Page 66 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 66

CHAPTER 3

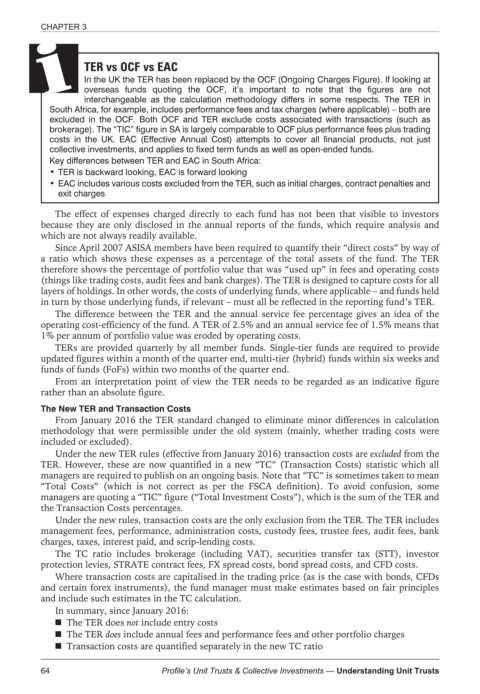

TER vs OCF vs EAC

In the UK the TER has been replaced by the OCF (Ongoing Charges Figure). If looking at

overseas funds quoting the OCF, it’s important to note that the figures are not

interchangeable as the calculation methodology differs in some respects. The TER in

South Africa, for example, includes performance fees and tax charges (where applicable) – both are

excluded in the OCF. Both OCF and TER exclude costs associated with transactions (such as

brokerage). The “TIC” figure in SA is largely comparable to OCF plus performance fees plus trading

costs in the UK. EAC (Effective Annual Cost) attempts to cover all financial products, not just

collective investments, and applies to fixed term funds as well as open-ended funds.

Key differences between TER and EAC in South Africa:

• TER is backward looking, EAC is forward looking

• EAC includes various costs excluded from the TER, such as initial charges, contract penalties and

exit charges

The effect of expenses charged directly to each fund has not been that visible to investors

because they are only disclosed in the annual reports of the funds, which require analysis and

which are not always readily available.

Since April 2007 ASISA members have been required to quantify their “direct costs” by way of

a ratio which shows these expenses as a percentage of the total assets of the fund. The TER

therefore shows the percentage of portfolio value that was “used up” in fees and operating costs

(things like trading costs, audit fees and bank charges). The TER is designed to capture costs for all

layers of holdings. In other words, the costs of underlying funds, where applicable – and funds held

in turn by those underlying funds, if relevant – must all be reflected in the reporting fund’s TER.

The difference between the TER and the annual service fee percentage gives an idea of the

operating cost-efficiency of the fund. A TER of 2.5% and an annual service fee of 1.5% means that

1% per annum of portfolio value was eroded by operating costs.

TERs are provided quarterly by all member funds. Single-tier funds are required to provide

updated figures within a month of the quarter end, multi-tier (hybrid) funds within six weeks and

funds of funds (FoFs) within two months of the quarter end.

From an interpretation point of view the TER needs to be regarded as an indicative figure

rather than an absolute figure.

The New TER and Transaction Costs

From January 2016 the TER standard changed to eliminate minor differences in calculation

methodology that were permissible under the old system (mainly, whether trading costs were

included or excluded).

Under the new TER rules (effective from January 2016) transaction costs are excluded from the

TER. However, these are now quantified in a new “TC” (Transaction Costs) statistic which all

managers are required to publish on an ongoing basis. Note that “TC” is sometimes taken to mean

“Total Costs” (which is not correct as per the FSCA definition). To avoid confusion, some

managers are quoting a “TIC” figure (“Total Investment Costs”), which is the sum of the TER and

the Transaction Costs percentages.

Under the new rules, transaction costs are the only exclusion from the TER. The TER includes

management fees, performance, administration costs, custody fees, trustee fees, audit fees, bank

charges, taxes, interest paid, and scrip-lending costs.

The TC ratio includes brokerage (including VAT), securities transfer tax (STT), investor

protection levies, STRATE contract fees, FX spread costs, bond spread costs, and CFD costs.

Where transaction costs are capitalised in the trading price (as is the case with bonds, CFDs

and certain forex instruments), the fund manager must make estimates based on fair principles

and include such estimates in the TC calculation.

In summary, since January 2016:

The TER does not include entry costs

The TER does include annual fees and performance fees and other portfolio charges

Transaction costs are quantified separately in the new TC ratio

64 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts