Page 197 - SHB 2020 Issue 1

P. 197

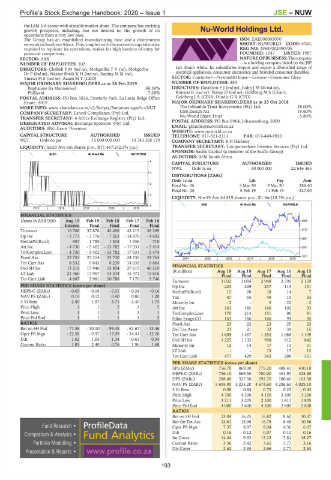

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – NUW

the LSM 3-6 sector with sizeable market share. The company has exciting

growth prospects, including, but not limited to, the growth of its Nu-World Holdings Ltd.

operations from a very low base. NUW

The Group has an established manufacturing base and a distribution ISIN: ZAE000005070

network in Southern Africa. This, coupled with the extensive capital outlay SHORT: NUWORLD CODE: NWL

required to replicate its operations, makes for high barriers of entry for REG NO: 1968/002490/06

potential competitors. FOUNDED: 1947 LISTED: 1987

SECTOR: AltX NATURE OF BUSINESS: The company

NUMBER OF EMPLOYEES: 102 is a holding company listed on the JSE

DIRECTORS: Chabeli P M (ind ne), Mokgatlha T V (ne), Mokgothu Ltd. South Africa. Its subsidiaries import and export a diversified range of

Dr P (ind ne), Nasser Sheik K H (ind ne), Suping M M (ne), electrical appliances, consumer electronics and branded consumer durables.

Tinawi M S (ind ne), Azum M T (CEO) SECTOR: Consumer—Personal&House—Leisure—Consumer Elecs

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019 NUMBER OF EMPLOYEES: 384

Baphalane Ba Mantserred 68.39% DIRECTORS: Davidson F J (ind ne), Judin J M (ld ind ne),

Philisani 7.28% Kinross R (ind ne), Piaray D (ind ne), Goldberg M S (Chair),

POSTAL ADDRESS: PO Box 5026, Frosterly Park, La Lucia Ridge Office Goldberg J A (CEO), Hindle G R (CFO)

Estate, 4019 MAJOR ORDINARY SHAREHOLDERS as at 25 Oct 2018

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=NUT The Inhlanhla Trust Investments (Pty) Ltd. 28.00%

COMPANY SECRETARY: Eshcol Compliance (Pty) Ltd. UBS Zurich AG 19.60%

TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd. Nu-World Share Trust 5.80%

DESIGNATED ADVISOR: Exchange Sponsors (Pty) Ltd. POSTAL ADDRESS: PO Box 8964, Johannesburg, 2000

AUDITORS: SNG Grant Thornton EMAIL: ghindle@nuworld.co.za

WEBSITE: www.nuworld.co.za

CAPITAL STRUCTURE AUTHORISED ISSUED TELE PHONE: 011-321-2111 FAX: 011-440-9920

NUT Ords no par 15 000 000 000 13 743 368 179 COMPANY SECRETARY: B H Haikney

LIQUIDITY: Jan20 Ave 6m shares p.w., R71 467.2(2.5% p.a.) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Sasfin Capital (a member of the Sasfin Group)

ALSH 40 Week MA NUTRITION

AUDITORS: RSM South Africa

4

CAPITAL STRUCTURE AUTHORISED ISSUED

NWL Ords 1c ea 30 000 000 22 646 465

3

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

2

Final No 26 3 Mar 20 9 Mar 20 288.40

Final No 25 5 Feb 19 11 Feb 19 327.50

2

LIQUIDITY: Nov19 Ave 44 819 shares p.w., R1.8m(10.3% p.a.)

IIND 40 Week MA NUWORLD

1

2015 | 2016 | 2017 | 2018 | 2019

FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16 4060

Interim Final Final Final Final

Turnover 16 706 37 876 42 496 43 215 38 269 3470

Op Inc - 3 773 - 3 776 - 7 263 - 14 870 - 4 692

2881

NetIntPd(Rcvd) 957 1 785 1 535 1 336 710

Att Inc - 4 730 - 5 402 - 13 782 - 17 031 - 5 414 2291

TotCompIncLoss - 4 730 - 5 402 - 13 782 - 17 031 - 5 474

Fixed Ass 23 755 23 214 23 730 24 730 24 764 2014 | 2015 | 2016 | 2017 | 2018 | 2019 1701

Tot Curr Ass 8 532 9 643 8 239 14 035 9 664

Ord SH Int 13 216 17 946 13 854 27 615 40 210 FINANCIAL STATISTICS Aug 18 Aug 17 Aug 16 Aug 15

(R million)

Aug 19

LT Liab 21 366 17 967 14 334 15 371 12 616 Final Final Final Final Final

Tot Curr Liab 4 667 3 981 10 786 7 170 5 746

Turnover 3 032 3 004 2 948 2 590 2 159

PER SHARE STATISTICS (cents per share) Op Inc 223 269 237 113 131

HEPS-C (ZARc) - 0.03 - 0.06 - 0.31 - 0.24 - 0.16 NetIntPd(Rcvd) 15 28 18 14 7

NAV PS (ZARc) 0.10 0.12 0.40 0.80 1.20 Tax 47 55 49 19 33

3 Yr Beta 2.50 1.57 3.71 2.40 1.73 Minority Int - 2 - 5 - 22 - 2

Price High 1 1 2 2 5 Att Inc 163 185 166 102 93

Price Low 1 1 1 1 1 TotCompIncLoss 170 213 151 96 91

Price Prd End 1 1 1 1 2 Hline Erngs-CO 163 186 166 94 92

RATIOS Fixed Ass 23 22 23 25 23

Ret on SH Fnd - 71.58 - 30.10 - 99.48 - 61.67 - 13.46 Def Tax Asset 23 21 32 39 15

Oper Pft Mgn - 22.58 - 9.97 - 17.09 - 34.41 - 12.26 Tot Curr Ass 1 605 1 467 1 252 1 088 1 109

D:E 1.62 1.05 1.34 0.61 0.34 Ord SH Int 1 225 1 132 998 912 842

Current Ratio 1.83 2.40 0.76 1.96 1.68 Minority Int 12 14 17 13 31

LT Liab - - 13 17 12

Tot Curr Liab 477 429 343 288 351

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 756.70 869.00 779.20 488.41 430.10

HEPS-C (ZARc) 756.10 869.50 780.00 451.90 428.60

DPS (ZARc) 288.40 327.50 292.70 180.40 163.50

NAV PS (ZARc) 5 695.90 5 235.20 4 674.60 4 286.60 4 029.10

3 Yr Beta 0.08 0.84 0.75 0.25 - 0.43

Price High 4 700 4 500 4 150 3 300 3 200

Price Low 3 211 3 205 2 100 1 811 1 805

Price Prd End 4 000 3 600 4 100 2 800 2 800

RATIOS

Ret on SH Fnd 13.04 16.25 16.82 8.62 10.37

Ret On Tot Ass 12.61 15.96 16.78 8.46 10.56

Oper Pft Mgn 7.37 8.97 8.04 4.36 6.07

D:E 0.16 0.12 0.07 0.10 0.16

Int Cover 14.44 9.52 13.23 7.81 18.27

Current Ratio 3.36 3.42 3.65 3.77 3.16

Div Cover 2.62 2.65 2.66 2.71 2.63

193