Page 199 - SHB 2020 Issue 1

P. 199

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – OCE

NUMBER OF EMPLOYEES: 0

DIRECTORS: Ebrahim A A (ind ne), Ebrahim Z, Oceana Group Ltd.

Mahomed Dr Y (ld ind ne), Mayman A (ind ne), Mohamed E (ind ne), OCE

Ebrahim M S (Chair), Ebrahim N (Dep Chair), Swingler M (FD) ISIN: ZAE000025284

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019 SHORT: OCEANA CODE: OCE

Oasis Crescent Property Company (Pty) Ltd. 12.50% REG NO: 1939/001730/06

Oasis Crescent Equity Fund 12.40% FOUNDED: 1918 LISTED: 1947

Oasis Crescent Bal Progressive Fund of Funds 11.50% NATURE OF BUSINESS:

POSTAL ADDRESS: PO Box 1217, Cape Town, 8000 Incorporated in 1918 and listed on

(JSE)

and

the

Johannesburg

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=OAS Namibian (NSX) stock exchanges, Oceana Group is the largest fishing

COMPANY SECRETARY: Nazeem Ebrahim company in Africa and an important participant in the Namibian and US

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. fishing industries.

DESIGNATED ADVISOR: PSG Capital (Pty) Ltd. SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish

AUDITORS: PwC Inc. NUMBER OF EMPLOYEES: 4 845

DIRECTORS: Bassa Z B M (ind ne), de Beyer P G (ind ne), Jakoet A (ind ne),

CAPITAL STRUCTURE AUTHORISED ISSUED Pangarker N A (ne), Pather S (ld ind ne), Sennelo L J (ne),

OAS Units no par - 63 650 278 Simamane N V (ind ne), Brey M A (Chair, ne), Soomra I (CEO),

DISTRIBUTIONS [ZARc] Bosch E R (CFO)

Units no par Ldt Pay Amt Scr/100 MAJOR ORDINARY SHAREHOLDERS as at 06 Dec 2019

Interim No 28 26 Nov 19 2 Dec 19 52.21 2.33 Brimstone Investment Corporation Ltd. 24.00%

Final No 27 4 Jun 19 10 Jun 19 57.45 2.61 Oceana Empowerment Trust 9.90%

Public Investment Corporation 9.40%

LIQUIDITY: Jan20 Ave 59 303 shares p.w., R1.3m(4.8% p.a.) POSTAL ADDRESS: PO Box 7206, Roggebaai, 8012

EMAIL: companysecretary@oceana.co.za

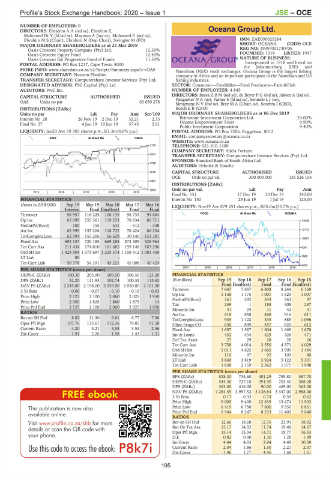

SAPY 40 Week MA OASIS

WEBSITE: www.oceana.co.za

2150 TELE PHONE: 021-410-1400

COMPANY SECRETARY: Adela Fortune

1973

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Standard Bank of South Africa Ltd.

1796

AUDITORS: Deloitte & Touche

1618 CAPITAL STRUCTURE AUTHORISED ISSUED

OCE Ords no par val. 300 000 000 135 526 154

1441

DISTRIBUTIONS [ZARc]

1264 Ords no par val. Ldt Pay Amt

2015 | 2016 | 2017 | 2018 | 2019

Final No 151 17 Dec 19 23 Dec 19 240.00

FINANCIAL STATISTICS Interim No 150 25 Jun 19 1 Jul 19 123.00

(Amts in ZAR’000) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16 LIQUIDITY: Nov19 Ave 879 251 shares p.w., R65.0m(33.7% p.a.)

Interim Final Final(rst) Final Final

Turnover 58 557 116 225 106 135 98 733 94 684 FOOD 40 Week MA OCEANA

Op Inc 63 099 155 361 119 253 78 834 86 711 13528

NetIntPd(Rcvd) 100 155 531 - 512 - 338

Att Inc 62 999 155 206 118 722 78 424 86 254 12112

TotCompIncLoss 62 994 155 206 66 629 30 140 151 381

10697

Fixed Ass 692 157 720 185 669 288 572 309 528 964

Tot Curr Ass 211 434 174 810 161 685 159 148 103 296 9281

Ord SH Int 1 428 904 1 373 697 1 235 374 1 158 412 1 083 450

LT Liab 88 - - - - 7866

Tot Curr Liab 50 378 54 391 45 221 45 008 40 424

6450

2014 | 2015 | 2016 | 2017 | 2018 | 2019

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 100.30 205.90 109.50 106.50 123.20 FINANCIAL STATISTICS

DPS (ZARc) 52.20 111.93 102.74 100.32 115.62 (R million) Sep 19 Sep 18 Sep 17 Sep 16 Sep 15

NAV PS (ZARc) 2 245.00 2 198.00 2 059.00 2 050.00 2 101.00 Final Final(rst) Final Final Final(rst)

3 Yr Beta - 0.06 - 0.07 - 0.10 - 0.19 - 0.03 Turnover 7 647 7 657 6 808 8 244 6 169

Price High 2 125 2 100 2 060 2 025 1 950 Op Inc 1 158 1 175 1 001 1 629 1 007

363

261

97

292

NetIntPd(Rcvd)

343

Price Low 2 050 1 825 1 860 1 875 14 Tax 249 1 188 408 287

Price Prd End 2 125 2 100 2 060 2 025 1 950 Minority Int 31 24 11 42 31

RATIOS Att Inc 618 858 468 916 611

Ret on SH Fnd 8.82 11.30 9.61 6.77 7.96 TotCompIncLoss 935 1 122 335 889 1 096

Oper Pft Mgn 107.76 133.67 112.36 79.85 91.58

Hline Erngs-CO 636 849 457 820 612

Current Ratio 4.20 3.21 3.58 3.54 2.56 Fixed Ass 1 697 1 587 1 604 1 669 1 678

Div Cover 1.91 2.26 1.98 1.43 1.51 Inv & Loans 432 434 425 426 471

Def Tax Asset 27 29 28 28 26

Tot Curr Ass 3 758 4 014 3 550 4 371 4 029

Ord SH Int 5 011 4 625 3 665 3 905 3 484

Minority Int 110 97 92 103 80

LT Liab 3 840 3 819 3 924 5 122 5 301

Tot Curr Liab 1 838 2 159 2 362 1 977 1 948

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 528.30 734.60 401.29 785.80 587.70

HEPS-C (ZARc) 544.30 727.10 391.90 703.40 588.20

DPS (ZARc) 363.00 416.00 90.00 469.00 365.00

NAV PS (ZARc) 4 284.55 3 957.52 3 138.84 3 347.00 2 988.00

3 Yr Beta 0.17 0.33 0.74 0.59 0.62

Price High 9 000 9 400 12 639 13 474 11 902

Price Low 6 419 6 750 7 800 9 550 6 851

Price Prd End 6 944 8 247 8 233 11 402 9 640

RATIOS

Ret on SH Fnd 12.66 18.68 12.76 23.91 18.02

Ret On Tot Ass 15.17 14.52 11.74 19.48 14.67

Oper Pft Mgn 15.14 15.34 14.71 19.77 16.33

D:E 0.82 0.90 1.30 1.28 1.49

Int Cover 4.44 4.03 2.94 4.49 10.59

Current Ratio 2.04 1.86 1.50 2.21 2.07

Div Cover 1.46 1.77 4.46 1.68 1.61

195