Page 62 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 62

CHAPTER 3

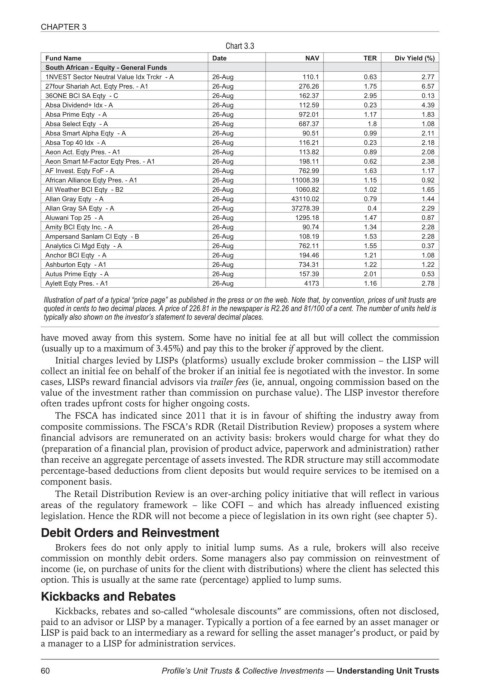

Chart 3.3

Fund Name Date NAV TER Div Yield (%)

South African - Equity - General Funds

1NVEST Sector Neutral Value Idx Trckr - A 26-Aug 110.1 0.63 2.77

27four Shariah Act. Eqty Pres. - A1 26-Aug 276.26 1.75 6.57

36ONE BCI SA Eqty - C 26-Aug 162.37 2.95 0.13

Absa Dividend+ Idx - A 26-Aug 112.59 0.23 4.39

Absa Prime Eqty - A 26-Aug 972.01 1.17 1.83

Absa Select Eqty - A 26-Aug 687.37 1.8 1.08

Absa Smart Alpha Eqty - A 26-Aug 90.51 0.99 2.11

Absa Top 40 Idx - A 26-Aug 116.21 0.23 2.18

Aeon Act. Eqty Pres. - A1 26-Aug 113.82 0.89 2.08

Aeon Smart M-Factor Eqty Pres. - A1 26-Aug 198.11 0.62 2.38

AF Invest. Eqty FoF - A 26-Aug 762.99 1.63 1.17

African Alliance Eqty Pres. - A1 26-Aug 11008.39 1.15 0.92

All Weather BCI Eqty - B2 26-Aug 1060.82 1.02 1.65

Allan Gray Eqty - A 26-Aug 43110.02 0.79 1.44

Allan Gray SA Eqty - A 26-Aug 37278.39 0.4 2.29

Aluwani Top 25 - A 26-Aug 1295.18 1.47 0.87

Amity BCI Eqty Inc. - A 26-Aug 90.74 1.34 2.28

Ampersand Sanlam CI Eqty - B 26-Aug 108.19 1.53 2.28

Analytics Ci Mgd Eqty - A 26-Aug 762.11 1.55 0.37

Anchor BCI Eqty - A 26-Aug 194.46 1.21 1.08

Ashburton Eqty - A1 26-Aug 734.31 1.22 1.22

Autus Prime Eqty - A 26-Aug 157.39 2.01 0.53

Aylett Eqty Pres. - A1 26-Aug 4173 1.16 2.78

Illustration of part of a typical “price page” as published in the press or on the web. Note that, by convention, prices of unit trusts are

quoted in cents to two decimal places. A price of 226.81 in the newspaper is R2.26 and 81/100 of a cent. The number of units held is

typically also shown on the investor’s statement to several decimal places.

have moved away from this system. Some have no initial fee at all but will collect the commission

(usually up to a maximum of 3.45%) and pay this to the broker if approved by the client.

Initial charges levied by LISPs (platforms) usually exclude broker commission – the LISP will

collect an initial fee on behalf of the broker if an initial fee is negotiated with the investor. In some

cases, LISPs reward financial advisors via trailer fees (ie, annual, ongoing commission based on the

value of the investment rather than commission on purchase value). The LISP investor therefore

often trades upfront costs for higher ongoing costs.

The FSCA has indicated since 2011 that it is in favour of shifting the industry away from

composite commissions. The FSCA’s RDR (Retail Distribution Review) proposes a system where

financial advisors are remunerated on an activity basis: brokers would charge for what they do

(preparation of a financial plan, provision of product advice, paperwork and administration) rather

than receive an aggregate percentage of assets invested. The RDR structure may still accommodate

percentage-based deductions from client deposits but would require services to be itemised on a

component basis.

The Retail Distribution Review is an over-arching policy initiative that will reflect in various

areas of the regulatory framework – like COFI – and which has already influenced existing

legislation. Hence the RDR will not become a piece of legislation in its own right (see chapter 5).

Debit Orders and Reinvestment

Brokers fees do not only apply to initial lump sums. As a rule, brokers will also receive

commission on monthly debit orders. Some managers also pay commission on reinvestment of

income (ie, on purchase of units for the client with distributions) where the client has selected this

option. This is usually at the same rate (percentage) applied to lump sums.

Kickbacks and Rebates

Kickbacks, rebates and so-called “wholesale discounts” are commissions, often not disclosed,

paid to an advisor or LISP by a manager. Typically a portion of a fee earned by an asset manager or

LISP is paid back to an intermediary as a reward for selling the asset manager’s product, or paid by

a manager to a LISP for administration services.

60 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts