Page 110 - SHB 2020 Issue 1

P. 110

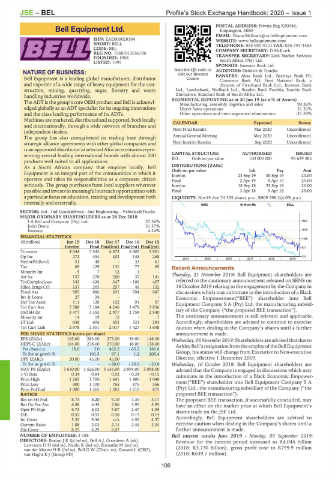

JSE – BEL Profile’s Stock Exchange Handbook: 2020 – Issue 1

POSTAL ADDRESS: Private Bag X20046,

Bell Equipment Ltd. Empangeni, 3880

BEL EMAIL: Diana.McIlrath@za.bellequipment.com

ISIN: ZAE000028304 WEBSITE: www.bellequipment.com

SHORT: BELL TELE PHONE: 035-907-9111 FAX: 035-797-4453

CODE: BEL COMPANY SECRETARY: D McIlrath

REG NO: 1968/013656/06 TRANSFER SECRETARY: Link Market Services

FOUNDED: 1968

LISTED: 1995 South Africa (Pty) Ltd.

SPONSOR: Investec Bank Ltd.

Scan the QR code to

NATURE OF BUSINESS: visit our Investor AUDITORS: Deloitte & Touche

Bell Equipment is a leading global man u fac turer, dis trib u tor Centre BANKERS: Absa Bank Ltd., Barclays Bank Plc,

Commerz Bank AG, First National Bank, a

and exporter of a wide range of heavy equipment for the con - division of FirstRand Bank Ltd., Investec Bank

struction, mining, quarrying, sugar, forestry and waste Ltd., Landesbank, Nedbank Ltd., Stanbic Bank Zambia, Stanbic Bank

handling in dus tries worldwide. Zimbabwe, Standard Bank of South Africa Ltd.

The ADT is the group’s core OEM product and Bell is ac knowl - SEGMENTAL REPORTING as at 30 Jun 19 (as a % of Assets) 90.26%

Manufacturing, assembly, logistics and sales

edged globally as an ADT spe cial ist for its ongoing in no va tions Direct Sales operations 31.33%

and the class leading per for mance of its ADTs. Other operations and inter-segmental eliminations -21.59%

Machines are marketed, dis trib uted and supported, both locally

and in ter na tion ally, through a wide network of branches and CALENDAR Expected Status

in de pend ent dealers. Next Final Results Mar 2020 Un con firmed

The group has also strengthened its trading base through Annual General Meeting May 2020 Un con firmed

strategic alliance agree ments with other global companies and Next Interim Results Sep 2020 Un con firmed

is an appointed dis trib u tor in selected African ter ri to ries rep re -

ISSUED

sent ing several leading in ter na tional brands with almost 200 CAPITAL STRUCTURE AUTHORISED 95 629 385

Ords no par value

100 000 000

BEL

products well suited to all ap pli ca tions.

As a South African company that employs locally, Bell DISTRIBUTIONS [ZARc] Ldt Pay Amt

Ords no par value

Equipment is an integral part of the com mu ni ties in which it Interim 23 Sep 19 30 Sep 19 20.00

operates and takes its re spon si bil i ties as a corporate citizen Final 2 Apr 19 8 Apr 19 25.00

seriously. The group purchases from local suppliers wherever Interim 18 Sep 18 25 Sep 18 20.00

possible and invests in mean ing ful outreach op por tu ni ties with Final 3 Apr 18 9 Apr 18 25.00

a par tic u lar focus on education, training and de vel op ment both LIQUIDITY: Nov19 Ave 74 335 shares p.w., R909 598.2(4.0% p.a.)

internally and externally.

INDE 40 Week MA BELL

SECTOR: Ind—Ind Goods&Srvcs—Ind Engineering—Vehicles&Trucks

MAJOR ORDINARY SHAREHOLDERS as at 28 Dec 2018

I A Bell and Company (Pty) Ltd. 37.36% 1902

John Deere 31.37%

Investec 4.24% 1545

FINANCIAL STATISTICS

1188

(R million) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15

Interim Final Final(rst) Final(rst) Final(rst) 831

Turnover 4 044 7 543 6 873 6 002 5 901

Op Inc 272 454 403 148 268 474

2014 | 2015 | 2016 | 2017 | 2018 | 2019

NetIntPd(Rcvd) 51 48 - 33 61

Tax 69 129 131 77 65 Recent Announcements

Minority Int - 5 7 12 1 -

Att Inc 157 270 260 37 141 Thursday, 21 November 2019: Bell Equipment shareholders are

TotCompIncLoss 143 426 247 - 166 427 referred to the cau tion ary an nounce ment released on SENS on

Hline Erngs-CO 157 265 257 46 132 16 October 2019 relating to the en gage ment by the Company in

Fixed Ass 905 886 691 704 687 dis cus sions which may culminate in the in tro duc tion of a Black

Inv & Loans 27 24 - - - Economic Em pow er ment(“BEE”) share holder into Bell

Def Tax Asset 111 128 102 91 97 Equipment Company S A (Pty) Ltd, the man u fac tur ing sub sid -

Tot Curr Ass 5 588 5 184 4 246 3 478 3 856

Ord SH Int 3 477 3 353 2 977 2 758 2 940 iary of the Company (“the proposed BEE trans ac tion”).

Minority Int 14 19 12 - 7 The cau tion ary an nounce ment is still relevant and ap pli ca ble.

LT Liab 638 606 352 322 293 Ac cord ingly, share hold ers are advised to continue to exercise

Tot Curr Liab 2 978 2 551 2 017 1 427 1 648 caution when dealing in the Company’s shares until a further

PER SHARE STATISTICS (cents per share) announcement is made.

EPS (ZARc) 165.00 283.00 273.00 39.00 148.00 Wednesday, 06 November 2019: Share hold ers are advised that due to

HEPS-C (ZARc) 164.00 278.00 270.00 48.00 138.00 Ashley Bell’s res ig na tion from the employ of the Bell Equipment

Pct chng p.a. 18.0 3.0 462.5 - 65.2 181.6

Tr 5yr av grwth % - 101.5 97.1 1.2 205.4 Group, his status will change from Executive to Non-executive

DPS (ZARc) 20.00 45.00 45.00 - - Director, effective 1 December 2019.

Tr 5yr av grwth % - - - 20.0 - 20.0 - 20.0 Wednesday, 16 October 2019: Bell Equipment shareholders are

NAV PS (ZARc) 3 650.00 3 526.00 3 136.00 2 894.00 3 098.00 advised that the Company is engaged in dis cus sions which may

3 Yr Beta 0.34 0.84 0.92 - 0.24 - 0.15 culminate in the in tro duc tion of a Black Economic Em pow er -

Price High 1 265 1 700 1 641 1 400 1 040 ment(“BEE”) share holder into Bell Equipment Company S A

Price Low 900 1 100 765 875 556

Price Prd End 1 000 1 265 1 285 1 210 875 (Pty) Ltd., the man u fac tur ing sub sid iary of the Company (“the

RATIOS proposed BEE trans ac tion”).

Ret on SH Fnd 8.73 8.20 9.10 1.35 5.17 The proposed BEE trans ac tion, if suc cess fully concluded, may

Ret On Tot Ass 6.48 6.44 7.86 3.95 5.95 have an effect on the market price at which Bell Equip ment’s

Oper Pft Mgn 6.73 6.02 5.87 2.47 4.55 shares trade on the JSE Ltd.

D:E 0.52 0.53 0.36 0.15 0.14

Int Cover 5.35 9.36 n/a 4.55 4.37 Accordingly, Bell Equipment shareholders are advised to

Current Ratio 1.88 2.03 2.11 2.44 2.34 exercise caution when dealing in the Company’s shares until a

Div Cover 8.25 6.29 6.07 - - further announcement is made.

NUMBER OF EMPLOYEES: 3 188 Bell interim results June 2019 - Monday, 09 September 2019:

DIRECTORS: Barton J R (ld ind ne), Bell A J, Goordeen A (alt), Revenue for the interim period increased to R4.044 billion

Lawrance D H (ind ne), Naidu R (ind ne), Ramathe M (ind ne),

van der Merwe H R (ind ne), Bell G W (Chair, ne), Goosen L (CEO), (2018: R3.730 billion), gross profit rose to R799.9 million

van Haght K J (Group FD) (2018: R639.7 million).

106