Page 196 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 196

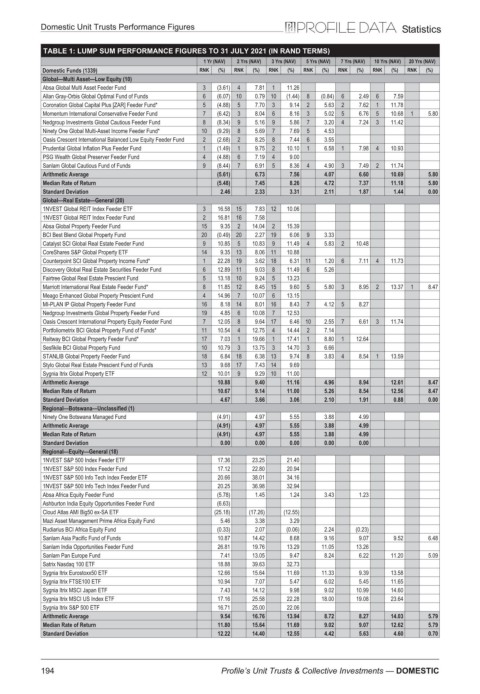

Domestic Unit Trusts Performance Figures Statistics

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JULY 2021 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1339) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Global—Multi Asset—Low Equity (10)

Absa Global Multi Asset Feeder Fund 3 (3.61) 4 7.81 1 11.26

Allan Gray-Orbis Global Optimal Fund of Funds 6 (6.07) 10 0.79 10 (1.44) 8 (0.84) 6 2.49 6 7.59

Coronation Global Capital Plus [ZAR] Feeder Fund* 5 (4.88) 5 7.70 3 9.14 2 5.63 2 7.62 1 11.78

Momentum International Conservative Feeder Fund 7 (6.42) 3 8.04 6 8.16 3 5.02 5 6.76 5 10.68 1 5.80

Nedgroup Investments Global Cautious Feeder Fund 8 (8.34) 9 5.16 9 5.86 7 3.20 4 7.24 3 11.42

Ninety One Global Multi-Asset Income Feeder Fund* 10 (9.29) 8 5.69 7 7.69 5 4.53

Oasis Crescent International Balanced Low Equity Feeder Fund 2 (2.68) 2 8.25 8 7.44 6 3.55

Prudential Global Inflation Plus Feeder Fund 1 (1.49) 1 9.75 2 10.10 1 6.58 1 7.98 4 10.93

PSG Wealth Global Preserver Feeder Fund 4 (4.88) 6 7.19 4 9.00

Sanlam Global Cautious Fund of Funds 9 (8.44) 7 6.91 5 8.36 4 4.90 3 7.49 2 11.74

Arithmetic Average (5.61) 6.73 7.56 4.07 6.60 10.69 5.80

Median Rate of Return (5.48) 7.45 8.26 4.72 7.37 11.18 5.80

Standard Deviation 2.46 2.33 3.31 2.11 1.87 1.44 0.00

Global—Real Estate—General (20)

1NVEST Global REIT Index Feeder ETF 3 16.58 15 7.83 12 10.06

1NVEST Global REIT Index Feeder Fund 2 16.81 16 7.58

Absa Global Property Feeder Fund 15 9.35 2 14.04 2 15.39

BCI Best Blend Global Property Fund 20 (0.49) 20 2.27 19 6.06 9 3.33

Catalyst SCI Global Real Estate Feeder Fund 9 10.85 5 10.83 9 11.49 4 5.83 2 10.48

CoreShares S&P Global Property ETF 14 9.35 13 8.06 11 10.88

Counterpoint SCI Global Property Income Fund* 1 22.28 19 3.62 18 6.31 11 1.20 6 7.11 4 11.73

Discovery Global Real Estate Securities Feeder Fund 6 12.89 11 9.03 8 11.49 6 5.26

Fairtree Global Real Estate Prescient Fund 5 13.18 10 9.24 5 13.23

Marriott International Real Estate Feeder Fund* 8 11.85 12 8.45 15 9.60 5 5.80 3 8.95 2 13.37 1 8.47

Meago Enhanced Global Property Prescient Fund 4 14.96 7 10.07 6 13.15

MI-PLAN IP Global Property Feeder Fund 16 8.18 14 8.01 16 8.43 7 4.12 5 8.27

Nedgroup Investments Global Property Feeder Fund 19 4.85 6 10.08 7 12.53

Oasis Crescent International Property Equity Feeder Fund 7 12.05 8 9.64 17 6.46 10 2.55 7 6.61 3 11.74

Portfoliometrix BCI Global Property Fund of Funds* 11 10.54 4 12.75 4 14.44 2 7.14

Reitway BCI Global Property Feeder Fund* 17 7.03 1 19.66 1 17.41 1 8.80 1 12.64

Sesfikile BCI Global Property Fund 10 10.79 3 13.75 3 14.70 3 6.66

STANLIB Global Property Feeder Fund 18 6.84 18 6.38 13 9.74 8 3.83 4 8.54 1 13.59

Stylo Global Real Estate Prescient Fund of Funds 13 9.68 17 7.43 14 9.69

Sygnia Itrix Global Property ETF 12 10.01 9 9.29 10 11.00

Arithmetic Average 10.88 9.40 11.16 4.96 8.94 12.61 8.47

Median Rate of Return 10.67 9.14 11.00 5.26 8.54 12.56 8.47

Standard Deviation 4.67 3.66 3.06 2.10 1.91 0.88 0.00

Regional—Botswana—Unclassified (1)

Ninety One Botswana Managed Fund (4.91) 4.97 5.55 3.88 4.99

Arithmetic Average (4.91) 4.97 5.55 3.88 4.99

Median Rate of Return (4.91) 4.97 5.55 3.88 4.99

Standard Deviation 0.00 0.00 0.00 0.00 0.00

Regional—Equity—General (18)

1NVEST S&P 500 Index Feeder ETF 17.36 23.25 21.40

1NVEST S&P 500 Index Feeder Fund 17.12 22.80 20.94

1NVEST S&P 500 Info Tech Index Feeder ETF 20.66 38.01 34.16

1NVEST S&P 500 Info Tech Index Feeder Fund 20.25 36.98 32.94

Absa Africa Equity Feeder Fund (5.78) 1.45 1.24 3.43 1.23

Ashburton India Equity Opportunities Feeder Fund (6.63)

Cloud Atlas AMI Big50 ex-SA ETF (25.18) (17.26) (12.55)

Mazi Asset Management Prime Africa Equity Fund 5.46 3.38 3.29

Rudiarius BCI Africa Equity Fund (0.33) 2.07 (0.06) 2.24 (0.23)

Sanlam Asia Pacific Fund of Funds 10.87 14.42 8.68 9.16 9.07 9.52 6.48

Sanlam India Opportunities Feeder Fund 26.81 19.76 13.29 11.05 13.26

Sanlam Pan Europe Fund 7.41 13.05 9.47 8.24 6.22 11.20 5.09

Satrix Nasdaq 100 ETF 18.88 39.63 32.73

Sygnia Itrix Eurostoxx50 ETF 12.66 15.64 11.69 11.33 9.39 13.58

Sygnia Itrix FTSE100 ETF 10.94 7.07 5.47 6.02 5.45 11.65

Sygnia Itrix MSCI Japan ETF 7.43 14.12 9.98 9.02 10.99 14.60

Sygnia Itrix MSCI US Index ETF 17.16 25.58 22.28 18.00 19.08 23.64

Sygnia Itrix S&P 500 ETF 16.71 25.00 22.06

Arithmetic Average 9.54 16.76 13.94 8.72 8.27 14.03 5.79

Median Rate of Return 11.80 15.64 11.69 9.02 9.07 12.62 5.79

Standard Deviation 12.22 14.40 12.55 4.42 5.63 4.60 0.70

194 Profile’s Unit Trusts & Collective Investments — DOMESTIC