Page 224 - SHB 2020 Issue 1

P. 224

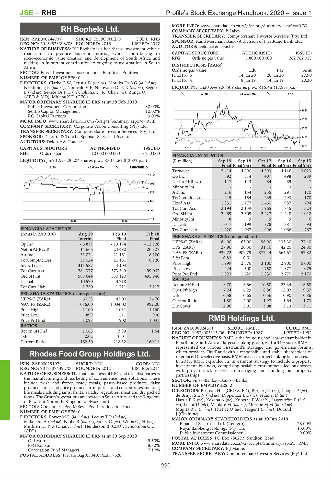

JSE – RHB Profile’s Stock Exchange Handbook: 2020 – Issue 1

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=RFG

RH Bophelo Ltd. COMPANY SECRETARY: B Lakey

RHB TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ISIN: ZAE000244737 SHORT: RHBOPHELO CODE: RHB SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

REG NO: 2016/533398/06 FOUNDED: 2016 LISTED: 2017 AUDITORS: Deloitte & Touche

NATURE OF BUSINESS: RH Bophelo is a healthcare investment vehicle

that aims to produce superior returns, whilst contributing to CAPITAL STRUCTURE AUTHORISED ISSUED

socio-economic value creation and development of South Africa and RFG Ords no par value 1 800 000 000 262 762 018

making an important contribution to ongoing transformation in South

Africa. DISTRIBUTIONS [ZARc]

Pay

Amt

Ldt

SECTOR: Fins—Investment Instruments—Equities—Equities Ords no par value 14 Jan 20 20 Jan 20 27.90

Final No 5

NUMBER OF EMPLOYEES: 0 Final No 4 8 Jan 19 14 Jan 19 20.30

DIRECTORS: Clarke C W, Lerutla D (ind ne), Motuba Dr S G (ld ind ne),

Nkadimeng R (ind ne), Nomvalo V P, Ntshwana Dr K R (ind ne), Segooa LIQUIDITY: Jan20 Ave 906 509 shares p.w., R15.4m(17.9% p.a.)

B (ind ne), Sekete Dr P D (ne), Oliphant J R (Chair, ne), Zunga Q

(CEO & MD), Mhlaba K D (CFO) ALSH 40 Week MA RFG

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

Public Investment Corporation 80.00%

Sentio Capital Management 10.00% 2643

RQ Capital Partners 3.00%

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=RHB 2332

COMPANY SECRETARY: Corporate Vision Consulting (Pty) Ltd.

2022

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd. 1711

AUDITORS: Deloitte & Touche

1400

CAPITAL STRUCTURE AUTHORISED ISSUED 2015 | 2016 | 2017 | 2018 | 2019

RHB Ords no par 10 000 000 000 53 750 000

FINANCIAL STATISTICS

LIQUIDITY: Jan20 Ave 29 204 shares p.w., R301 269.8(2.8% p.a.) (R million) Sep 19 Sep 18 Oct 17 Sep 16 Sep 15

Final Final(rst) Final Final(rst) Final(rst)

ALSH 40 Week MA RHBOPHELO

Turnover 5 414 4 990 4 593 4 146 3 023

1194

Op Inc 392 314 407 498 289

NetIntPd(Rcvd) 117 113 84 89 47

1057

Minority Int - - - 3 -

921 Att Inc 216 154 235 291 170

TotCompIncLoss 215 154 235 293 170

784

Fixed Ass 1 831 1 777 1 460 987 794

Tot Curr Ass 2 194 2 139 1 965 1 745 1 324

648

Ord SH Int 2 469 2 309 2 227 1 248 1 012

511 Minority Int 8 9 9 9 6

2018 | 2019

LT Liab 1 017 1 199 878 787 693

FINANCIAL STATISTICS Tot Curr Liab 1 220 1 067 996 1 066 767

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18

Interim Final Final PER SHARE STATISTICS (cents per share)

Op Inc - 5 837 - 13 174 - 12 128 HEPS-C (ZARc) 84.00 63.00 96.90 133.30 77.40

NetIntPd(Rcvd) - 14 666 - 24 490 - 20 827 DPS (ZARc) 27.90 20.30 31.10 42.20 24.80

Att Inc 31 024 21 161 8 120 NAV PS (ZARc) 939.72 909.79 877.44 564.67 457.82

TotCompIncLoss 31 024 21 161 8 120 3 Yr Beta 0.83 0.51 - - -

Inv & Loans 311 587 4 103 - Price High 1 999 2 376 3 100 2 900 5 000

Tot Curr Ass 284 377 373 549 499 063 Price Low 1 424 1 500 1 750 1 877 1 075

Ord SH Int 583 644 530 120 495 946 Price Prd End 1 523 1 620 1 830 2 770 2 170

LT Liab 10 570 3 718 - RATIOS

Tot Curr Liab 1 750 1 711 3 117 Ret on SH Fnd 8.70 6.66 10.50 23.34 16.68

Oper Pft Mgn 7.24 6.29 8.86 12.02 9.57

PER SHARE STATISTICS (cents per share) D:E 0.58 0.65 0.56 0.90 0.86

HEPS-C (ZARc) 60.53 42.00 24.70 Current Ratio 1.80 2.00 1.97 1.64 1.73

NAV PS (ZARc) 1 086.00 1 034.00 992.00 Div Cover 2.96 3.01 3.08 3.13 3.11

Price High 1 100 1 031 1 160

Price Low 899 511 900

Price Prd End 1 098 900 1 031 RMB Holdings Ltd.

RATIOS ISIN: ZAE000024501 SHORT: RMBH CODE: RMH

RMB

Ret on SH Fnd 10.63 3.99 1.64 REG NO: 1987/005115/06 FOUNDED: 1987 LISTED: 1992

D:E 0.02 0.01 - NATURE OF BUSINESS: RMH is the founding and largest shareholder in

Current Ratio 162.50 218.32 160.11 FirstRand, South Africa’s largest banking group, with a 34% stake. RMH is

represented on various FirstRand’s strategic and governance forums,

Rhodes Food Group Holdings Ltd. which provides FirstRand with a responsible and stable shareholder of

reference. On a selective basis, RMH invests in other banking businesses.

RHO In 2015, RMH expanded its investment strategy to include a property

ISIN: ZAE000191979 SHORT: RFG CODE: RFG investment business, comprising scalable entrepreneur-led businesses

REG NO: 2012/074392/06 FOUNDED: 2012 LISTED: 2014 with proven track records in managing and building out property

NATURE OF BUSINESS: The main business of RFG and its subsidiaries is partnerships.

the manufacturing and marketing of convenience meal solutions. These SECTOR: Fins—Banks—Banks—Banks

include fresh and frozen ready meals, pastry-based products, dairy NUMBER OF EMPLOYEES: 2

products, juice and juice products, fruit purees and concentrates and long

life meals including jams, fruits, salads, vegetables, meat and dry packed DIRECTORS: Bosman H L (CEO & FD), Burger J P (ne), Cooper P (ne),

foods. The Group’s operations are located in South Africa and the Kingdom de Bruyn S E N (ind ne), Dippenaar L L (ne), Frankel D (alt),

of Eswatini (formerly Kingdom of Swaziland). Harris P K (ne), Kekana A (ne), Knoetze F W (alt), Lagerström P (ind

SECTOR: Consumer—Food&Bev—Food Producers—Food ne), Lucht U (alt), Mahlare M (ind ne), Morobe M M (ld ind ne),

Mupita R T (ind ne), Phetwe O (ne), Teeger J (ind ne), Durand J

NUMBER OF EMPLOYEES: 0 J (Chair, ne)

DIRECTORS: Bower M R (ld ind ne), Leeuw T P (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Makenete A (ind ne), Njobe B (ind ne), Smart C (ne), Willis G J H (ne), Financial Securities Ltd. (Remgro) 28.00%

Muthien Dr Y G (Chair, ind ne), Henderson B (CEO), Schoombie C C Royal Bafokeng Holdings (Pty) Ltd. 13.00%

(CFO) Public Investment Commissioner 9.00%

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2019 POSTAL ADDRESS: PO Box 786273, Sandton, 2146

Old Mutual 9.60% MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=RMH

PSG Konsult 8.80%

Coronation Fund Managers 7.10% COMPANY SECRETARY: E J Marais

POSTAL ADDRESS: Private Bag X3040, Paarl, 7620 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

220