Page 68 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 68

CHAPTER 3

The reason for another cost measure is that the TER does not allow for all the expenses

associated with fixed term products. Unlike the TER, the EAC makes it possible to compare costs

over defined periods, which is important for charges like initial fees which need to be amortised

over the life spans of product options to achieve fairly comparable results.

The EAC comprises four components which are calculated separately and then combined to

reflect the total EAC:

Investment Management Charges (IMC): costs and charges associated with management of

all underlying investment portfolios

Advice Charges: initial and annual fees, both lump sum and recurring

Administration Charges: all costs of administration

Other Charges: a category for all remaining costs, including exit charges, penalties, loyalty

bonuses, guarantees, smoothing or risk benefits, wrap fund charges and risk benefits (such

as waiver of premium)

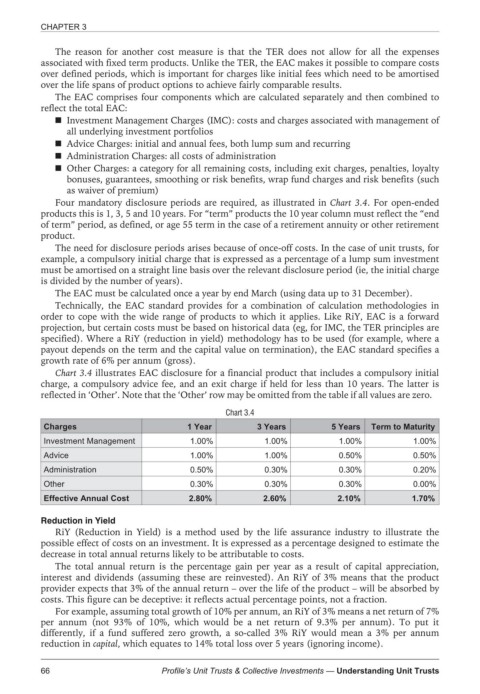

Four mandatory disclosure periods are required, as illustrated in Chart 3.4. For open-ended

products this is 1, 3, 5 and 10 years. For “term” products the 10 year column must reflect the “end

of term” period, as defined, or age 55 term in the case of a retirement annuity or other retirement

product.

The need for disclosure periods arises because of once-off costs. In the case of unit trusts, for

example, a compulsory initial charge that is expressed as a percentage of a lump sum investment

must be amortised on a straight line basis over the relevant disclosure period (ie, the initial charge

is divided by the number of years).

The EAC must be calculated once a year by end March (using data up to 31 December).

Technically, the EAC standard provides for a combination of calculation methodologies in

order to cope with the wide range of products to which it applies. Like RiY, EAC is a forward

projection, but certain costs must be based on historical data (eg, for IMC, the TER principles are

specified). Where a RiY (reduction in yield) methodology has to be used (for example, where a

payout depends on the term and the capital value on termination), the EAC standard specifies a

growth rate of 6% per annum (gross).

Chart 3.4 illustrates EAC disclosure for a financial product that includes a compulsory initial

charge, a compulsory advice fee, and an exit charge if held for less than 10 years. The latter is

reflected in ‘Other’. Note that the ‘Other’ row may be omitted from the table if all values are zero.

Chart 3.4

Charges 1 Year 3 Years 5 Years Term to Maturity

Investment Management 1.00% 1.00% 1.00% 1.00%

Advice 1.00% 1.00% 0.50% 0.50%

Administration 0.50% 0.30% 0.30% 0.20%

Other 0.30% 0.30% 0.30% 0.00%

Effective Annual Cost 2.80% 2.60% 2.10% 1.70%

Reduction in Yield

RiY (Reduction in Yield) is a method used by the life assurance industry to illustrate the

possible effect of costs on an investment. It is expressed as a percentage designed to estimate the

decrease in total annual returns likely to be attributable to costs.

The total annual return is the percentage gain per year as a result of capital appreciation,

interest and dividends (assuming these are reinvested). An RiY of 3% means that the product

provider expects that 3% of the annual return – over the life of the product – will be absorbed by

costs. This figure can be deceptive: it reflects actual percentage points, not a fraction.

For example, assuming total growth of 10% per annum, an RiY of 3% means a net return of 7%

per annum (not 93% of 10%, which would be a net return of 9.3% per annum). To put it

differently, if a fund suffered zero growth, a so-called 3% RiY would mean a 3% per annum

reduction in capital, which equates to 14% total loss over 5 years (ignoring income).

66 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts