Page 103 - SHB 2020 Issue 1

P. 103

Profile’s Stock Exchange Handbook: 2020 – Issue 1 JSE – AST

Price Low 169 1 000 930 923 1 401

Price Prd End 243 1 260 1 166 1 060 1 710 Atlantic Leaf Properties Ltd.

RATIOS

ATL

Ret on SH Fnd - 30.20 - 13.09 17.38 3.05 - 1.36 ISIN: MU0422N00009 SHORT: ATLEAF CODE: ALP

Oper Pft Mgn 110.59 120.12 91.98 64.70 - 151.75 REG NO: 119492 C1/GBL FOUNDED: 2013 LISTED: 2014

Current Ratio 114.60 158.57 49.46 202.18 247.10 NATURE OF BUSINESS: Atlantic Leaf’s primary objective is to provide

Div Cover - - 0.15 - - - attractive returns to investors, through long-term investments in quality

real estate assets in the United Kingdom which have sound property

Astral Foods Ltd. fundamentals and stable contracted income.

SECTOR: Fins—Financial Srvcs—Real Estate—Hldgs&Development

AST

ISIN: ZAE000029757 SHORT: AS TRAL CODE: ARL NUMBER OF EMPLOYEES: 0

REG NO: 1978/003194/06 FOUNDED: 2001 LISTED: 2001 DIRECTORS: Butler C (ind ne), Folkes C L (ind ne), Pretorius R (ind ne),

NATURE OF BUSINESS: Astral is a leading Southern African integrated Rapp L (ne), Winearls N (ind ne, UK), Bacon P (Chair, ind ne, UK),

poultry producer. Key activities comprise manufacturing of animal feeds, Leaf-Wright P (CEO), Pryce M (FD)

broiler genetics, production and sale of day-old chicks and hatching eggs, MAJOR ORDINARY SHAREHOLDERS as at 12 Dec 2019

breeder and broiler production, abattoir and further processing operations Vukile Property Fund Ltd. 34.90%

and sales and distribution of various key poultry brands. Sentinel Retirement Fund 9.85%

SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish Atlantic Property Investments Ltd. 5.00%

NUMBER OF EMPLOYEES: 11 543 POSTAL ADDRESS: 26 New Street, St Helier, Jersey, JE2 3RA

DIRECTORS: Fouché D (ld ind ne), Maumela T P (ne), Mayet S (ind ne), MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ALP

Potgieter W (ind ne), Shabangu T M (ind ne), Eloff Dr T (Chair, ind ne), COMPANY SECRETARY: Ocorian Secretaries (Jersey) Ltd.

Schutte C E (CEO), Arnold G D (MD), Crocker A B (MD), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Ferreira D D (CFO) SPONSOR: Java Capital (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 27 Sep 2019 AUDITORS: Mazars Mauritius, Mazars South Africa

Government Employees Pension Fund 13.05%

Astral Operations Ltd. 9.53% CAPITAL STRUCTURE AUTHORISED ISSUED

Allan Gray (Pty) Ltd. 5.02% ALP Ords no par value - 188 976 628

POSTAL ADDRESS: Postnet Suite 278, Private Bag X1028, Doringkloof, DISTRIBUTIONS [GBPp]

0140 Ords no par value Ldt Pay Amt

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ARL Interim No 9 5 Nov 19 11 Nov 19 4.50

COMPANY SECRETARY: Maryna Eloff Final No 8 14 May 19 20 May 19 4.65

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Nedbank Corporate and Investment Banking LIQUIDITY: Jan20 Ave 852 039 shares p.w., R13.9m(23.4% p.a.)

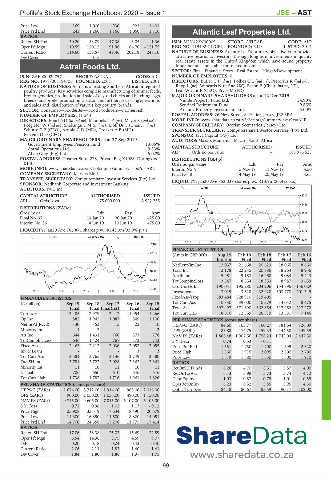

AUDITORS: PwC Inc. ALSH 40 Week MA ATLEAF

CAPITAL STRUCTURE AUTHORISED ISSUED 2700

ARL Ords 1c ea 75 000 000 42 922 235

2456

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt 2212

Final No 37 14 Jan 20 20 Jan 20 425.00

Interim No 36 4 Jun 19 10 Jun 19 475.00 1968

LIQUIDITY: Jan20 Ave 766 871 shares p.w., R143.3m(92.9% p.a.) 1724

FOOD 40 Week MA ASTRAL

1480

2015 | 2016 | 2017 | 2018 | 2019

32165

FINANCIAL STATISTICS

27612

(Amts in GBP’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

Interim Final Final Final Final

23059

NetRent/InvInc 12 037 21 668 20 623 18 065 8 660

18506 Total Inc 12 178 22 245 20 786 18 264 8 956

Attrib Inc 5 951 9 183 16 968 9 084 5 443

13953

TotCompIncLoss 3 547 8 554 18 353 8 987 3 659

Ord UntHs Int 190 041 195 280 204 206 154 796 136 029

9400

2015 | 2016 | 2017 | 2018 | 2019 Investments 3 019 3 618 32 920 303 770 201 349

FINANCIAL STATISTICS FixedAss/Prop 383 484 328 910 319 405 - -

(R million) Sep 19 Sep 18 Sep 17 Sep 16 Sep 15 Tot Curr Ass 10 830 39 000 10 379 14 032 8 475

Final Final Final(rst) Final Final Total Ass 397 497 371 690 362 854 317 952 217 272

Turnover 13 485 12 979 12 417 11 954 11 266 Tot Curr Liab 18 610 12 559 26 819 13 581 7 146

Op Inc 882 1 942 1 087 549 1 100 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) - 30 - 53 15 22 10 HEPS-C (ZARc) 84.60 163.77 160.27 181.64 126.09

Minority Int 4 3 - - 2 DPS (ZARc) 83.88 174.75 159.33 144.58 149.59

Att Inc 644 1 431 760 373 778 NAV PS (ZARc) 1 866.48 1 907.56 1 758.24 1 742.04 2 447.50

TotCompIncLoss 646 1 424 767 372 743 3 Yr Beta 0.74 0.53 - 0.11 - -

Fixed Ass 2 463 2 212 2 036 2 052 2 055 Price Prd End 1 551 1 750 1 700 1 699 2 620

Inv & Loans - - - 3 3 Price High 1 860 1 915 2 095 2 600 2 700

Tot Curr Ass 3 581 3 765 3 136 2 749 2 580 Price Low 1 519 1 580 1 550 1 600 1 910

Ord SH Int 3 784 3 727 3 028 2 363 2 361 RATIOS

Minority Int 11 10 11 10 11 RetOnSH Funds 6.26 4.70 8.31 5.87 4.00

LT Liab 706 650 610 646 616 RetOnTotAss 6.13 5.98 5.73 5.74 4.12

Tot Curr Liab 1 738 1 787 1 716 1 961 1 826 Debt:Equity 1.03 0.87 0.75 1.01 0.55

PER SHARE STATISTICS (cents per share) OperRetOnInv 6.23 6.52 5.85 5.95 4.30

HEPS-C (ZARc) 1 674.00 3 712.00 1 914.00 965.00 2 016.00 OpInc:Turnover 84.18 80.67 85.59 90.17 102.00

DPS (ZARc) 900.00 2 050.00 1 055.00 490.00 1 150.00

NAV PS (ZARc) 9 745.00 9 606.00 7 815.00 6 107.00 6 105.00

3 Yr Beta 0.72 0.96 1.02 1.13 - 0.12

Price High 25 908 33 519 17 634 18 490 20 679

Price Low 14 300 16 850 11 600 8 820 14 051

Price Prd End 14 700 24 658 17 208 11 775 17 414

RATIOS

Ret on SH Fnd 17.06 38.38 25.03 15.69 32.89

Oper Pft Mgn 6.54 14.96 8.75 4.59 9.77

D:E 0.20 0.18 0.24 0.43 0.40

Current Ratio 2.06 2.11 1.83 1.40 1.41

Div Cover 1.84 1.80 1.86 1.97 1.75

99