Page 200 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 200

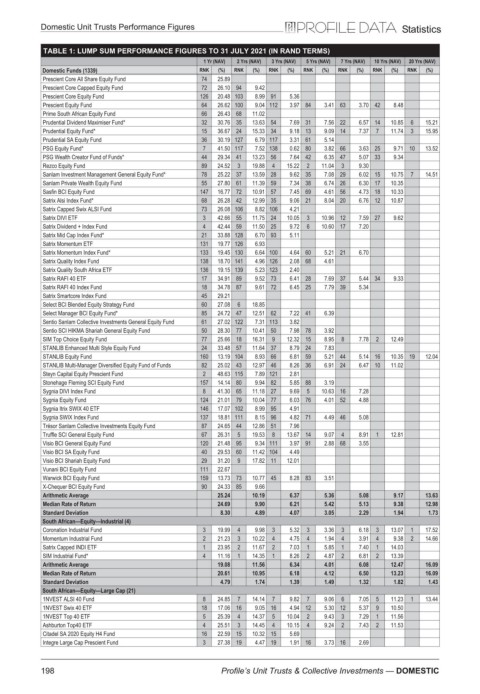

Domestic Unit Trusts Performance Figures Statistics

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JULY 2021 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1339) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Prescient Core All Share Equity Fund 74 25.89

Prescient Core Capped Equity Fund 72 26.10 94 9.42

Prescient Core Equity Fund 126 20.48 103 8.99 91 5.36

Prescient Equity Fund 64 26.62 100 9.04 112 3.97 84 3.41 63 3.70 42 8.48

Prime South African Equity Fund 66 26.43 68 11.02

Prudential Dividend Maximiser Fund* 32 30.76 35 13.63 54 7.69 31 7.56 22 6.57 14 10.85 6 15.21

Prudential Equity Fund* 15 36.67 24 15.33 34 9.18 13 9.09 14 7.37 7 11.74 3 15.95

Prudential SA Equity Fund 36 30.19 127 6.79 117 3.31 61 5.14

PSG Equity Fund* 7 41.50 117 7.52 138 0.62 80 3.82 66 3.63 25 9.71 10 13.52

PSG Wealth Creator Fund of Funds* 44 29.34 41 13.23 56 7.64 42 6.35 47 5.07 33 9.34

Rezco Equity Fund 89 24.52 3 19.88 4 15.22 2 11.04 3 9.30

Sanlam Investment Management General Equity Fund* 78 25.22 37 13.59 28 9.62 35 7.08 29 6.02 15 10.75 7 14.51

Sanlam Private Wealth Equity Fund 55 27.80 61 11.39 59 7.34 38 6.74 26 6.30 17 10.35

Sasfin BCI Equity Fund 147 16.77 72 10.91 57 7.45 69 4.61 56 4.73 18 10.33

Satrix Alsi Index Fund* 68 26.28 42 12.99 35 9.06 21 8.04 20 6.76 12 10.87

Satrix Capped Swix ALSI Fund 73 26.08 106 8.82 106 4.21

Satrix DIVI ETF 3 42.66 55 11.75 24 10.05 3 10.96 12 7.59 27 9.62

Satrix Dividend + Index Fund 4 42.44 59 11.50 25 9.72 6 10.60 17 7.20

Satrix Mid Cap Index Fund* 21 33.88 128 6.70 93 5.11

Satrix Momentum ETF 131 19.77 126 6.93

Satrix Momentum Index Fund* 133 19.45 130 6.64 100 4.64 60 5.21 21 6.70

Satrix Quality Index Fund 138 18.70 141 4.96 126 2.08 68 4.61

Satrix Quality South Africa ETF 136 19.15 139 5.23 123 2.40

Satrix RAFI 40 ETF 17 34.91 89 9.52 73 6.41 28 7.69 37 5.44 34 9.33

Satrix RAFI 40 Index Fund 18 34.78 87 9.61 72 6.45 25 7.79 39 5.34

Satrix Smartcore Index Fund 45 29.21

Select BCI Blended Equity Strategy Fund 60 27.08 6 18.85

Select Manager BCI Equity Fund* 85 24.72 47 12.51 62 7.22 41 6.39

Sentio Sanlam Collective Investments General Equity Fund 61 27.02 122 7.31 113 3.82

Sentio SCI HIKMA Shariah General Equity Fund 50 28.30 77 10.41 50 7.98 78 3.92

SIM Top Choice Equity Fund 77 25.66 18 16.31 9 12.32 15 8.95 8 7.78 2 12.49

STANLIB Enhanced Multi Style Equity Fund 24 33.48 57 11.64 37 8.79 24 7.83

STANLIB Equity Fund 160 13.19 104 8.93 66 6.81 59 5.21 44 5.14 16 10.35 19 12.04

STANLIB Multi-Manager Diversified Equity Fund of Funds 82 25.02 43 12.97 46 8.26 36 6.91 24 6.47 10 11.02

Steyn Capital Equity Prescient Fund 2 48.63 115 7.89 121 2.81

Stonehage Fleming SCI Equity Fund 157 14.14 80 9.94 82 5.85 88 3.19

Sygnia DIVI Index Fund 8 41.30 65 11.18 27 9.69 5 10.63 16 7.28

Sygnia Equity Fund 124 21.01 79 10.04 77 6.03 76 4.01 52 4.88

Sygnia Itrix SWIX 40 ETF 146 17.07 102 8.99 95 4.91

Sygnia SWIX Index Fund 137 18.81 111 8.15 96 4.82 71 4.49 46 5.08

Trésor Sanlam Collective Investments Equity Fund 87 24.65 44 12.86 51 7.96

Truffle SCI General Equity Fund 67 26.31 5 19.53 8 13.67 14 9.07 4 8.91 1 12.81

Visio BCI General Equity Fund 120 21.48 95 9.34 111 3.97 91 2.88 68 3.55

Visio BCI SA Equity Fund 40 29.53 60 11.42 104 4.49

Visio BCI Shariah Equity Fund 29 31.20 9 17.82 11 12.01

Vunani BCI Equity Fund 111 22.67

Warwick BCI Equity Fund 159 13.73 73 10.77 45 8.28 83 3.51

X-Chequer BCI Equity Fund 90 24.33 85 9.66

Arithmetic Average 25.24 10.19 6.37 5.36 5.08 9.17 13.63

Median Rate of Return 24.69 9.90 6.21 5.42 5.13 9.38 12.98

Standard Deviation 8.30 4.89 4.07 3.05 2.29 1.94 1.73

South African—Equity—Industrial (4)

Coronation Industrial Fund 3 19.99 4 9.98 3 5.32 3 3.36 3 6.18 3 13.07 1 17.52

Momentum Industrial Fund 2 21.23 3 10.22 4 4.75 4 1.94 4 3.91 4 9.38 2 14.66

Satrix Capped INDI ETF 1 23.95 2 11.67 2 7.03 1 5.85 1 7.40 1 14.03

SIM Industrial Fund* 4 11.16 1 14.35 1 8.26 2 4.87 2 6.81 2 13.39

Arithmetic Average 19.08 11.56 6.34 4.01 6.08 12.47 16.09

Median Rate of Return 20.61 10.95 6.18 4.12 6.50 13.23 16.09

Standard Deviation 4.79 1.74 1.39 1.49 1.32 1.82 1.43

South African—Equity—Large Cap (21)

1NVEST ALSI 40 Fund 8 24.85 7 14.14 7 9.82 7 9.06 6 7.05 5 11.23 1 13.44

1NVEST Swix 40 ETF 18 17.06 16 9.05 16 4.94 12 5.30 12 5.37 9 10.50

1NVEST Top 40 ETF 5 25.39 4 14.37 5 10.04 2 9.43 3 7.29 1 11.56

Ashburton Top40 ETF 4 25.51 3 14.45 4 10.15 4 9.24 2 7.43 2 11.53

Citadel SA 2020 Equity H4 Fund 16 22.59 15 10.32 15 5.69

Integre Large Cap Prescient Fund 3 27.38 19 4.47 19 1.91 16 3.73 16 2.69

198 Profile’s Unit Trusts & Collective Investments — DOMESTIC