Page 107 - SHB 2020 Issue 1

P. 107

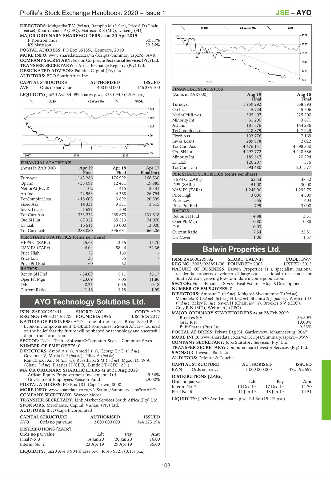

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – AYO

DIRECTORS: Mokgatlha T V (ind ne), Ramplin M (ind ne), Price S D (Chair,

TECH 40 Week MA AYO

ind ne), Koutromanos P (CEO), Mattison K S (MD), Larsen J (FD)

MAJOR ORDINARY SHAREHOLDERS as at 30 Apr 2019 4579

P Koutromanos 60.81%

KS Mattison 32.36% 3735

POSTAL ADDRESS: PO Box 651856, Benmore, 2010

2891

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AVR

COMPANY SECRETARY: Fusion Corporate Secretarial Services (Pty) Ltd. 2048

TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

DESIGNATED ADVISOR: Pallidus Capital (Pty) Ltd. 1204

AUDITORS: BDO South Africa Inc.

360

CAPITAL STRUCTURE AUTHORISED ISSUED 2018 | 2019

AVR Ords no par value 400 000 000 146 285 100 FINANCIAL STATISTICS

LIQUIDITY: Jan20 Ave 54 099 shares p.w., R33 094.3(1.9% p.a.) (Amts in ZAR’000) Aug 19 Aug 18

Final Final

ALSH 40 Week MA AVIOR

Turnover 1 959 292 638 893

188 Op Inc - 15 724 - 5 606

NetIntPd(Rcvd) - 305 407 - 225 200

157

Minority Int 31 200 3 671

Att Inc 187 676 144 286

127

TotCompIncLoss 218 879 147 929

96 Fixed Ass 102 776 7 169

Inv & Loans 289 978 2 022

66

Tot Curr Ass 4 476 141 4 598 350

Ord SH Int 4 297 772 4 448 686

35

2017 | 2018 | 2019

Minority Int 185 647 20 294

FINANCIAL STATISTICS LT Liab 120 207 575

(Amts in ZAR’000) Apr 19 Apr 18 Apr 17 Tot Curr Liab 593 480 201 577

Final Final Final(rst) PER SHARE STATISTICS (cents per share)

Turnover 143 286 176 992 168 530 HEPS-C (ZARc) 53.53 48.32

Op Inc - 33 091 12 481 19 985 DPS (ZARc) 51.00 30.00

NetIntPd(Rcvd) - 102 - 415 - 2 331 NAV PS (ZARc) 1 248.90 1 292.75

Att Inc - 22 963 4 368 26 794 Price High 3 000 4 500

TotCompIncLoss - 18 603 3 692 20 599 Price Low 555 1 404

Fixed Ass 14 331 9 331 3 615 Price Prd End 799 3 000

Inv & Loans 1 621 1 508 - RATIOS

Tot Curr Ass 333 232 468 670 131 618 Ret on SH Fnd 4.88 3.31

Ord SH Int 67 352 85 513 74 070 Oper Pft Mgn - 0.80 - 0.88

LT Liab 16 511 13 000 13 000 D:E 0.03 -

Tot Curr Liab 288 080 396 651 66 206 Current Ratio 7.54 22.81

PER SHARE STATISTICS (cents per share) Div Cover 1.06 1.57

HEPS-C (ZARc) - 15.68 3.55 15.70

NAV PS (ZARc) 46.04 58.46 52.36 Balwin Properties Ltd.

Price High 75 160 -

BAL

Price Low 35 35 - ISIN: ZAE000209532 SHORT: BALWIN CODE: BWN

Price Prd End 60 62 - REG NO: 2003/028851/06 FOUNDED: 2003 LISTED: 2015

RATIOS NATURE OF BUSINESS: Balwin Properties is a specialist, national

Ret on SH Fnd - 34.09 5.11 36.17 residential property developer of large-scale, sectional title estates for

Oper Pft Mgn - 23.09 7.05 11.86 South Africa’s growing low-to-middle income population.

D:E 0.25 0.15 0.18 SECTOR: Fins—Financial Srvcs—Real Estate—Hldgs&Development

Current Ratio 1.16 1.18 1.99 NUMBER OF EMPLOYEES: 0

DIRECTORS: Amosun T (ind ne), Mokgosi-Mwantembe T (ind ne),

Mzondeki K (ind ne), Scher J H (ind ne), Shapiro A J (ind ne), Westcott D

AYO Technology Solutions Ltd. (ind ne), Zekry R (ne), Saven H (Chair, ind ne), Brookes S V (CEO),

Gray R N (MD), Weltman J (CFO)

AYO

ISIN: ZAE000252441 SHORT: AYO CODE: AYO MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

REG NO: 1996/014461/06 FOUNDED: 1996 LISTED: 2017 Brookes S V 35.50%

NATURE OF BUSINESS: AYO is one of the largest Broad-Based Black Gray R N 10.00%

Economic Empowerment (B-BBEE) companies in South Africa – founded Buff-Shares (Pty) Ltd. 9.23%

on the belief that the future will be shaped by technology and successful POSTAL ADDRESS: Private Bag X4, Gardenview, Johannesburg, 2047

digital transformation. MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=BWN

SECTOR: Tech—Tech—Software&Computer Srvcs—Computer Srvcs COMPANY SECRETARY: Juba Statutory Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 0 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Amod A (ne), Amod I (ne), George Dr D (ind ne), SPONSOR: Investec Bank Ltd.

Govender V, Mosia R P (ind ne), Pillay A (ind ne), AUDITORS: Deloitte & Touche

Ramatlhodi Adv N (ind ne), Rasethaba S M (ind ne), Mgoqi Dr W A

(Chair, ind ne), Plaatjes H (CEO), Bundo I T (CFO, Zim) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2018 BWN Ords no par val 1 000 000 000 472 192 592

African Equity Empowerment Investments Ltd. 49.36% DISTRIBUTIONS [ZARc]

Government Employees Pension Fund 29.00% Ords no par val Ldt Pay Amt

POSTAL ADDRESS: PO Box 181, Cape Town, 8000 Interim No 7 10 Dec 19 17 Dec 19 11.70

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AYO Final No 6 11 Jun 19 18 Jun 19 14.51

COMPANY SECRETARY: Wazeer Moosa

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. LIQUIDITY: Jan20 Ave 1m shares p.w., R4.3m(15.4% p.a.)

SPONSORS: Merchantec Capital, Vunani (Pty) Ltd.

AUDITORS: BDO Cape Incorporated

CAPITAL STRUCTURE AUTHORISED ISSUED

AYO Ords no par value 2 000 000 000 344 125 194

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

Final No 3 14 Jan 20 20 Jan 20 16.00

Interim No 2 23 Apr 19 29 Apr 19 35.00

LIQUIDITY: Jan20 Ave 8 904 shares p.w., R143 972.7(0.1% p.a.)

103