Page 89 - SHB 2020 Issue 1

P. 89

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – AFR

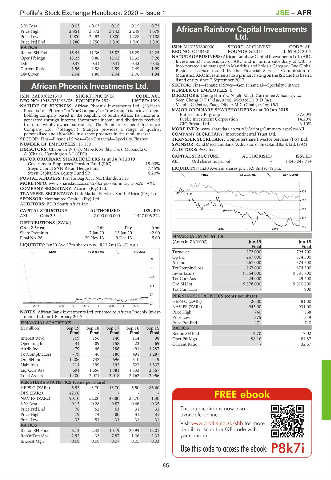

3 Yr Beta 0.03 - 0.03 0.15 0.15 0.73

Price High 2 851 3 372 3 143 2 249 1 679 African Rainbow Capital Investments

Price Low 1 900 2 493 1 800 1 228 1 108 Ltd.

Price Prd End 2 280 2 750 2 800 1 900 1 300

AFR

RATIOS ISIN: MU0553S00000 SHORT: ARCINVEST CODE: AIL

Ret on SH Fnd 16.44 11.36 15.82 16.29 12.25 REG NO: C148430 FOUNDED: 2015 LISTED: 2017

Oper Pft Mgn 15.23 9.86 15.02 15.32 9.28 NATURE OF BUSINESS: African Rainbow Capital Investments Ltd. (ARC

D:E 0.47 0.41 0.41 0.43 0.45 Investments), a subsidiary of ARC and in turn a subsidiary of UBI, is

incorporated and managed in Mauritius and holds a Category One Global

Current Ratio 1.96 2.58 2.59 2.49 1.99 Business Licence issued by the Financial Services Commission of

Div Cover 2.04 1.88 2.04 2.06 1.94 Mauritius. ARC Investments has a primary listing on the JSE and has been a

listed entity since 7 September 2017.

African Phoenix Investments Ltd. SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance

NUMBER OF EMPLOYEES: 0

AFR

ISIN: ZAE000221370 SHORT: PHOE NIX CODE: AXL DIRECTORS: Cheng Hin Y C N (alt, Mau), Currimjee A (ind ne), Lo

REG NO: 1946/021193/06 FOUNDED: 1974 LISTED: 1998 Seen Chong D T (ind ne, Mau), Mokate Dr R D (ne),

NATURE OF BUSINESS: African Phoenix Investments Ltd. (“African Msipha C (ind ne, Zim), Olivier M C (Chair, ind ne, UK)

Phoenix” or “Phoenix” or “the Company” or “the Group”) is an investment MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2018

holding company based in the Republic of South Africa. Its income is Entities in UBI group 57.60%

generated through interest, investment income and dividends received Public Investment Corporation 14.20%

from its wholly-owned subsidiary, The Standard General Insurance GIC Private Ltd. 3.10%

Company Ltd. (“Stangen”). Stangen provides a range of quality, MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AIL

personalised and affordable insurance products in the retail market. COMPANY SECRETARY: Intercontinental Trust Ltd.

SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 13 180 SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd. (SA))

DIRECTORS: Chapman W (ne), Mabe K M (ld ind ne), Mabandla O AUDITORS: PwC Inc.

A (Chair), Hannington A J (CFO) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 24 Jul 2019 AIL Ord shares no par val - 1 045 047 714

Government Employees Pension Fund (PIC) 15.00%

Steyn Capital SNN Retail Hedge Fund 7.45% LIQUIDITY: Jan20 Ave 2m shares p.w., R9.8m(9.7% p.a.)

Steyn Capital SA Equity Fund SP 6.20%

FINA 40 Week MA ARCINVEST

POSTAL ADDRESS: Private Bag X31, Northlands, 2116

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AXL

COMPANY SECRETARY: Acorim (Pty) Ltd.

804

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

SPONSOR: Merchantec Capital (Pty) Ltd. 702

AUDITORS: BDO South Africa Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED 600

AXL Ords 2.5c ea 2 000 000 000 1 427 005 272

497

DISTRIBUTIONS [ZARc]

Ords 2.5c ea Ldt Pay Amt 2018 | 2019 395

Share Premium 7 Jan 20 13 Jan 20 42.00

Final No 26 29 Nov 13 9 Dec 13 5.00 FINANCIAL STATISTICS

(Amts in ZAR’000) Jun 19 Jun 18

LIQUIDITY: Jan20 Ave 17m shares p.w., R13.2m(63.4% p.a.)

Final Final

GENF 40 Week MA PHOENIX Turnover 272 000 794 700

Op Inc 267 000 674 500

393

Att Inc 267 000 674 500

319 TotCompIncLoss 267 000 674 500

Inv & Loans 9 854 000 9 581 700

245

Tot Curr Ass 24 000 29 400

Ord SH Int 9 878 000 9 610 200

171

Tot Curr Liab - 900

97

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 26.00 81.00

23

2015 | 2016 | 2017 | 2018 | 2019 NAV PS (ZARc) 945.00 931.00

NOTES: African Bank In vest ments Ltd. renamed to African Phoenix In vest - Price High 740 868

ments Ltd. on 1 February 2017. Price Low 375 549

FINANCIAL STATISTICS Price Prd End 471 740

(R million) Sep 19 Sep 18 Sep 17 Sep 16 Sep 15 RATIOS

Final Final Final Final Final Ret on SH Fnd 2.70 7.02

Interest Rcvd 109 156 140 114 98 Oper Pft Mgn 98.16 84.87

Operating Inc - 41 89 158 23 69 Current Ratio - 32.67

Attrib Inc - 79 46 186 491 1 287

TotCompIncLoss - 79 46 186 491 1 287

Ord SH Int 1 286 742 696 510 19

Liabilities 114 199 192 522 1 807

Liq/Curr Ass 691 1 656 1 881 1 833 2 367

Total Assets 1 400 2 071 2 018 2 162 2 956

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 5.53 3.70 13.70 - 6.50 86.60

DPS (ZARc) 42.00 - - - -

NAV PS (ZARc) 90.10 52.00 48.80 35.70 1.30

3 Yr Beta - 0.13 - 0.28 - 0.87 0.46 - 0.35

Price Prd End 78 52 63 31 31

Price High 79 74 80 31 31

Price Low 33 51 31 31 31

RATIOS

Ret on SH Fund - 6.13 2.43 10.19 29.94 112.01

RetOnTotalAss - 2.92 4.33 7.87 1.06 2.33

Interest Mgn 0.08 0.08 0.07 0.05 0.03

85