Page 195 - SHB 2020 Issue 1

P. 195

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – NIC

Nictus Ltd. Niveus Investments Ltd.

NIC NIV

ISIN: NA0009123481 ISIN: ZAE000169553 SHORT: NIVEUS CODE: NIV

SHORT: NICTUS REG NO: 1996/005744/06 FOUNDED: 1996 LISTED: 2012

CODE: NCS NATURE OF BUSINESS: Niveus Investments is a focused investment

REG NO: 1981/011858/06 entity holding three principal unlisted investments across a diversified

FOUNDED: 1964 range of sectors. Niveus’ intention is to focus on growing and fully

LISTED: 1969 developing the existing investments. Some of these are startups,

NATURE OF BUSINESS: Nictus Group is a retailer of household furniture, turnarounds and some are businesses with a mature business model but

electrical appliances and home electronics sold through the Nictus have significant growth potential. The Group will also opportunistically

Furnishers brand as well as a short-term insurer through the Corporate pursue other investments with asymmetrical risk/reward profiles where it

Guarantee brand. can leverage its management’s expertise and experience. No specific

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Broadline Rets industries or business profiles are targeted.

NUMBER OF EMPLOYEES: 50 The highest peaks of mountain ranges are snow white (Niveus). Through

DIRECTORS: de Vrye C J (ind ne), Swart G (ind ne), Tromp N C (ne), the Group’s investment philosophies, Niveus aims to achieve outcomes

Tromp P J de W (ne), Willemse Prof B J (Chair, ind ne), Tromp G R that will reach these pinnacles.

de V (Group MD), Prozesky H E (FD) SECTOR: Fins—Investment Instruments—Equities—Equities

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019 NUMBER OF EMPLOYEES: 0

Landswyd Beleggings (Pty) Ltd. 46.60% DIRECTORS: Molefi Dr M L (ld ind ne), Ngcobo J G (ind ne), Shaik

Namprop (Pty) Ltd. 11.44% Y (ne), Watson R D (ind ne), Copelyn J A (Chair, ne), Bethlehem L

Trocor (Pty) Ltd. 10.63% I (CEO), Pereira A F (Group FD)

POSTAL ADDRESS: PO Box 2878, Randburg, 2125 MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

EMAIL: fd@nictus.com.na HCI 52.30%

WEBSITE: www.nictuslimited.co.za Legae Peresec (Pty) Ltd. 12.60%

TELE PHONE: 011-787-9019 FAX: 011-326-0863 Geomer Investments (Pty) Ltd. 6.50%

COMPANY SECRETARY: Veritas BOE (Pty) Ltd. POSTAL ADDRESS: PO Box 6185, Paarl, 7620

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=NIV

SPONSOR: One Capital COMPANY SECRETARY: HCI Managerial Services (Pty) Ltd.

AUDITORS: PWC Inc. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: BDO South Africa Inc.

NCS Ords no par value 250 000 000 53 443 500

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] NIV Ords no par 500 000 000 119 162 734

Ords no par value Ldt Pay Amt

Final No 36 16 Jul 19 22 Jul 19 3.75 DISTRIBUTIONS [ZARc]

Final No 35 17 Jul 18 23 Jul 18 3.00 Ords no par Ldt Pay Amt

Interim 6 Mar 18 12 Mar 18 120.00

LIQUIDITY: Nov19 Ave 15 462 shares p.w., R9 042.5(1.5% p.a.) Final No 8 12 Jun 17 19 Jun 17 22.00

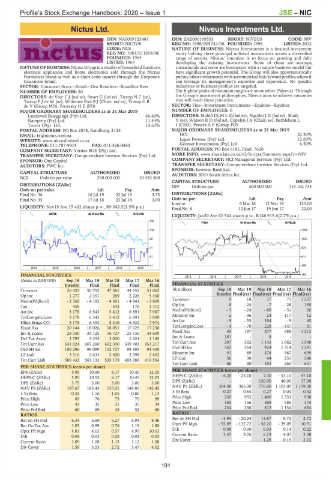

GERE 40 Week MA NICTUS

LIQUIDITY: Jan20 Ave 62 544 shares p.w., R146 915.6(2.7% p.a.)

130

FINA 40 Week MA NIVEUS

110 1250

90 1037

71 824

51 611

31 398

2014 | 2015 | 2016 | 2017 | 2018 | 2019

FINANCIAL STATISTICS 185

2015 | 2016 | 2017 | 2018 | 2019

(Amts in ZAR’000) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16

Interim Final Final Final Final FINANCIAL STATISTICS

Turnover 26 423 50 752 47 361 44 651 51 062 (R million) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16

Op Inc 1 277 2 351 269 2 228 5 430 Interim Final(rst) Final(rst) Final(rst) Final(rst)

NetIntPd(Rcvd) - 2 360 - 4 192 - 4 601 - 4 841 - 3 869 Turnover 9 18 17 71 1 237

Tax 459 - - 542 178 1 312 Op Inc - 8 - 24 - 7 - 28 135

Att Inc 3 178 6 543 5 412 6 891 7 987 NetIntPd(Rcvd) - 5 - 24 - 80 - 51 26

TotCompIncLoss 3 178 6 543 5 412 6 891 7 800 Minority Int - 2 - 36 24 - 117 12

Hline Erngs-CO 3 178 6 493 5 416 6 922 7 974 Att Inc - 9 - 55 184 - 9 45

Fixed Ass 20 144 18 026 18 051 17 629 17 230 TotCompIncLoss - 4 - 70 228 - 147 81

Inv & Loans 28 330 33 125 16 727 25 730 44 609 Fixed Ass 43 197 377 688 1 212

Def Tax Asset 2 795 3 253 3 020 1 424 1 145 Inv & Loans 181 - 8 - -

Tot Curr Ass 641 024 607 260 602 390 549 903 453 217 Tot Curr Ass 307 302 1 143 1 062 1 548

Ord SH Int 100 296 99 099 102 727 99 303 94 400 Ord SH Int 362 364 924 1 314 1 381

LT Liab 3 516 2 633 2 400 2 398 2 602 Minority Int 91 89 476 567 699

Tot Curr Liab 589 433 561 133 535 179 493 086 419 554 LT Liab 36 38 44 231 246

Tot Curr Liab 86 80 183 265 651

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 5.95 10.60 8.17 10.40 12.05 PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 5.95 10.52 8.17 10.45 12.03 HEPS-C (ZARc) - 6.20 - 23.10 7.30 - 53.10 47.10

DPS (ZARc) 3.75 3.00 3.00 3.00 3.00 DPS (ZARc) - - 120.00 40.00 17.00

NAV PS (ZARc) 187.67 185.43 155.01 149.85 142.45 NAV PS (ZARc) 304.00 305.00 776.00 1 103.00 1 159.00

3 Yr Beta 0.32 1.16 - 1.05 - 0.86 - 1.13 3 Yr Beta 0.27 0.84 0.27 0.04 0.62

Price High 69 70 75 70 99 Price High 250 955 1 400 1 353 938

Price Low 41 35 31 35 34 Price Low 180 156 588 586 375

Price Prd End 60 69 45 52 60 Price Prd End 234 238 812 1 134 654

RATIOS RATIOS

Ret on SH Fnd 6.34 6.60 5.27 6.94 8.46 Ret on SH Fnd - 4.94 - 20.24 14.87 - 6.72 2.72

Ret On Tot Ass 1.05 0.99 0.76 1.19 1.80 Oper Pft Mgn - 92.89 - 132.72 - 42.20 - 39.09 10.91

Oper Pft Mgn 4.83 4.63 0.57 4.99 10.63 D:E 0.08 0.08 0.03 0.14 0.22

D:E 0.04 0.03 0.02 0.02 0.03 Current Ratio 3.57 3.76 6.23 4.01 2.38

Current Ratio 1.09 1.08 1.13 1.12 1.08 Div Cover - - 1.29 - 0.19 2.23

Div Cover 1.59 3.53 2.72 3.47 4.02

191