Page 221 - SHB 2020 Issue 1

P. 221

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – RES

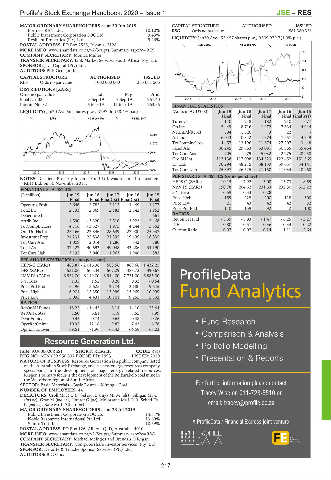

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 CAPITAL STRUCTURE AUTHORISED ISSUED

Fortress REIT Ltd. 10.10% RSG Ords no par value - 581 380 338

Public Investment Corporation SOC Ltd. 9.43%

Resilient Properties (Pty) Ltd. 9.26% LIQUIDITY: Jan20 Ave 452 457 shares p.w., R509 979.7(4.0% p.a.)

POSTAL ADDRESS: PO Box 2555, Rivonia, 2128 JSE-COAL 40 Week MA RESGEN

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=RES

250

COMPANY SECRETARY: Monica Muller

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. 204

SPONSOR: Java Capital (Pty) Ltd.

AUDITORS: PKF Octagon Inc. 158

CAPITAL STRUCTURE AUTHORISED ISSUED 112

RES Ords no par value 1 000 000 000 363 061 506

DISTRIBUTIONS [ZARc] 67

Ords no par value Ldt Pay Amt

Final No 33 3 Sep 19 9 Sep 19 267.40 2015 | 2016 | 2017 | 2018 | 2019 21

Interim No 32 5 Mar 19 11 Mar 19 263.66 FINANCIAL STATISTICS

LIQUIDITY: Jan20 Ave 5m shares p.w., R297.0m(68.4% p.a.) (Amts in AUD’000) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15

Final Final Final Final Final(rst)

SAPY 40 Week MA RESILIENT

Turnover 140 218 182 210 677

Op Inc - 5 449 - 8 716 - 1 972 - 7 634 - 4 944

NetIntPd(Rcvd) 594 1 626 3 22 -

13093

Att Inc - 6 043 - 10 342 - 1 974 - 7 657 - 4 949

11070 TotCompIncLoss - 4 457 - 12 196 11 674 - 27 207 3 448

Fixed Ass 30 245 29 563 33 081 30 365 35 464

9046 Tot Curr Ass 1 705 1 979 5 032 12 275 28 958

Ord SH Int 112 138 117 098 134 523 122 452 151 565

7023

LT Liab 70 294 48 215 38 159 39 657 34 141

5000 Tot Curr Liab 25 397 26 525 21 150 11 034 10 968

2015 | 2016 | 2017 | 2018 | 2019

PER SHARE STATISTICS (cents per share)

NOTES: Resilient Property Income Fund Ltd. was renamed to Resilient

REIT Ltd. on 30 November 2015. HEPS-C (ZARc) - 10.15 - 17.92 - 3.08 - 13.73 - 8.59

NAV PS (ZARc) 190.78 204.62 231.63 232.50 612.22

FINANCIAL STATISTICS 3 Yr Beta 0.59 0.33 - 0.28 - -

(R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15

Final Final Final(rst) Final(rst) Final Price High 159 225 200 118 300

Operatng Proft 2 646 2 783 2 113 1 449 1 277 Price Low 21 43 42 42 82

Total Inc 2 733 2 869 2 183 2 342 1 962 Price Prd End 110 159 92 42 100

Debenture Int - - - - 661 RATIOS

Attrib Inc 4 590 - 3 320 2 510 3 923 5 468 Ret on SH Fnd - 5.39 - 8.83 - 1.47 - 6.25 - 3.27

TotCompIncLoss 4 716 - 3 327 1 975 4 244 5 552 D:E 0.80 0.57 0.36 0.34 0.22

Ord UntHs Int 25 166 22 846 28 649 27 900 25 937 Current Ratio 0.07 0.07 0.24 1.11 2.64

Investmnt Prop 24 231 22 838 21 395 19 499 18 835

Tot Curr Ass 1 009 2 014 1 286 842 780

Total Ass 37 127 40 693 49 048 43 286 34 190

Tot Curr Liab 3 192 3 040 1 963 1 946 882

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 468.87 - 2 016.38 588.56 869.66 1 432.25

DPS (ZARc) 531.06 565.44 567.29 488.73 390.67

NAV PS (ZARc) 6 932.00 6 149.00 8 944.00 7 731.00 6 885.00

3 Yr Beta 1.35 1.52 0.28 0.32 - 0.54

Price Prd End 6 196 5 625 12 174 13 180 9 645

Price High 6 901 15 350 13 999 13 969 10 999

Price Low 5 095 4 431 10 101 9 255 5 832

RATIOS

RetOnSH Funds 18.22 - 14.43 8.14 14.10 23.44

RetOnTotAss 7.50 6.61 5.18 5.55 7.99

Debt:Equity 0.45 0.74 0.65 0.48 0.26 l Fund Research

OperRetOnInv 10.92 12.18 9.87 7.43 6.78

OpInc:Turnover 69.51 71.96 67.43 64.58 68.02

l Comparison & Analysis

Resource Generation Ltd.

l Portfolio Modelling

RES

ISIN: AU000000RES1 SHORT: RESGEN CODE: RSG

REG NO: ACN 059 950 337 FOUNDED: 1993 LISTED: 2010 l Presentation & Reports

NATURE OF BUSINESS: Resource Generation is a public company listed

on the Australian Stock Exchange, and is a new energy resources company

specialising in the development of major energy related resources.

Resgen’s primary focus is the development of the Boikarabelo coal mine in

the Waterberg region of South Africa.

SECTOR: Basic Materials—Basic Resrcs—Mining—Coal For further information please contact

NUMBER OF EMPLOYEES: 44

DIRECTORS: Croll Mr R C (ld ind ne), Dahiya Mr M (alt), Gilligan Mr C Tracey Wise on 011-728-5510 or

(ind ne), Gray M (ind ne), Hunter G (ne), Molotsane Mr L R R, Sebati Dr

K (ind ne), Xate Mr L (Chair, ne) email: tracey@profile.co.za

MAJOR ORDINARY SHAREHOLDERS as at 23 Jul 2019

Public Investment Corporation SOC Ltd. 14.81%

Noble Resources International Pte Ltd. 13.69%

Shinto Torii Inc. 10.69% A ProfileData / Financial Express joint venture

POSTAL ADDRESS: PO Box 126, Albion, QLD, Australia, 4010

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=RSG

COMPANY SECRETARY: Michael Meintjes and Brendan O’Regan

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd.

AUDITORS: BDO Inc.

217