Page 196 - SHB 2020 Issue 1

P. 196

JSE – NOR Profile’s Stock Exchange Handbook: 2020 – Issue 1

Northam Platinum Ltd. Novus Holdings Ltd.

NOR NOV

ISIN: ZAE000030912 SHORT: NORTHAM CODE: NHM ISIN: ZAE000202149 SHORT: NOVUS CODE: NVS

REG NO: 1977/003282/06 FOUNDED: 1977 LISTED: 1987 REG NO: 2008/011165/06 FOUNDED: 2000 LISTED: 2015

NATURE OF BUSINESS: Northam is an independent, fully empowered, NATURE OF BUSINESS: Operational expansion and diversification

mid-tier, integrated PGM producer with two primary operating assets, the established Novus as a market leader in the print industry. Investment in

Zondereinde and Booysendal mines in the South African Bushveld cutting-edge technology has taken us further. Today, Novus’ reputation

Complex. The Zondereinde lease area is also the location for Northam’s for the highest quality and personalised service transcends borders and

metallurgical operations, which include concentrators, a smelter and base industries.

metals recovery plant. At 30 June 2018, Northam held a combined resource SECTOR: Ind—Ind Goods&Srvcs—Support Srvcs—Bus Support Srvcs

base of 238.5 million ounces (Moz) 4E and 28.5Moz 4E was in the reserve NUMBER OF EMPLOYEES: 2 364

category. DIRECTORS: Alwar K (alt), Botha C G (ind ne), Mack D J (ind ne),

SECTOR: Basic Materials—Basic Resrcs—Mining—Plat&Prcs Metals Mkhondo N (ne), Mtanga L (ind ne), Zungu S D M (ind ne), Mnganga Dr

NUMBER OF EMPLOYEES: 13 258 P (Chair, ind ne), Birch N W (CEO), Todd H (CFO)

DIRECTORS: Brown D H (ind ne), Chabedi C K (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

Havenstein R (ld ind ne), Hickey H H (ind ne), Jekwa Dr N Y (ind ne), Media24 Ltd. 17.48%

Jonas M H (ind ne), Kgosi T E (ind ne), Mvusi T I (ind ne), Prudential Investment Managers (SA) (Pty) Ltd. 11.99%

Nel Mr J (ind ne), Smithies J G (ind ne, UK), Mosehla K B (Chair, ne), Investec Asset Management 9.68%

Dunne P A (CEO, UK), Coetzee A H (CFO) POSTAL ADDRESS: PO Box 37014, Chempet, 7442

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2018 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=NVS

Zambezi Platinum (RF) Ltd. 31.37% COMPANY SECRETARY: Melonie Brink

Coronation Asset Management (Pty) Ltd. 29.66% TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Public Investment Corporation 10.42%

POSTAL ADDRESS: PO Box 412694, Craighall, 2024 SPONSOR: Investec Bank Ltd.

AUDITORS: PwC Inc.

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=NHM

COMPANY SECRETARY: Patricia Beale CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. NVS Ords no par value 3 000 000 000 346 656 348

SPONSOR: One Capital DISTRIBUTIONS [ZARc]

AUDITORS: Ernst & Young Ords no par value Ldt Pay Amt

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 5 10 Sep 19 16 Sep 19 30.00

NHM Ords no par value 2 000 000 000 509 781 212 Final No 4 4 Sep 18 10 Sep 18 52.00

DISTRIBUTIONS [ZARc] LIQUIDITY: Jan20 Ave 1m shares p.w., R5.4m(19.4% p.a.)

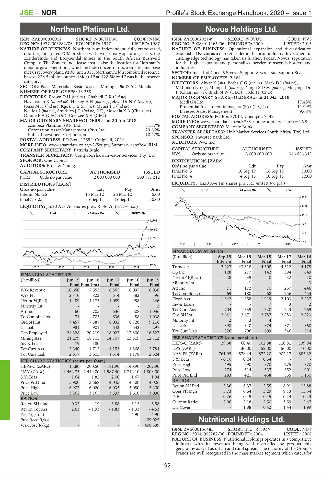

Ords no par value Ldt Pay Amt SUPS 40 Week MA NOVUS

Interim No 26 15 Mar 12 26 Mar 12 5.00

Final No 25 9 Sep 11 19 Sep 11 10.00 1781

LIQUIDITY: Jan20 Ave 7m shares p.w., R536.7m(67.7% p.a.) 1469

PLAT 40 Week MA NORTHAM

1156

12751

843

10452

531

8153

218

2015 | 2016 | 2017 | 2018 | 2019

5853

FINANCIAL STATISTICS

3554 (R million) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16

Interim Final Final Final Final

1255 Turnover 2 227 43 318 4 308 4 312 4 175

2015 | 2016 | 2017 | 2018 | 2019

Op Inc 128 277 142 394 649

FINANCIAL STATISTICS NetIntPd(Rcvd) 28 39 40 32 10

(R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15

Final Final(rst) Final Final Final Minority Int - - 1 - - 3

Wrk Revenue 10 650 7 552 6 865 6 097 6 036 Att Inc 71 172 70 257 446

Wrk Pft 2 410 823 614 383 596 TotCompIncLoss 69 180 68 256 453

NetIntPd(Rcd) 1 489 1 175 1 089 958 246 Fixed Ass 1 842 1 858 1 919 2 103 2 237

Minority Int - - - - 2 Inv & Loans - - 7 3 2

Att Inc 60 - 705 - 636 - 508 - 1 036 Tot Curr Ass 1 704 1 539 1 520 1 243 1 269

TotCompIncLoss 71 - 705 - 636 - 488 - 1 038 Ord SH Int 2 641 2 671 2 787 2 883 2 823

Ord SH Int 7 457 7 387 8 092 8 728 9 216 Minority Int 2 3 4 - -

LT Liab 981 901 643 633 297 LT Liab 398 340 374 371 360

Cap Employed 24 328 20 219 18 022 17 800 16 527 Tot Curr Liab 826 706 609 346 514

Mining Ass 21 279 18 705 14 707 13 519 12 712 PER SHARE STATISTICS (cents per share)

Inv & Loans 179 180 - - - HEPS-C (ZARc) 29.38 60.40 102.88 110.81 139.94

Tot Curr Ass 5 340 4 715 4 153 4 868 5 784 DPS (ZARc) - 30.00 52.00 56.00 70.00

Tot Curr Liab 2 617 3 605 1 614 1 178 2 624 NAV PS (ZARc) 761.95 878.44 872.20 902.17 883.32

3 Yr Beta - 0.10 0.24 0.34 - -

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 15.80 - 200.50 - 181.90 - 140.90 - 202.90 Price High 495 590 870 1 275 1 870

NAV (ZARc) 1 462.75 1 449.00 1 587.40 1 712.10 1 808.00 Price Low 274 314 337 652 901

3 Yr Beta 1.64 1.82 2.00 1.67 1.94 Price Prd End 283 421 458 855 1 150

Price Prd End 5 900 3 668 4 045 4 300 4 026 RATIOS

Ret on SH Fnd 5.36 6.37 2.55 8.91 15.88

Price High 6 902 6 020 6 035 5 080 5 200

Price Low 3 262 3 165 3 593 1 610 3 096 Oper Pft Mgn 5.73 0.64 3.29 9.13 15.54

RATIOS D:E 0.26 0.19 0.15 0.14 0.13

Ret on SH fund 0.33 - 4.19 - 3.88 - 3.15 - 6.58 Current Ratio 2.06 2.18 2.50 3.59 2.47

Ret on Tot Ass 2.63 - 1.93 - 1.83 - 1.33 - 4.53 Div Cover - 1.88 0.42 1.44 1.99

Yield (g/ton) - - - 4.90 4.90

Prce Recd R/kg - - - - 409 025 Nutritional Holdings Ltd.

WrkCost(R/kg) - - - - 408 599 NUT

ISIN: ZAE000156485 SHORT: NU TRI TION CODE: NUT

REG NO: 2004/002282/06 FOUNDED: 2004 LISTED: 2006

NATURE OF BUSINESS: Nutritional Holdings operates in a competitive

industry with its revenues being well diversified by product mix,

geography as well as urban and rural spread. The majority of the Group’s

brands are well recognized in the mass market segment which caters for

192