Page 70 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 70

CHAPTER 3

Investing through a platform often changes the fee arithmetic somewhat. The main

implications are:

Underlying fund fees may be less

An additional layer of costs will be imposed by the LISP

As we will cover later in this chapter, funds often have multiple unit classes with different fee

structures. The unit classes made available to bulk buyers, like LISPs, typically have lower fees

(and lower TERs) than retail classes. This means that the investment performance of a fund

bought through a LISP, if platform fees are ignored, will be slightly better than the performance of

the same fund’s retail class. However, the net performance of an investment via a platform may be

less attractive after paying the LISP fees.

It’s important to note that performance tables (including rates of return) published by stats

providers like ProfileData do not factor in platform fees. Generally the fund performance figures

available on LISP websites are also, ironically, shown before the impact of LISP costs (ie, returns to

the LISP client are lower than shown).

Similarly, the fee information shown for underlying funds on a platform website (such as TERs

and TICs) pertains to each fund and does not include the LISP fees that will be levied over and

above the fund fees. The costs reported by a platform under the EAC model should, however,

capture both the underlying fund costs and the costs of the platform itself.

As we saw earlier, the annual fees of a fund manager are deducted from the portfolio, which

means the NAV unit price is net of manager fees. But a LISP’s ongoing fees are deducted from the

client’s LISP account. To cover their fees, LISPs will sell units of funds in the client’s portfolio if

there is no cash in the client’s account.

Initial Charges versus Trailer Fees

LISPs (fund platforms) and fund managers who sell directly to the public may offer the investor

a choice of paying either an upfront fee or an ongoing fee (sometimes called a trailer fee) in respect

of commissions payable to financial advisors.

Which is better for the investor?

There are several things to consider in answering this question. Firstly, trailer fees are nearly

always lower than initial charges. For example, the maximum allowable initial fee (broker

commission) is usually 3.45% (including VAT) and the maximum allowable trailer fee might be

1%. Secondly, the initial fee is an immediate deduction against capital and the investor first has to

recoup this loss before achieving any positive performance. Because trailer fees are typically

collected monthly in arrears, they have much less of an impact on starting capital.

Against this is the fact that trailer fees may persist indefinitely and therefore represent an

ongoing charge against performance. In a positive equity market, an investor may well “pay off” an

initial fee after only a few months (ie, recoup the lost capital because of market gains), whereas the

trailer fee would continue to nibble at performance year after year.

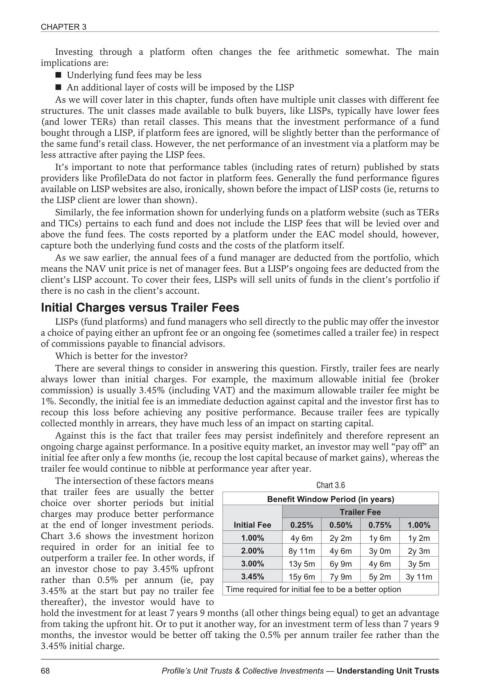

The intersection of these factors means Chart 3.6

that trailer fees are usually the better

choice over shorter periods but initial Benefit Window Period (in years)

charges may produce better performance Trailer Fee

at the end of longer investment periods. Initial Fee 0.25% 0.50% 0.75% 1.00%

Chart 3.6 shows the investment horizon 4y 6m 2y 2m 1y 6m 1y 2m

1.00%

required in order for an initial fee to 8y 11m 4y 6m 3y 0m 2y 3m

outperform a trailer fee. In other words, if 2.00%

an investor chose to pay 3.45% upfront 3.00% 13y 5m 6y 9m 4y 6m 3y 5m

rather than 0.5% per annum (ie, pay 3.45% 15y 6m 7y 9m 5y 2m 3y 11m

3.45% at the start but pay no trailer fee Time required for initial fee to be a better option

thereafter), the investor would have to

hold the investment for at least 7 years 9 months (all other things being equal) to get an advantage

from taking the upfront hit. Or to put it another way, for an investment term of less than 7 years 9

months, the investor would be better off taking the 0.5% per annum trailer fee rather than the

3.45% initial charge.

68 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts