Page 88 - SHB 2020 Issue 1

P. 88

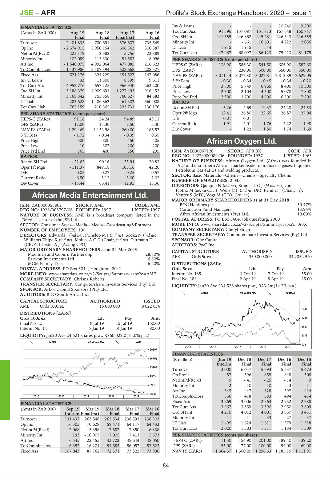

JSE – AFR Profile’s Stock Exchange Handbook: 2020 – Issue 1

FINANCIAL STATISTICS Inv & Loans - - - 10 240 9 200

(Amts in ZAR’000) Aug 19 Aug 18 Aug 17 Aug 16 Tot Curr Ass 91 396 137 087 151 713 167 648 160 747

Final Final Final(rst) Final Ord SH Int 241 555 246 862 245 281 226 643 216 559

Turnover 2 401 835 700 691 576 607 735 569 Minority Int - - 661 16 601 4 222 2 056

Op Inc - 2 674 915 5 950 154 606 362 310 387 LT Liab 1 915 1 915 544 - -

NetIntPd(Rcvd) - 223 179 - 2 582 5 756 22 889 Tot Curr Liab 47 967 68 097 86 123 75 413 81 175

Minority Int 102 089 115 330 51 583 - 8 096 PER SHARE STATISTICS (cents per share)

Att Inc - 1 540 075 4 992 064 477 085 216 623 HEPS-C (ZARc) 138.90 586.30 541.50 606.90 587.60

TotCompIncLoss - 1 437 986 5 107 394 528 668 208 527 DPS (ZARc) - 230.00 300.00 350.00 350.00

Fixed Ass 521 176 324 229 154 527 147 086 NAV PS (ZARc) 3 011.14 3 077.30 3 027.81 2 813.89 2 629.05

Inv & Loans 33 11 808 8 399 9 611 3 Yr Beta - 0.30 - 0.34 - 0.45 - 0.34 - 0.20

Tot Curr Ass 4 952 776 657 125 966 940 263 200 Price High 3 800 5 749 6 965 8 400 10 300

Ord SH Int 3 188 379 4 909 691 1 277 493 916 452 Price Low 2 300 2 104 4 500 5 070 7 800

Minority Int 3 168 842 755 358 760 627 84 583 Price Prd End 2 300 3 700 4 500 6 500 7 800

LT Liab 283 628 1 486 862 461 302 560 008 RATIOS

Tot Curr Liab 762 159 210 365 322 731 130 176 Ret on SH Fnd - 5.26 4.69 19.37 24.28 24.53

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 12.41 26.80 22.65 26.87 27.04

HEPS-C (ZARc) 91.16 24.24 94.89 43.11 D:E 0.01 0.01 - - -

DPS (ZARc) 17.00 15.30 7.50 3.30 Current Ratio 1.91 2.01 1.76 2.22 1.98

NAV PS (ZARc) 1 294.69 1 152.98 260.00 186.52 Div Cover - 1.22 1.80 1.74 1.69

3 Yr Beta - 1.72 - 0.34 - 0.39 0.35

Price High 500 800 450 405 African Oxygen Ltd.

Price Low 10 307 200 200

AFR

Price Prd End 165 400 350 295 ISIN: ZAE000067120 SHORT: AFROX CODE: AFX

RATIOS REG NO: 1927/000089/06 FOUNDED: 1927 LISTED: 1963

Ret on SH Fnd - 22.62 90.16 25.94 20.83 NATURE OF BUSINESS: African Oxygen Ltd. (Afrox) was founded in

1927 and is southern Africa’s market leader in industrial gases, Liquefied

Oper Pft Mgn - 111.37 849.18 105.16 42.20

Petroleum Gas (LPG) and welding products.

D:E 0.05 0.27 0.25 0.57 SECTOR: Basic Materials—Chems—Chems—Specialty Chems

Current Ratio 6.50 3.12 3.00 2.02 NUMBER OF EMPLOYEES: 2 035

Div Cover - 18.44 66.41 12.95 13.36

DIRECTORS: Qangule N (ind ne), Strauss L G J (ld ind ne), von

Plotho M (ne, German), Wells C F (ind ne, UK), Panikar J (Chair, ne),

African Media Entertainment Ltd. Venter S (MD), Vogt M (CFO, German)

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018

AFR

ISIN: ZAE000055802 SHORT: AME CODE: AME BOC Holdings plc 50.47%

REG NO: 1926/008797/06 FOUNDED: 1997 LISTED: 1997 Coronation Fund Managers 13.94%

NATURE OF BUSINESS: AME is a broadcast company listed in the Afrox African Investments (Pty) Ltd. 10.00%

“Media” sector of the JSE Ltd. POSTAL ADDRESS: PO Box 5404, Johannesburg, 2000

SECTOR: Consumer Srvcs—Media—Media—Broadcasting&Entment MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AFX

NUMBER OF EMPLOYEES: 100 COMPANY SECRETARY: Cheryl Singh

DIRECTORS: Edwards J (ind ne), Prinsloo M J (ind ne), Sooka N (ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Williams-Thipe K (ind ne), Molusi A C G (Chair, ind ne), Tiltmann D SPONSOR: One Capital

(CEO), Isbister A J (Acting CFO) AUDITORS: PwC Inc.

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019 CAPITAL STRUCTURE AUTHORISED ISSUED

Moolman and Coburn Partnership 28.80% AFX Ords 5c ea 350 000 000 342 852 910

Barwon Investments Ltd. 6.60%

MGM Family Trust 6.20% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 3014, Houghton, 2041 Ords 5c ea Ldt Pay Amt

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AME Interim No 185 1 Oct 19 7 Oct 19 55.00

COMPANY SECRETARY: Chrisna Roberts Final No 184 2 Apr 19 8 Apr 19 25.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jan20 Ave 934 526 shares p.w., R23.2m(14.2% p.a.)

SPONSOR: Arbor Capital Sponsors (Pty) Ltd.

AUDITORS: BDO South Africa Inc. CHES 40 Week MA AFROX

CAPITAL STRUCTURE AUTHORISED ISSUED

AME Ords 100c ea 15 000 000 8 022 034

2744

DISTRIBUTIONS [ZARc]

Ords 100c ea Ldt Pay Amt 2288

Final No 15 9 Jul 19 15 Jul 19 150.00

Interim No 14 8 Jan 19 14 Jan 19 80.00 1833

LIQUIDITY: Jan20 Ave 24 621 shares p.w., R860 022.0(16.0% p.a.) 1378

MEDI 40 Week MA AME

922

2015 | 2016 | 2017 | 2018 | 2019

20307

FINANCIAL STATISTICS

16706 (R million) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15

Interim Final Final Final Final

13104

Turnover 3 000 6 047 5 693 5 537 5 473

Op Profit 457 596 855 848 508

9503

NetIntPd(Rcvd) 9 - 41 - 25 - 14 9

5901 Minority Int 2 10 10 3 11

Att Inc 345 447 628 597 414

2300 TotCompIncLoss 336 418 683 494 474

2015 | 2016 | 2017 | 2018 | 2019

Fixed Ass 3 269 3 006 2 964 2 952 2 988

FINANCIAL STATISTICS

(Amts in ZAR’000) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16 Tot Curr Ass 3 967 3 359 3 390 2 950 2 609

Interim Final(rst) Final Final Final Ord SH Int 4 210 4 012 4 001 3 657 3 431

Turnover 131 437 263 548 262 534 238 593 238 303 Minority Int 11 11 33 27 37

Op Inc 16 305 70 628 59 471 64 117 64 433 LT Liab 1 495 1 624 1 611 1 579 1 518

NetIntPd(Rcvd) - 2 068 - 5 398 - 7 682 - 7 850 - 6 338 Tot Curr Liab 2 020 1 303 1 311 1 184 1 309

Minority Int 193 - 10 907 7 005 7 413 5 573 PER SHARE STATISTICS (cents per share)

Att Inc - 6 545 22 455 43 722 48 644 48 050 HEPS-C (ZARc) 111.30 154.90 201.00 189.40 139.20

TotCompIncLoss - 6 352 16 204 54 685 56 057 53 623 DPS (ZARc) 55.00 77.00 100.00 94.00 69.00

Fixed Ass 107 043 87 762 72 371 73 822 73 996 NAV PS (ZARc) 1 364.37 1 300.20 1 296.63 1 185.15 1 111.91

84