Page 231 - SHB 2020 Issue 1

P. 231

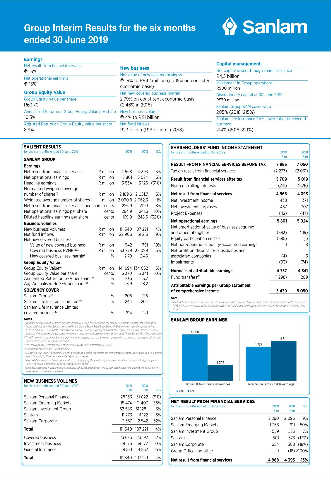

Group Interim Results for the six months

ended 30 June 2019

Earnings

Net result from fi nancial services Capital management

13% New business Net capital raised through share inssuance

Net value of new covered business

Net operational earnings 19% to R942 million (up 15% on consistent R4,5 billion

15% Investment in Group operations

economic basis) R900 million

Group Equity Value Net new covered business margin Discretionary capital at 30 June 2019

Group Equity Value per share 2,79% on constitent economic basis R570 million

R63,70 (2.46% in 2018) Sanlam Group SAM cover ratio

Annualised Return on Group Equity Value per share New business volumes 205% (2018: 215%)

10,5% 4% to R111 billion Sanlam Life Insurance SAM cover ratio for covered

Adjusted Return on Group Equity Value per share Net fund infl ows business

8,9% R23 billion (R19 billion in 2018) 214% (2018: 221%)

SALIENT RESULTS SHAREHOLDERS’ FUND INCOME STATEMENT

for the six months ended 30 June 2019 2019 2018 % for the six months ended 30 June 2019 2019 2018

R’m R’m

SANLAM GROUP

Earnings RESULT FROM FINANCIAL SERVICES BEFORE TAX 7 986 7 050

Net result from fi nancial services R million 4 968 4 393 13% Tax on result from fi nancial services (2 277) (2 031)

Net operational earnings R million 5 801 5 024 15% Result from fi nancial services after tax 5 709 5 019

Headline earnings R million 3 534 5 126 (31%) Non-controlling interests (741) (626)

Normalised weighted average

(1)

number of shares R million 2 189,6 2 081,7 5% Net result from fi nancial services 4 968 4 393

(1)

Weighted average number of shares million 2 090,8 2 062,3 1% Net investment income 438 371

Net result from fi nancial services per share cents 226,9 211,0 8% Net investment surpluses 437 307

Net operational earnings per share cents 264,9 241,3 10% Project Expenses (42) (47)

Diluted headline earnings per share cents 169,0 248,6 (32%)

Business volumes Net operational earnings 5 801 5 024

New business volumes R million 111 340 107 221 4% Net amortisationof value of business acquired

Net fund infl ows R million 22 906 19 213 19% and other intangibles (383) (119)

(1)

Net new covered business Equity participation costs (595) (1)

Value of new covered business R million 942 791 19% Net non-operational equity-accounted earnings 11 8

(2)

Covered business PVNBP R million 33 779 32 099 5% Net profi t on disposal or subsidiaries and

New covered business margin % 2,79 2,46 associated companies (4) 3

(3)

Group Equity Value Impairments (93) (74)

Group Equity Value R million 141 694 134 052 6%

(4)

Group Equity Value per share cents 6 370 6 341 0% Normalised attributable earnings 4 737 4 841

(1)

Annualised Return on GEV per share % 10,5 13,7 Fund transfers (1 298) 209

(5)

(6)

Adj. Annualised RoGEV per share % 8,9 18,2 Attributable earnings per Group statement

SOLVENCY COVER of comprehensive income 3 439 5 050

Sanlam Group % 205 215 Note

(6)

(6)

Sanlam Life Insurance Limited % 244 264 (1) The B-BBEE transaction gives rise to a non-recurring share-based payment charge of R1,686 billion. The above market-related discount of

Sanlam Life Insurance Limited R595 million is recognisedas equity participationcost in the Shareholders’ fund income statement, with the remainder recoginised in fund

transfers.

(7)

covered business % 214 221

Notes SANLAM GROUP EARNINGS

(1) Weighted average number of shares excludes Sanlam shares held directly or indirectly through consolidated investment funds in policy-

holder portfolios, as well as Sanlam shares held by the Group’s Broad-Based Black Economic Empowerment special purposes vehicle

(B-BBEE SPV) that is consolidated in terms of International Financial Reporting Standards. These shares are treated as shares in issue for 4 968

purposes of normalised weighted average number of shares, which are used for the per-share metrics for the Shareholders’ fund information.

(2) PVNBP = present value of new business premiums and is equal to the present value of new recurring premiums, at the relevant risk discount 4 841

rate for each business, plus single premiums.

(3) New covered business margin = value of new covered business as a percentage of PVNBP. 4 737

(4) Comparative fi gures as at 31 December 2018.

(5) Growth in Group Equity Value per share (with dividends paid, capital movements and cost of treasury shares acquired reversed) as a percent-

age of Group Equity Value per share at the beginning of the year.

(6) Adjusted Return on Group Equity Value = Return on Group Equity Value excluding investment market and currency volatility, changes in

interest rates and other factors outside of management’s control 4 393

(7) Excludes investments in subsidiaries and associated companies, discretionary capital, cash accumulated for dividend payments and the net

asset value of non-covered operations.

NEW BUSINESS VOLUMES

for the six months ended 30 June 2019 2019 2018 Net result from fi nancial services Normalised attributable earnings

R’m R’m %

2019 2018

Sanlam Personal Finance 28 153 31 022 (9%)

Sanlam Emerging Markets 15 474 11 407 36% NET RESULT FROM FINANCIAL SERVICES 2019 2018

for the six months ended 30 June 2019

Sanlam Investment Group 52 583 51 128` 3% R’m R’m %

Santam 11 773 11 122 6%

Sanlam Corporate 3 357 2 542 32% Sanlam Personal Finance 2 290 2 096 9%

Sanlam Emerging Markets 1 363 911 50%

Total 111 340 107 221 4%

Sanlam Investment Group 559 523 7%

Covered business 23 633 23 192 2% Santam 501 573 (13%)

Investment business 69 176 69 177 0% Sanlam Corporate 254 308 (18%)

General Insurance 18 531 14 852 25% Group Offi ce and other 1 (18) >100%

Total 111 340 107 221 4%

Net result from fi nancial services 4 968 4 393 13%

JSE R&E book IR2019 v20191010.indd 1 11.10.2019 12:24:19