Page 225 - SHB 2020 Issue 1

P. 225

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – ROL

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

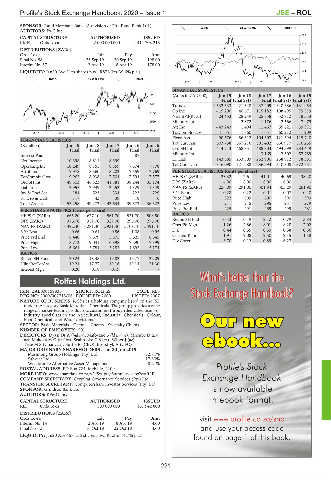

ALSH 40 Week MA ROLFES

AUDITORS: PwC Inc.

589

CAPITAL STRUCTURE AUTHORISED ISSUED

RMH Ords 1c ea 2 000 000 000 1 411 703 218

515

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt 441

Final No 58 23 Sep 19 30 Sep 19 198.00

Interim No 57 2 Apr 19 8 Apr 19 178.00 368

LIQUIDITY: Jan20 Ave 11m shares p.w., R876.3m(39.6% p.a.) 294

BANK 40 Week MA RMBH 220

2015 | 2016 | 2017 | 2018 | 2019

FINANCIAL STATISTICS

8297 (Amts in ZAR’000) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15

Final Final(rst) Final Final(rst) Final(rst)

7384

Turnover 1 532 533 1 421 648 1 437 409 1 310 386 1 131 954

Op Inc - 19 290 40 671 115 182 108 495 79 519

6472

NetIntPd(Rcvd) 24 453 28 249 25 858 32 712 18 333

5559 Minority Int - - 2 372 - 1 176 - 2 566 7 979

Att Inc - 43 243 1 494 11 467 55 621 39 371

4646 TotCompIncLoss - 41 651 - 1 860 11 651 60 212 47 209

2015 | 2016 | 2017 | 2018 | 2019

Fixed Ass 90 576 86 612 104 307 121 594 115 740

FINANCIAL STATISTICS Tot Curr Ass 603 738 667 216 591 402 666 977 516 255

(R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15

Final Final Final Final Final Ord SH Int 414 713 468 851 488 803 494 399 284 449

Interest Paid - - - 87 - Minority Int - - - 3 169 - 2 502 57 789

LT Liab 143 585 233 509 262 900 258 912 78 381

Net Income 10 398 8 811 8 399 - -

Operating Inc 10 249 8 755 8 359 7 574 7 778 Tot Curr Liab 316 090 321 288 236 593 310 808 372 751

Attrib Inc 9 978 8 560 8 202 7 559 7 769 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 9 962 8 938 7 504 7 594 7 577 HEPS-C (ZARc) 23.32 12.61 41.01 40.69 38.20

Ord SH Int 49 303 46 323 41 381 38 244 35 174 DPS (ZARc) 4.00 8.00 8.00 6.00 -

Liabilities 3 955 2 949 2 253 1 329 1 349 NAV PS (ZARc) 256.09 291.00 301.84 305.29 261.90

Inv & Trad Sec 184 523 334 223 229 3 Yr Beta - 0.28 - 0.22 - 0.01 - 0.07 - 0.10

ST Dep & Cash 117 43 39 18 16 Price High 322 509 600 390 393

Total Assets 53 258 49 272 43 634 39 573 36 523 Price Low 211 215 295 237 279

Price Prd End 225 291 469 299 281

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 665.20 627.10 561.70 531.70 508.50 RATIOS

DPS (ZARc) 376.00 351.00 327.00 295.00 276.00 Ret on SH Fnd - 10.43 - 0.19 2.12 10.79 13.84

NAV PS (ZARc) 3 492.40 3 281.40 2 931.40 2 709.10 2 491.10 Oper Pft Mgn - 1.26 2.86 8.01 8.28 7.02

3 Yr Beta 0.66 0.64 0.56 1.08 0.95 D:E 0.44 0.55 0.59 0.58 0.56

Price Prd End 8 440 7 579 5 875 5 625 6 645 Current Ratio 1.91 2.08 2.50 2.15 1.38

Price High 8 773 9 041 6 898 7 290 7 399 Div Cover - 6.70 0.12 0.89 6.27 -

Price Low 6 661 5 784 5 253 4 695 5 174

RATIOS

Ret on SH Fund 20.24 18.48 19.82 19.77 22.09

HlineRetTotAss 19.24 17.77 19.16 19.14 21.30

Interest Mgn 0.20 0.18 0.19 - -

Rolfes Holdings Ltd.

ROL

ISIN: ZAE000159836 SHORT: ROLFES CODE: RLF

REG NO: 2000/002715/06 FOUNDED: 2000 LISTED: 2007

NATURE OF BUSINESS: Rolfes is a holding company listed on the JSE

under the category Basic Materials: Chemicals. The group provides a wide

range of market-leading products to customers through dedicated teams of

industry specialists in the Agricultural, Industrial Chemicals, Colour,

Food Chemicals and Water divisions.

SECTOR: Basic Materials—Chems—Chems—Specialty Chems

NUMBER OF EMPLOYEES: 501

DIRECTORS: Dyasi Dr A (ind ne), Mafoyane S (ld ind ne), Mncube D (ind

ne), Mokoka M G (ind ne), Seabrooke C S (ne), Winer J (ne),

Teke M S (Chair, ne), Buttle R (CEO), Broodryk A (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Masimong Group Holdings (Pty) Ltd. 32.71%

Sabvest Ltd. 17.60%

Westbrooke Alternative Asset Management 8.21%

POSTAL ADDRESS: PO Box 724, Melville, 2109 Profile's Stock

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=RLF

COMPANY SECRETARY: CorpStat Governance Services (Pty) Ltd. Exchange Handbook

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Grindrod Bank Ltd. is now available

AUDITORS: KPMG Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED in ebook format.

RLF Ords 1c ea 500 000 000 161 942 800

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt visit www.profile.co.za/shb

Interim No 14 2 Apr 19 8 Apr 19 4.00

Final No 13 16 Oct 18 22 Oct 18 4.00 and use your access code

LIQUIDITY: Jan20 Ave 457 156 shares p.w., R1.3m(14.7% p.a.) found on page 1 of this book.

221