Page 106 - SHB 2020 Issue 1

P. 106

JSE – AVE Profile’s Stock Exchange Handbook: 2020 – Issue 1

Aveng Ltd. AVI Ltd.

AVE AVI

ISIN: ZAE000194940 SHORT: AVENG CODE: AEG ISIN: ZAE000049433 SHORT: A-V-I CODE: AVI

REG NO: 1944/018119/06 FOUNDED: 1944 LISTED: 1999 REG NO: 1944/017201/06 FOUNDED: 1944 LISTED: 1944

NATURE OF BUSINESS: Aveng’s primary geographic markets are South NATURE OF BUSINESS: AVI is a South African based company focusing

Africa and sub-Saharan Africa, Australasia and Southeast Asia. on the branded consumer products industry. Its key competencies are the

As the Group transitions to an international infrastructure and resources marketing, processing and manufacturing of food, beverages, footwear and

business, its main market sectors will be contract mining in sub-Saharan cosmetics.

Africa and West Africa, and construction in Australia, New Zealand and SECTOR: Consumer—Food&Bev—Food Producers—Food

Southeast Asia. NUMBER OF EMPLOYEES: 10 351

SECTOR: Ind—Constn&Matrls—Constn&Matrls—Heavy Construction DIRECTORS: Bosman M J (ind ne), Hersov J R (ind ne), Koursaris M,

NUMBER OF EMPLOYEES: 14 158 Muller A (ind ne), Nühn A (ind ne), Thebyane A M (ind ne), Tipper G R

DIRECTORS: Hermanus M (ld ind ne), Hourquebie P (ind ne), Kilbride M (Chair, ind ne), Crutchley S L (CEO), Cressey O P (CFO)

(ind ne), Modise B (ind ne), Mokgosi-Mwantembe T (ind ne), Seedat M I MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

(ind ne), Diack E K (Chair), Flanagan S J (CEO), Macartney A (Group Government Employees Pension Fund 13.30%

CFO) AVI Investment Services (Pty) Ltd. 4.90%

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 Vanguard Investment Management 3.30%

Highbridge Capital Management LLC 10.94% POSTAL ADDRESS: PO Box 1897, Saxonwold, 2132

1992 MFS International Fund 7.26% MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AVI

Aton GmbH 7.01% COMPANY SECRETARY: Sureya Scheepers

POSTAL ADDRESS: PO Box 6062, Rivonia, 2128 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AEG SPONSOR: The Standard Bank of South Africa Ltd.

COMPANY SECRETARY: Edinah Mandizha AUDITORS: Ernst & Young Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: UBS South Africa (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: Ernst & Young Inc. AVI Ords 5c ea 960 000 000 335 430 838

DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED

AEG Ords 5c ea - 19 394 498 220 Ords 5c ea Ldt Pay Amt

Final No 93 8 Oct 19 14 Oct 19 250.00

DISTRIBUTIONS [ZARc] Interim No 92 15 Apr 19 23 Apr 19 165.00

Ords 5c ea Ldt Pay Amt

Final No 14 5 Oct 12 15 Oct 12 60.00 LIQUIDITY: Jan20 Ave 5m shares p.w., R496.3m(79.1% p.a.)

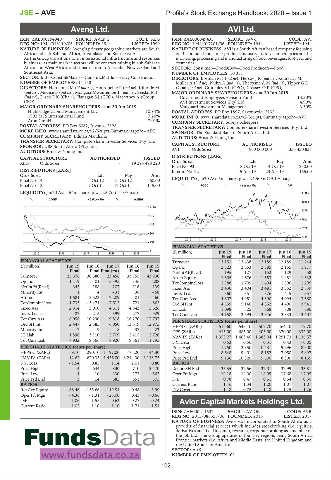

Final No 13 7 Oct 11 17 Oct 11 145.00 FOOD 40 Week MA A-V-I

LIQUIDITY: Jan20 Ave 154m shares p.w., R5.7m(41.3% p.a.) 11850

CONM 40 Week MA AVENG

10564

2152

9279

1721

7993

1291

6708

861

5422

2015 | 2016 | 2017 | 2018 | 2019

431

FINANCIAL STATISTICS

1 (R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15

2015 | 2016 | 2017 | 2018 | 2019

Final Final Final Final Final

FINANCIAL STATISTICS Turnover 13 151 13 438 13 185 12 189 11 244

(R million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15 Op Inc 2 523 2 553 2 385 2 155 1 917

Final Final Final(rst) Final Final NetIntPd(Rcvd) 195 127 152 129 58

Turnover 25 676 30 580 23 456 33 755 43 930 Att to Equity 1 605 1 676 1 553 1 481 1 332

Op Inc - 1 119 - 401 - 5 395 146 - 288 TotCompIncLoss 1 588 1 709 1 494 1 596 1 295

NetIntPd(Rcvd) 343 188 207 116 139 Fixed Ass 3 430 3 404 3 481 3 352 2 839

Minority Int 1 4 - 31 36 - 58 Inv & Loans 360 351 376 415 357

Att Inc - 1 681 - 3 523 - 7 209 - 101 - 460 Tot Curr Ass 4 807 4 951 4 390 4 094 3 660

TotCompIncLoss - 1 733 - 3 471 - 7 512 721 - 862 Ord SH Int 4 539 5 146 4 852 4 490 3 941

Fixed Ass 2 814 3 010 4 611 4 843 5 626 LT Liab 1 098 825 768 708 686

Inv & Loans 187 215 599 277 929 Tot Curr Liab 4 158 3 694 3 646 3 833 3 407

Tot Curr Ass 8 058 10 290 9 818 16 270 17 797 PER SHARE STATISTICS (cents per share)

Ord SH Int 2 447 2 585 6 050 13 519 12 975 HEPS-C (ZARc) 516.60 543.10 507.70 464.10 419.70

Minority Int 7 9 8 37 23 DPS (ZARc) 415.00 685.00 405.00 370.00 332.00

LT Liab 1 896 3 110 2 709 2 415 2 726 NAV PS (ZARc) 1 353.27 1 463.40 1 383.04 1 291.73 1 136.57

Tot Curr Liab 7 932 9 366 8 920 9 361 11 795

3 Yr Beta 0.53 0.56 0.31 0.43 - 0.05

PER SHARE STATISTICS (cents per share) Price High 11 750 12 350 10 481 9 296 8 900

HEPS-C (ZARc) - 9.70 - 290.10 - 1 197.00 - 75.20 - 144.30 Price Low 8 648 9 401 8 182 7 050 5 897

NAV PS (ZARc) 12.62 620.35 1 456.00 3 244.30 3 113.75 Price Prd End 9 136 10 820 9 500 8 300 8 155

3 Yr Beta - 1.54 0.85 1.14 2.01 0.80 RATIOS

Price High 14 644 830 710 2 470 Ret on SH Fnd 35.35 32.56 32.01 32.99 33.81

Price Low 1 10 330 173 562 Oper Pft Mgn 19.18 19.00 18.09 17.68 17.05

Price Prd End 3 14 585 351 575 D:E 0.78 0.47 0.51 0.54 0.60

RATIOS Current Ratio 1.16 1.34 1.20 1.07 1.07

Ret Ave Equity - 68.46 - 135.66 - 119.51 - 0.48 - 3.99 Div Cover 1.18 0.75 1.18 1.25 1.26

Oper Pft Mgn - 4.36 - 1.31 - 23.00 0.43 - 0.66

D:E 1.06 1.55 0.63 0.27 0.24 Avior Capital Markets Holdings Ltd.

Current Ratio 1.02 1.10 1.10 1.74 1.51

AVI

ISIN: ZAE000211637 SHORT: AVIOR CODE: AVR

REG NO: 2015/086358/06 FOUNDED: 2015 LISTED: 2017

NATURE OF BUSINESS: Avior was incorporated in South Africa as a

provider of financial services which includes stockbroking (i.e. equities,

derivatives and fixed income), research, corporate broking as a member of

the JSE Ltd. The Group operates in four key regions being South Africa,

Frontier markets (i.e. Africa and Middle East), the United Kingdom and

the United States of America.

SECTOR: AltX

NUMBER OF EMPLOYEES: 65

102