 CAPITAL STRUCTURE AUTHORISED ISSUED

Coronation Fund Managers 21.00% ASC Ords no par value 2 000 000 000 489 469 959

East & West Investment (Pty) Ltd. 12.10%

Investec 9.70% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 685, Melrose Arch, 2076 Ords no par value Ldt Pay Amt

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AHA Interim No 6 9 May 17 15 May 17 11.00

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. Final No 5 29 Nov 16 5 Dec 16 12.00

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. LIQUIDITY: Jan20 Ave 3m shares p.w., R15.5m(30.6% p.a.)

SPONSOR: Java Capital (Pty) Ltd.

AUDITORS: BDO South Africa Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

AHA A ord shares 1 000 000 000 62 718 658

AHB B ord shares 2 000 000 000 408 184 961

96