Page 202 - SHB 2020 Issue 1

P. 202

JSE – ONE Profile’s Stock Exchange Handbook: 2020 – Issue 1

Copper-Zinc Project in South Africa’s Areachap geological terrane,

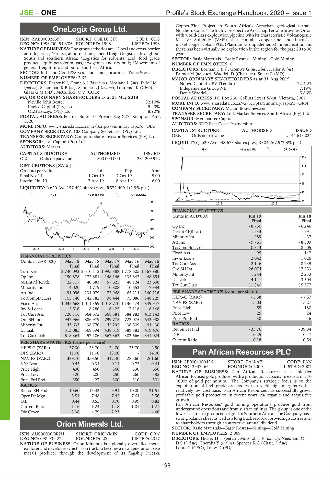

OneLogix Group Ltd. Northern Cape. The highly prospective Areachap Terrane provides Orion

with world-class exploration pipeline with its characteristic Volcanogenic

ONE

ISIN: ZAE000026399 SHORT: ONELOGIX CODE: OLG Massive Sulphide (VMS) that contain copper-zinc and intrusive

REG NO: 1998/004519/06 FOUNDED: 1998 LISTED: 1998 nickel-copper-cobalt-PGE (Platinum Group Elements) mineralisation but

NATURE OF BUSINESS: The group activities are : *Local and cross-border there has been virtually no exploration in the region for the past 20 to 30

auto-logistics; *Project, abnormal and general freight logistics throughout years.

South and southern Africa; *Logistics for solvents, acid, food grade SECTOR: Basic Materials—Basic Resrcs—Mining—Gold Mining

product, liquid petroleum, gas, cryogenics and dry bulk; *Movement of NUMBER OF EMPLOYEES: 0

general freight into and out of southern Africa. DIRECTORS: Borman T (ne), Gomwe G (ne, Zim), Haller A (ne),

SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs Palmer M (ne, Aus), Waddell D (Chair, ne), Smart E (MD)

NUMBER OF EMPLOYEES: 2 634 MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2019

DIRECTORS: Bester N J, Grant A J (ld ind ne), Mosiane L (alt), Pule I M Ndovu Capital x BV (Tembo) 22.42%

(ind ne), Schoeman K B (ne), Sennelo L J (ind ne), Lourens I K (CEO), Independence Group NL 7.19%

Glass G M (FD), McCulloch C V (COO) Denis Waddell 5.86%

MAJOR ORDINARY SHAREHOLDERS as at 31 May 2018 POSTAL ADDRESS: PO Box 260, Collins Street West, Victoria, 8007

Neville John Bester 32.10% MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ORN

Kagiso Capital (Pty) Ltd. 9.90% COMPANY SECRETARY: Martin Bouwmeester

OLG Esizayo (Pty) Ltd. 8.90% TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

POSTAL ADDRESS: Postnet Suite 10, Private Bag X27, Kempton Park, SPONSOR: Merchantec Capital

1620

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=OLG AUDITORS: BDO East Coast Partnership

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. ORN Ords no par value - 2 144 619 024

SPONSOR: Java Capital (Pty) Ltd. LIQUIDITY: Jan20 Ave 938 673 shares p.w., R304 267.9(2.3% p.a.)

AUDITORS: Mazars

MINI 40 Week MA ORIONMIN

CAPITAL STRUCTURE AUTHORISED ISSUED

OLG Ords no par value 500 000 000 281 209 972 140

DISTRIBUTIONS [ZARc] 116

Ords no par value Ldt Pay Amt

Final No 11 1 Oct 19 7 Oct 19 5.00 93

Interim No 10 2 Apr 19 8 Apr 19 6.00

69

LIQUIDITY: Jan20 Ave 157 491 shares p.w., R572 409.4(2.9% p.a.)

46

INDT 40 Week MA ONELOGIX

696 22

2018 | 2019

597 FINANCIAL STATISTICS

(Amts in AUD’000) Jun 19 Jun 18

497 Final Final

Op Inc - 8 760 - 6 246

398

NetIntPd(Rcvd) 1 533 1 791

299 Minority Int - 989 - 437

Att Inc - 9 761 - 8 309

200 TotCompIncLoss - 10 313 - 8 605

2015 | 2016 | 2017 | 2018 | 2019

Fixed Ass 95 147

FINANCIAL STATISTICS Inv & Loans 2 042 1 026

(Amts in ZAR’000) May 19 May 18 May 17 May 16 May 15 Tot Curr Ass 2 146 8 239

Final Final Final Final Final

Turnover 2 740 092 2 310 112 1 995 888 1 778 605 1 367 980 Ord SH Int 28 074 17 553

Op Inc 150 878 172 881 148 146 135 842 48 654 Minority Int 1 244 2 233

3 504

4 111

LT Liab

NetIntPd(Rcvd) 22 117 40 583 57 625 48 124 23 638

Minority Int 14 020 11 779 10 808 10 653 7 934 Tot Curr Liab 11 840 15 377

Att Inc 91 096 131 079 72 968 65 214 140 116 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 105 140 142 782 98 444 75 086 148 229 HEPS-C (ZARc) - 5.38 - 7.57

Fixed Ass 1 035 668 1 011 359 1 018 770 1 136 474 849 947 NAV PS (ZARc) 15.03 15.27

Inv & Loans 5 516 8 280 6 425 7 118 8 148 Price High 55 180

Tot Curr Ass 720 116 564 572 668 581 384 983 413 143 Price Low 25 24

Ord SH Int 947 966 886 979 799 775 722 075 643 988 Price Prd End 30 46

Minority Int 43 633 38 770 45 295 36 509 44 430 RATIOS

LT Liab 313 085 369 394 438 519 589 883 419 476 Ret on SH Fnd - 33.76 - 39.84

Tot Curr Liab 618 364 457 106 567 363 382 666 341 024 D:E 0.25 0.47

Current Ratio 0.18 0.54

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 37.30 33.70 24.00 25.70 - 2.50

DPS (ZARc) 11.00 11.00 13.00 - 14.00 Pan African Resources PLC

NAV PS (ZARc) 389.70 359.50 317.40 286.60 261.60 PAN

CODE: PAN

3 Yr Beta 0.45 0.34 0.11 0.75 0.64 ISIN: GB0004300496 SHORT: PAN-AF LISTED: 2007

REG NO: 3937466

FOUNDED: 2000

Price High 490 450 360 530 650 NATURE OF BUSINESS: Pan African Resources is a mid-tier

Price Low 320 200 250 260 385 African-focused gold producer with a production capacity in excess of 170

Price Prd End 350 427 300 310 501 000oz of gold per annum. The Company’s strategic focus is on the

RATIOS exploitation of high-grade ore bodies that yield high margins with a

Ret on SH Fnd 10.60 15.43 9.91 10.00 21.51 relatively low cost base. Pan African Resources has successfully grown

Oper Pft Mgn 5.51 7.48 7.42 7.64 3.56 profitable gold production in recent years via organic and acquisitive

D:E 0.44 0.55 0.70 0.99 0.82 growth.

Current Ratio 1.16 1.24 1.18 1.01 1.21 Pan African Resources’ gold mining operations produce gold from

underground operations and from surface tailings. The group is one of the

Div Cover 3.38 4.79 2.23 - 4.46

lowest cash-cost producers of gold in Southern Africa. The Company has a

strong balance sheet as well as a long track record of providing a cash return

Orion Minerals Ltd. to shareholders through an attractive annual dividend.

SECTOR: Basic Materials—Basic Resrcs—Mining—Gold Mining

ORI

ISIN: AU000000ORN1 SHORT: ORIONMIN CODE: ORN NUMBER OF EMPLOYEES: 2 069

REG NO: 098 939 274 FOUNDED: 2001 LISTED: 2017 DIRECTORS: Hickey H H (ind ne), Mosololi T F (ind ne), Needham C

NATURE OF BUSINESS: Orion Minerals is a globally diversified metal D S (ind ne), Themba Y (ind ne), Spencer K C (Chair, ind ne),

explorer and developer which is on track to become a new generation base Loots C (CEO), Louw D (FD)

metals producer through the development of its flagship Prieska

198