Page 200 - SHB 2020 Issue 1

P. 200

JSE – OCT Profile’s Stock Exchange Handbook: 2020 – Issue 1

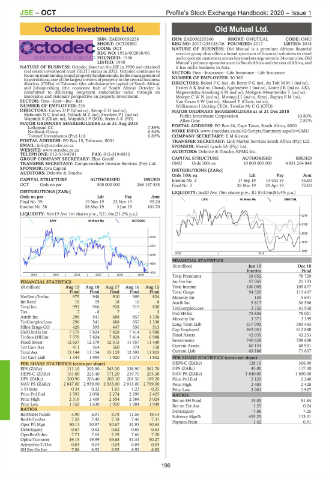

Octodec Investments Ltd. Old Mutual Ltd.

OCT OLD

ISIN: ZAE000192258 ISIN: ZAE000255360 SHORT: OMUTUAL CODE: OMU

SHORT: OCTODEC REG NO: 2017/235138/06 FOUNDED: 2017 LISTED: 2018

CODE: OCT NATURE OF BUSINESS: Old Mutual is a premium African financial

REG NO: 1956/002868/06 services group that offers a broad spectrum of financial solutions to retail

FOUNDED: 1956 and corporate customers across key markets segments in 14 countries. Old

LISTED: 1990 Mutual’s primary operations are in South Africa and the rest of Africa, and

NATURE OF BUSINESS: Octodec listed on the JSE in 1990 and obtained it has niche business in Asia.

real estate investment trust (REIT) status in 2013. Octodec continues to SECTOR: Fins—Insurance—Life Insurance—Life Insurance

focus on maintaining sound property fundamentals. In the management of

its portfolio as one of the largest owners of property in the central business NUMBER OF EMPLOYEES: 30 365

districts (CBDs) of Tshwane (the administrative capital of South Africa) DIRECTORS: Baloyi P C (ne), de Beyer P G (ne), du Toit M M ( (ind ne),

and Johannesburg (the economic hub of South Africa) Octodec is Essien A K (ind ne, Ghana), Kgaboesele I (ind ne), Lister J R (ind ne, UK),

committed to delivering long-term stakeholder value through an Magwentshu-Rensburg S M (ind ne), Mokgosi-Mwantembe T (ind ne),

innovative and visionary perspective on property investment. Molope C W N (ind ne), Mwangi J I (ind ne, Keny), Rapiya B M (ne),

SECTOR: Fins—Rest—Inv—Ret Van Graan S W (ind ne), Manuel T (Chair, ind ne),

NUMBER OF EMPLOYEES: 236 Williamson I (Acting CEO), Troskie Mr C G (CFO)

DIRECTORS: Cohen D P (ld ind ne), Kemp G H (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018

Mabunda N C (ind ne), Pollack M Z (ne), Strydom P J (ind ne), Public Investment Corporation 10.80%

Wapnick S (Chair, ne), Wapnick J P (MD), Stein A K (FD)

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2018 Allan Gray 7.81%

Lefkopaul CC 7.89% POSTAL ADDRESS: PO Box 66, Cape Town, South Africa, 8000

Nedbank Group 6.94% MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=OMU

Tomnef Investments (Pty) Ltd. 6.89% COMPANY SECRETARY: E M Kirsten

POSTAL ADDRESS: PO Box 15, Tshwane, 0001 TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

EMAIL: info@octodec.co.za SPONSOR: Merrill Lynch SA (Pty) Ltd.

WEBSITE: www.octodec.co.za AUDITORS: Deloitte & Touche, KPMG Inc.

TELE PHONE: 012-319-8781 FAX: 012-319-8812

GROUP COMPANY SECRETARY: Elize Greeff CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. OMU Ords 100c ea 10 000 000 000 4 831 264 848

SPONSOR: Java Capital DISTRIBUTIONS [ZARc]

AUDITORS: Deloitte & Touche

Ords 100c ea Ldt Pay Amt

CAPITAL STRUCTURE AUTHORISED ISSUED Interim No 3 17 Sep 19 14 Oct 19 45.00

OCT Ords no par 500 000 000 266 197 535 Final No 2 26 Mar 19 29 Apr 19 72.00

DISTRIBUTIONS [ZARc] LIQUIDITY: Jan20 Ave 79m shares p.w., R1 833.9m(85.4% p.a.)

Ords no par Ldt Pay Amt

LIFE 40 Week MA OMUTUAL

Final No 59 19 Nov 19 25 Nov 19 99.20

Interim No 58 28 May 19 3 Jun 19 101.70

LIQUIDITY: Nov19 Ave 1m shares p.w., R21.0m(21.2% p.a.)

2279

SAPY 40 Week MA OCTODEC

2158

2038

2579

1917

2327

1797

2018 | 2019

2076

FINANCIAL STATISTICS

1824

(R million) Jun 19 Dec 18

Interim Final

1573

2014 | 2015 | 2016 | 2017 | 2018 | 2019

Total Premiums 38 652 78 729

FINANCIAL STATISTICS Inc Fm Inv 57 065 25 133

(R million) Aug 19 Aug 18 Aug 17 Aug 16 Aug 15 Total Income 100 005 109 877

Final Final Final Final Final Total Outgo 94 520 113 437

NetRent/InvInc 975 948 910 909 824 Minority Int 135 5 641

Int Recd 19 19 18 10 6 Attrib Inc 5 817 36 566

Total Inc 993 966 928 919 830 TotCompIncLoss 3 750 41 950

Tax 7 - 8 7 - 3 Ord SH Int 75 836 78 021

Attrib Inc 296 541 688 857 1 338 Minority Int 3 371 3 399

TotCompIncLoss 296 541 688 857 1 338 Long-Term Liab 617 092 583 443

Hline Erngs-CO 429 595 447 556 513 Cap Employed 845 041 812 848

Ord UntHs Int 7 579 7 824 7 828 7 414 6 988

TotStockHldInt 7 579 7 824 7 828 7 414 6 988 Fixed Assets 42 035 42 253

Fixed Invest 12 637 12 379 12 315 11 957 11 449 Investments 740 628 708 638

Tot Curr Ass 411 564 560 374 158 Current Assets 60 144 68 901

Total Ass 13 144 13 154 13 129 12 593 11 803 Current Liab 63 188 71 607

Tot Curr Liab 1 344 1 984 1 920 1 073 1 802 PER SHARE STATISTICS (cents per share)

PER SHARE STATISTICS (cents per share) HEPS-C (ZARc) 128.10 306.90

EPS (ZARc) 111.10 202.90 263.30 338.90 561.70 DPS (ZARc) 45.00 117.00

HEPS-C (ZARc) 161.00 223.40 171.20 219.70 203.30 NAV PS (ZARc) 1 640.00 1 650.00

DPS (ZARc) 200.90 203.40 203.10 201.50 189.20 Price Prd End 2 120 2 240

NAV PS (ZARc) 2 847.00 2 939.00 2 933.00 2 913.00 2 769.00 Price High 2 403 2 428

3 Yr Beta 0.34 0.32 1.05 1.23 - 0.25 Price Low 2 001 1 967

Price Prd End 1 592 2 058 2 274 2 299 2 425 RATIOS

Price High 2 319 2 469 2 554 2 584 3 024 Ret on SH Fund 15.03 51.84

Price Low 1 550 1 630 1 950 1 904 1 949 Ret on Tot Ass 1.25 0.24

RATIOS Debt:Equity 7.86 7.25

RetOnSH Funds 3.90 6.91 8.78 11.56 19.14 Solvency Mgn% 455.25 113.01

RetOnTotAss 7.59 7.42 7.18 7.46 7.31 Payouts:Prem 1.42 0.91

Oper Pft Mgn 50.11 50.97 50.67 51.91 50.63

Debt:Equity 0.67 0.62 0.62 0.65 0.63

OperRetOnInv 7.71 7.65 7.39 7.60 7.20

OpInc:Turnover 49.15 49.99 49.68 51.34 50.27

AdminFee:T/Ovr 0.04 0.04 0.04 0.04 0.04

SH Ret On Inv 7.06 6.92 6.92 6.92 6.83

196