Page 228 - SHB 2020 Issue 1

P. 228

JSE – SAB Profile’s Stock Exchange Handbook: 2020 – Issue 1

SECTOR: Fins—Rest—Inv—Div

Sabvest Ltd. NUMBER OF EMPLOYEES: 191

SAB DIRECTORS: Biesman-Simons R J (ind ne), Ford-Hoon N (ind ne),

ISIN: ZAE000006417 SHORT: SABVEST CODE: SBV Hendricks E (ind ne), Heron G J (ind ne), Mosetlhi O R (ld ind ne),

ISIN: ZAE000012043 SHORT: SABVEST-N CODE: SVN Seedat E S (ind ne), van Heerden A (ind ne), Moloto A (Chair, ld ind ne),

REG NO: 1987/003753/06 FOUNDED: 1987 LISTED: 1987 Mackey T R (MD), Basson A M (FD)

NATURE OF BUSINESS: Sabvest is an investment holding company which MAJOR ORDINARY SHAREHOLDERS as at 14 Aug 2019

was listed since 1988. Its ordinary and “N” ordinary shares are quoted in Government Employees Pension Fund 23.25%

the Financials - Equity Investment Instruments sector of the JSE Ltd. Old Mutual Group 8.63%

Sabvest has significant interests in three unlisted industrial groups, Allan Gray 8.31%

long-term holdings in five JSE listed investments, and offshore share, bond POSTAL ADDRESS: Postnet Suite 1051, Private Bag X2, Century City,

and cash portfolios, all accounted for on a fair value basis. 7446

SECTOR: Fins—Investment Instruments—Equities—Equities MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SAC

NUMBER OF EMPLOYEES: 5 184 COMPANY SECRETARY: Luvivi (Pty) Ltd.

DIRECTORS: Mthimunye L E (ind ne), Pillay K (ind ne), Rood L, TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Shongwe B J T (ld ind ne), Mokhobo D N M (Chair, ind ne),

Seabrooke C S (CEO), Pleaner R (CFO) SPONSORS: Nedbank Corporate and Investment Banking, a division of

Nedbank Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018 AUDITORS: Deloitte & Touche

Seabrooke Family Trust 70.10%

BNP Paribas (Suisse) SA 17.20% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 78677, Sandton, 2146 SAC Ords no par 4 000 000 000 2 530 689 337

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SBV DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Levitt Kirson Business Services (Pty) Ltd. Ords no par Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Interim No 49 1 Oct 19 7 Oct 19 20.38

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) Final No 48 2 Apr 19 8 Apr 19 20.52

AUDITORS: Deloitte & Touche

LIQUIDITY: Jan20 Ave 23m shares p.w., R84.2m(47.9% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

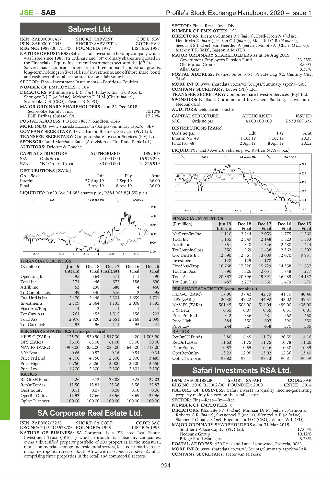

SBV Ords 5c ea 24 000 000 16 975 293 SAPY 40 Week MA SA CORP

SVN “N” Ords 0.01c ea 80 000 000 24 826 919 589

DISTRIBUTIONS [ZARc]

525

Ords 5c ea Ldt Pay Amt

Interim 27 Aug 19 2 Sep 19 36.00

461

Final 2 Apr 19 8 Apr 19 36.00

LIQUIDITY: Jan20 Ave 14 685 shares p.w., R684 903.8(4.5% p.a.) 398

EQII 40 Week MA SABVEST 334

6250

270

2015 | 2016 | 2017 | 2018 | 2019

5460

FINANCIAL STATISTICS

4670 (R million) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15

Interim Final Final Final Final

3880 NetRent/InvInc 1 110 2 244 2 053 1 775 1 560

Total Inc 1 155 2 349 2 148 1 823 1 583

3090

Attrib Inc 351 848 1 526 2 480 1 414

TotCompIncLoss 350 969 1 438 2 362 1 502

2300

2015 | 2016 | 2017 | 2018 | 2019

Ord UntHs Int 12 690 12 861 13 009 12 070 9 981

FINANCIAL STATISTICS Investments 128 129 170 - -

(R million) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15 FixedAss/Prop 16 768 17 326 15 729 14 358 11 637

Interim Final Final(rst) Final Final Tot Curr Ass 1 896 1 326 2 051 1 748 1 217

Operating Inc 95 364 571 111 590 Total Ass 20 367 20 396 19 391 16 989 14 137

Total Inc 171 446 672 186 690 Tot Curr Liab 487 2 277 1 560 1 479 670

Attrib Inc 53 238 688 4 460 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 39 340 676 - 12 495 HEPS-C (ZARc) 17.96 37.42 42.79 41.10 40.46

Ord UntHs Int 2 470 2 446 2 304 1 659 1 701 DPS (ZARc) 20.38 42.22 44.92 43.02 39.57

Investments 2 709 2 364 1 135 2 008 1 895 NAV PS (ZARc) 501.45 508.00 514.04 499.00 436.00

FixedAss/Prop 4 3 1 1 1 3 Yr Beta 0.35 0.07 0.35 0.51 0.01

Tot Curr Ass 261 453 1 515 158 202 Price Prd End 312 336 481 562 460

Total Ass 2 976 2 820 2 651 2 168 2 099 Price High 384 550 607 590 550

Tot Curr Liab 95 96 111 95 41 Price Low 244 327 438 370 385

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 125.70 530.90 1 517.30 9.20 1 003.90 RetOnSH Funds 5.80 6.45 11.73 20.55 14.16

DPS (ZARc) 36.00 68.00 61.00 55.00 50.00 RetOnTotAss 11.63 11.75 11.75 10.78 11.26

NAV PS (ZARc) 5 908.00 5 852.00 5 085.00 3 646.00 3 719.00 Debt:Equity 0.57 0.55 0.46 0.38 0.39

3 Yr Beta - 0.66 - 0.57 - 0.16 - 0.54 - 0.34 OperRetOnInv 13.23 12.95 13.02 12.36 13.40

Price Prd End 4 700 4 750 2 300 2 900 3 485 OpInc:Turnover 97.82 97.17 97.13 96.81 96.59

Price High 6 750 5 250 3 000 3 500 3 650

Price Low 4 200 2 300 2 300 2 801 2 100 Safari Investments RSA Ltd.

RATIOS

SAF

RetOnSH Funds 4.26 9.73 29.88 0.25 27.03 ISIN: ZAE000188280 SHORT: SA FARI CODE: SAR

RetOnTotAss 11.50 15.81 25.36 8.56 32.87 REG NO: 2000/015002/06 FOUNDED: 2000 LISTED: 2014

Debt:Equity 0.11 0.07 0.08 0.10 0.06 NATURE OF BUSINESS: Safari invests in quality income-generating

OperRetOnInv 11.93 17.66 58.56 8.69 35.96 property mainly focused on the retail sector.

OpInc:Turnover 100.00 100.00 100.00 100.00 100.00 SECTOR: Fins—Rest—Inv—Ret

NUMBER OF EMPLOYEES: 0

SA Corporate Real Estate Ltd. DIRECTORS: Khanyile F N (ind ne), Minnaar Dr M (ind ne), Pashiou K,

Roberts C R (ind ne), Swanepoel E (ind ne), Wentzel A E (ld ind ne),

SAC Slabber T (Chair, ind ne), Engelbrecht D C (CEO), Venter W L (FD)

ISIN: ZAE000203238 SHORT: SA CORP CODE: SAC MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

REG NO: 2015/015578/06 FOUNDED: 1995 LISTED: 1995 Southern Palace Capital (Pty) Ltd. 17.03%

NATURE OF BUSINESS: SA Corporate is a JSE-listed Real Estate Nedbank Group 10.12%

Investment Trust (“REIT”) which, through its subsidiary companies, Bridge Fund Managers 8.23%

owns a diversified property portfolio of 200 properties in the industrial, POSTAL ADDRESS: 420 Friesland Lane, Lynnwood, Pretoria, 0081

retail, commercial, storage and residential sectors, located primarily in the MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SAR

major metropolitan areas of South Africa with a secondary node in Zambia

comprising three properties in the retail and commercial sectors. COMPANY SECRETARY: Pieter van Niekerk

224