Page 86 - SHB 2020 Issue 1

P. 86

JSE – AEC Profile’s Stock Exchange Handbook: 2020 – Issue 1

AECI Ltd. AEP Energy Africa Ltd.

AEC AEP

ISIN: ZAE000000220 SHORT: AECI CODE: AFE SUS PENDED COM PANY

ISIN: ZAE000000238 SHORT: AECI 5.5%P CODE: AFEP ISIN: ZAE000241741 SHORT: AFENERGY CODE: AEY

REG NO: 1924/002590/06 FOUNDED: 1924 LISTED: 1966 REG NO: 2017/024904/06 FOUNDED: 2017 LISTED: 2017

NATURE OF BUSINESS: AECI is a diversified Group of 17 companies. It NATURE OF BUSINESS: AEP was incorporated on 24 January 2017 and

has regional and international businesses in Africa, Europe, South East successfully listed as a Special Purpose Acquisition Company (SPAC) on

Asia, North America, South America and Australia. Products and services the Alternative Exchange Board (AltX) of the Johannesburg Stock

are provided to a broad spectrum of customers in the mining, water Exchange (JSE) on 30 June 2017. The primary purpose of a SPAC is to

treatment, plant and animal health, food and beverage, infrastructure and pursue the acquisition of viable assets being investments in commercial

general industrial sectors. enterprises in the energy sector with high growth potential. Unless and

SECTOR: Basic Materials—Chems—Chems—Specialty Chems until such viable assets are acquired, the only material asset of a SPAC is

NUMBER OF EMPLOYEES: 8 038 the cash which it holds pursuant to a capital raise through the issue of

DIRECTORS: Dawson S (ind ne), De Buck F F T (ne), shares. The cash is held in escrow and invested conservatively for the

Dissinger W (ind ne), Dunne R M W (ne, UK), Gomwe G (ne, Zim), protection of the company’s shareholders. If the acquisition of a viable

Molapo J (ne), Morgan A J (ne), Ramashia Adv R (ne), Sibiya P (ne), asset is not completed within a 24-month period from the date on which

Mokhele Dr K D K (Chair, ind ne), Dytor M A (CE), Kathan K M (CFO) the SPAC was listed or such later date as the JSE may permit, the SPAC is

MAJOR ORDINARY SHAREHOLDERS as at 28 Dec 2018 required to return the subscription funds initially invested to

Government Employees Pension Fund (PIC) 13.44% shareholders, plus accrued interest, less permissible expenses and

PSG Flexible Fund 4.26% taxation.

AECI Community Education and Development Trust 3.63% SECTOR: AltX

POSTAL ADDRESS: Private Bag X21, Gallo Manor, 2052 NUMBER OF EMPLOYEES: 0

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AFE DIRECTORS: Dooling C J (ind ne), Sibiya S S (ind ne),

COMPANY SECRETARY: Nomini Rapoo Wright D W (Chair, ind ne), David S M (Dep Chair, ld ind ne),

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Kikonyogo E C M B (CEO), Gugushe N (COO)

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2018

AUDITORS: Deloitte & Touche Public Investment Corporation SOC Ltd. 48.99%

POSTAL ADDRESS: PO Box 652101, Benmore, 2010

CAPITAL STRUCTURE AUTHORISED ISSUED MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AEY

AFE Ords 100c ea 180 000 000 121 829 083 COMPANY SECRETARY: Imbokodvo Bethany Governance

AFEP Prefs 200c ea 3 000 000 3 000 000

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DISTRIBUTIONS [ZARc] DESIGNATED ADVISOR: Questco Corporate Advisory (Pty) Ltd.

Ords 100c ea Ldt Pay Amt AUDITORS: Deloitte & Touche

Interim No 171 27 Aug 19 2 Sep 19 156.00 CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 170 2 Apr 19 8 Apr 19 366.00 AEY Ords no par value 10 000 000 000 40 000 200

LIQUIDITY: Jan20 Ave 962 436 shares p.w., R95.6m(41.1% p.a.) DISTRIBUTIONS [ZARc]

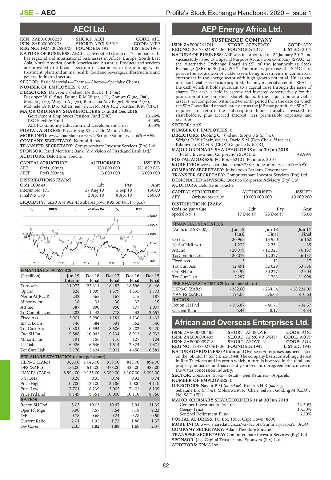

CHES 40 Week MA AECI Ords no par value Ldt Pay Amt

Special No 1 17 Dec 19 23 Dec 19 95.00

16900

FINANCIAL STATISTICS

15048

(Amts in ZAR’000) Jun 19 Jun 18 Jun 17

Final Final Final

13196

Op Inc - 20 965 - 13 950 - 6 162

11345

NetIntPd(Rcvd) - 1 232 - 2 264 - 35

Att Inc - 20 079 - 12 327 - 6 137

9493

TotCompIncLoss - 20 079 - 12 327 - 6 137

7641 Fixed Ass 5 11 17

2015 | 2016 | 2017 | 2018 | 2019

Tot Curr Ass 12 491 32 029 53 686

FINANCIAL STATISTICS Ord SH Int 10 199 30 277 42 604

(R million) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15 Tot Curr Liab 2 297 1 763 11 098

Interim Final Final Final Final

Turnover 11 972 23 314 18 482 18 596 18 446 PER SHARE STATISTICS (cents per share)

Op Inc 826 1 999 1 579 1 335 1 703 HEPS-C (ZARc) - 382.00 - 234.54 - 18 224.00

NetIntPd(Rcvd) 242 365 167 215 187 NAV PS (ZARc) 194.06 576.08 810.63

Minority Int 18 34 30 32 19 RATIOS

Att Inc 387 990 950 777 1 007 Ret on SH Fnd - 196.87 - 40.71 - 34.57

TotCompIncLoss 283 1 443 778 433 2 657 Current Ratio 5.44 18.17 4.84

Fixed Ass 5 901 5 990 4 181 4 130 4 433

Inv & Loans 146 384 391 352 340 African and Overseas Enterprises Ltd.

Tot Curr Ass 10 381 10 594 8 606 8 282 9 420 AFR

Ord SH Int 9 888 10 043 9 234 8 913 8 932 ISIN: ZAE000000485 SHORT: AF & OVR CODE: AOO

Minority Int 191 156 116 127 104 ISIN: ZAE000000493 SHORT: AF&OVR 6%PP CODE: AOVP

CODE: AON

ISIN: ZAE000009718

SHORT: AFOVR-N

LT Liab 6 926 6 646 1 614 2 324 1 871 REG NO: 1947/027461/06 FOUNDED: 1947 LISTED: 1948

Tot Curr Liab 5 170 5 424 5 001 4 450 6 881 NATURE OF BUSINESS: African and Overseas Enterprises has been listed

PER SHARE STATISTICS (cents per share) on the JSE Ltd. (“JSE”) since 1948. The company has a controlling interest

HEPS-C (ZARc) 365.00 1 045.00 959.00 818.00 894.00 in Rex Trueform and its group which in turn is invested in the retail and

DPS (ZARc) 156.00 515.00 478.00 435.00 385.00 property industries and has recently entered into an agreement to invest in

the water concession industry.

NAV PS (ZARc) 8 994.00 9 135.00 8 399.00 8 107.00 8 092.00 SECTOR: Consumer Srvcs—Retail—Gen Retailers—Apparels

3 Yr Beta 0.28 0.35 0.74 0.92 0.74 NUMBER OF EMPLOYEES: 0

Price High 10 700 12 100 12 186 11 000 14 110 DIRECTORS: Naylor P M (ld ind ne), Roberts H B (ind ne),

Price Low 7 701 8 239 5 005 7 401 8 109 Sebatane L K (ind ne), Molosiwa M R (Chair, ind ne), Golding M (CEO),

Price Prd End 9 149 8 351 10 000 10 110 8 866 Nel W D (FD)

RATIOS MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Ret on SH Fnd 8.03 10.03 10.47 8.94 11.35 Geomer Investments Pty Ltd. 72.30%

Oper Pft Mgn 6.90 8.57 8.54 7.18 9.23 Ceejay Trust 13.50%

D:E 0.78 0.68 0.24 0.28 0.50 Sentinel Retirement Fund 6.20%

Current Ratio 2.01 1.95 1.72 1.86 1.37 POSTAL ADDRESS: PO Box 1856, Cape Town, 8000

Div Cover 2.35 1.82 1.88 1.69 2.37 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AOO

COMPANY SECRETARY: Adam Theodore Snitcher

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

AUDITORS: KPMG Inc.

82