Page 87 - SHB 2020 Issue 1

P. 87

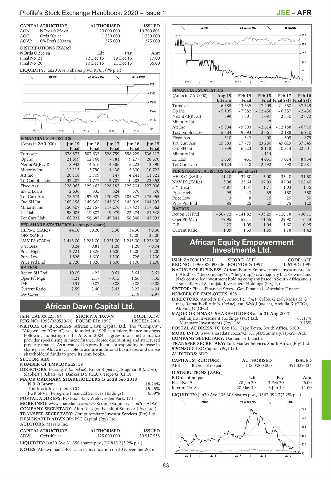

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – AFR

CAPITAL STRUCTURE AUTHORISED ISSUED

ALSH 40 Week MA AFDAWN

AON NOrds 0.25c ea 20 000 000 10 200 801

AOO Ords 50c ea 1 250 000 1 250 000 360

AOVP 6% Prefs 200c ea 275 000 275 000

289

DISTRIBUTIONS [ZARc]

NOrds 0.25c ea Ldt Pay Amt 217

Final No 21 12 Dec 16 19 Dec 16 17.00

Final No 20 10 Dec 15 21 Dec 15 35.00 146

LIQUIDITY: Jan20 Ave 3 shares p.w., R76.3(-% p.a.) 74

GERE 40 Week MA AF & OVR

3

2015 | 2016 | 2017 | 2018 | 2019

2721

FINANCIAL STATISTICS

2322

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

Interim Final Final Final(rst) Final(rst)

1923

Turnover 6 385 13 335 17 409 21 360 37 329

1524 Op Inc - 5 105 - 7 882 - 12 456 - 6 387 - 2 436

NetIntPd(Rcvd) 399 1 501 1 087 2 530 2 672

1125

Minority Int - - - 47 - -

Att Inc - 5 504 - 9 393 - 2 614 - 12 188 - 6 910

726

2015 | 2016 | 2017 | 2018 | 2019

TotCompIncLoss - 5 504 - 9 393 - 2 661 - 12 188 - 6 910

FINANCIAL STATISTICS Fixed Ass 310 343 400 605 879

(Amts in ZAR’000) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15 Tot Curr Ass 15 383 17 775 23 280 49 029 57 545

Final Final Final Final Final Ord SH Int 1 939 6 623 8 118 10 313 22 501

Turnover 678 873 587 632 528 759 558 229 536 217 Minority Int - - - 114 - -

Op Inc 21 809 12 768 - 781 9 277 28 670 LT Liab 1 339 431 4 031 7 074 8 954

NetIntPd(Rcvd) - 8 943 - 4 616 - 4 386 - 5 223 - 3 390 Tot Curr Liab 14 124 11 618 12 592 41 398 40 581

Minority Int 12 113 5 790 1 438 5 300 10 723 PER SHARE STATISTICS (cents per share)

Att Inc 20 118 5 709 147 4 241 11 821 HEPS-C (ZARc) - 11.10 - 32.80 - 5.00 - 33.40 - 31.60

TotCompIncLoss 32 207 11 777 2 707 10 282 22 552 NAV PS (ZARc) 3.98 23.64 37.03 47.04 102.40

Fixed Ass 128 065 129 462 128 182 125 204 127 006 3 Yr Beta - 4.87 1.37 1.71 1.03 - 1.35

Inv & Loans 2 636 835 524 576 576 Price High 95 43 85 160 360

Tot Curr Ass 178 574 192 920 170 987 185 827 175 955 Price Low 3 8 15 25 80

Ord SH Int 169 158 149 365 143 519 145 009 144 397 Price Prd End 85 25 20 75 120

Minority Int 150 407 123 157 117 276 117 401 117 563 RATIOS

LT Liab 98 005 19 807 19 979 22 274 21 548 Ret on SH Fnd - 567.72 - 141.82 - 33.25 - 118.18 - 30.71

Tot Curr Liab 68 921 56 687 49 841 56 848 43 593 Oper Pft Mgn - 79.95 - 59.11 - 71.55 - 29.90 - 6.53

PER SHARE STATISTICS (cents per share) D:E 4.23 1.09 1.04 1.60 0.95

HEPS-C (ZARc) 44.10 50.20 3.30 34.30 90.30 Current Ratio 1.09 1.53 1.85 1.18 1.42

DPS (ZARc) - - - 17.00 35.00

NAV PS (ZARc) 1 443.00 1 281.00 1 231.00 1 243.00 1 238.00 African Equity Empowerment

3 Yr Beta 0.24 0.81 1.28 1.28 - 0.04

Price High 2 721 1 826 1 600 1 200 1 200 Investments Ltd.

Price Low 1 826 1 600 1 100 726 1 200 AFR

CODE: AEE

Price Prd End 2 720 1 826 1 600 1 100 1 200 ISIN: ZAE000195731 SHORT: AEEI LISTED: 1999

REG NO: 1996/006093/06 FOUNDED: 1997

RATIOS NATURE OF BUSINESS: African Equity Empowerment Investments Ltd.

Ret on SH Fnd 10.09 4.22 0.61 3.64 8.61 (“AEEI” or “the company” or “the group”) is a majority black-owned and

Oper Pft Mgn 3.21 2.17 - 0.15 1.66 5.35 black controlled investment holding company based in South Africa and is

D:E 0.31 0.07 0.08 0.08 0.08 a subsidiary of Sekunjalo Investment Holdings (Pty) Ltd.

Current Ratio 2.59 3.40 3.43 3.27 4.04 SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance

Div Cover - - - 2.19 2.97 NUMBER OF EMPLOYEES: 858

DIRECTORS: Amod A (ne), Amod I (ind ne), Colbie G (ne), Mosia M G

African Dawn Capital Ltd. (ne), Ramatlhodi Adv N (ind ne), van Wyk J (ind ne), Abdulla K (CEO),

Ah Sing C (CFO)

AFR MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2017

ISIN: ZAE000223194 SHORT: AFDAWN CODE: ADW Sekunjalo Investment Holdings (Pty) Ltd. 61.17%

REG NO: 1998/020520/06 FOUNDED: 1997 LISTED: 2004 Miramare Investments (Pty) Ltd. 9.45%

NATURE OF BUSINESS: African Dawn Capital Ltd. (the “Company”, POSTAL ADDRESS: PO Box 181, Cape Town, South Africa, 8000

“Afdawn” or “Group”) was founded in 1998 as a micro finance business. MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AEE

Following its listing on the AltX in 2004, it grew into a niche finance

provider specialising in micro finance, debtor discounting and structured COMPANY SECRETARY: Damien Terblanche

property finance. As a result of its growth and corresponding increase in TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

share price, Afdawn was able to acquire additional businesses and utilise SPONSOR: PSG Capital (Pty) Ltd.

shareholders’ funds to grow its loan books. AUDITORS: BDO

SECTOR: AltX CAPITAL STRUCTURE AUTHORISED ISSUED

NUMBER OF EMPLOYEES: 59 AEE B Ords of no par 1 000 000 000 491 339 434

DIRECTORS: Lessing V (ld ind ne), Roper S (ind ne), Stagman B (ind ne),

Slabbert J (Chair, ne), Danker D S (CEO), Hope G (CFO) DISTRIBUTIONS [ZARc]

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2018 B Ords of no par Ldt Pay Amt

N R O Brown 18.24% Final No 9 28 Jan 20 3 Feb 20 6.00

Toothrock Investments CC 15.25% Interim No 8 28 May 19 3 Jun 19 11.00

PGR SPV1 (Peregrine Financial Services Holdings) 6.69% LIQUIDITY: Jan20 Ave 205 308 shares p.w., R567 092.3(2.2% p.a.)

POSTAL ADDRESS: PO Box 5455, Weltevreden Park, 1715

FINA 40 Week MA AEEI

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ADW

COMPANY SECRETARY: Alun Rich (on behalf of Statucor (Pty) Ltd.) 765

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: PSG Capital (Pty) Ltd. 630

AUDITORS: Mazars Inc.

496

CAPITAL STRUCTURE AUTHORISED ISSUED

ADW Ords 40c ea 125 000 000 50 917 533 361

LIQUIDITY: Jan20 Ave 31 356 shares p.w., R7 843.2(3.2% p.a.)

227

NOTES: Afdawn had a 40:1 share con sol i da tion on 30 November 2016.

92

2015 | 2016 | 2017 | 2018 | 2019

83