Page 201 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 201

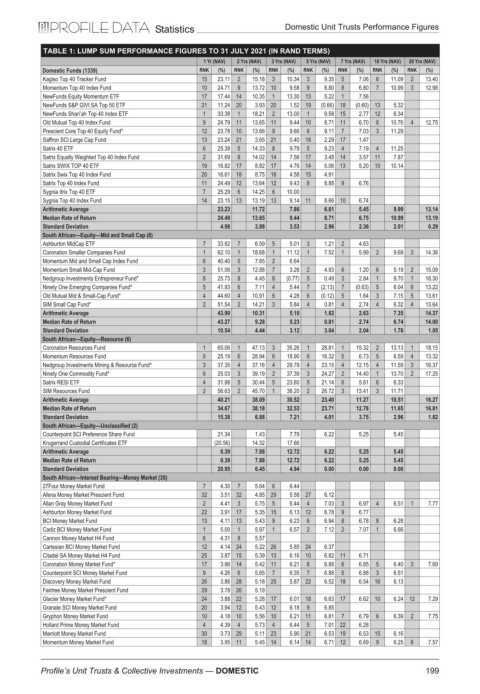

Statistics Domestic Unit Trusts Performance Figures

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JULY 2021 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1339) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Kagiso Top 40 Tracker Fund 15 23.11 2 15.18 3 10.34 3 9.35 5 7.06 6 11.09 2 13.40

Momentum Top 40 Index Fund 10 24.71 9 13.72 10 9.58 9 8.80 8 6.80 7 10.99 3 12.98

NewFunds Equity Momentum ETF 17 17.44 14 10.35 1 13.30 13 5.22 1 7.56

NewFunds S&P GIVI SA Top 50 ETF 21 11.24 20 3.93 20 1.52 19 (0.66) 18 (0.60) 13 5.32

NewFunds Shari’ah Top 40 Index ETF 1 33.38 1 18.21 2 13.00 1 9.58 15 2.77 12 6.34

Old Mutual Top 40 Index Fund 9 24.79 11 13.65 11 9.44 10 8.71 11 6.70 8 10.76 4 12.75

Prescient Core Top 40 Equity Fund* 12 23.78 10 13.66 9 9.66 6 9.11 7 7.03 3 11.29

Saffron SCI Large Cap Fund 13 23.24 21 3.65 21 0.40 18 2.29 17 1.47

Satrix 40 ETF 6 25.38 5 14.33 8 9.79 5 9.23 4 7.19 4 11.25

Satrix Equally Weighted Top 40 Index Fund 2 31.69 8 14.02 14 7.56 17 3.48 14 3.57 11 7.87

Satrix SWIX TOP 40 ETF 19 16.82 17 8.82 17 4.76 14 5.06 13 5.20 10 10.14

Satrix Swix Top 40 Index Fund 20 16.61 18 8.75 18 4.58 15 4.91

Satrix Top 40 Index Fund 11 24.49 12 13.64 12 9.43 8 8.88 9 6.76

Sygnia Itrix Top 40 ETF 7 25.29 6 14.25 6 10.00

Sygnia Top 40 Index Fund 14 23.15 13 13.19 13 9.14 11 8.66 10 6.74

Arithmetic Average 23.23 11.72 7.86 6.81 5.45 9.99 13.14

Median Rate of Return 24.49 13.65 9.44 8.71 6.75 10.99 13.19

Standard Deviation 4.98 3.88 3.53 2.96 2.36 2.01 0.29

South African—Equity—Mid and Small Cap (8)

Ashburton MidCap ETF 7 33.82 7 6.59 5 5.01 3 1.21 2 4.63

Coronation Smaller Companies Fund 1 62.10 1 18.68 1 11.12 1 7.52 1 5.99 2 9.69 3 14.36

Momentum Mid and Small Cap Index Fund 6 40.40 5 7.65 2 6.64

Momentum Small Mid-Cap Fund 3 51.06 3 12.88 7 3.26 2 4.93 6 1.20 6 5.19 2 15.09

Nedgroup Investments Entrepreneur Fund* 8 25.73 8 4.45 8 (0.77) 5 0.49 3 2.84 1 9.70 1 16.30

Ninety One Emerging Companies Fund* 5 41.93 6 7.11 4 5.44 7 (2.13) 7 (0.63) 5 6.04 6 13.22

Old Mutual Mid & Small-Cap Fund* 4 44.60 4 10.91 6 4.28 6 (0.12) 5 1.64 3 7.15 5 13.61

SIM Small Cap Fund* 2 51.54 2 14.21 3 5.84 4 0.81 4 2.74 4 6.32 4 13.64

Arithmetic Average 43.90 10.31 5.10 1.82 2.63 7.35 14.37

Median Rate of Return 43.27 9.28 5.23 0.81 2.74 6.74 14.00

Standard Deviation 10.54 4.44 3.12 3.04 2.04 1.76 1.05

South African—Equity—Resource (6)

Coronation Resources Fund 1 65.06 1 47.13 3 35.26 1 28.81 1 15.32 2 13.13 1 18.15

Momentum Resources Fund 5 25.19 6 28.94 6 18.90 6 16.32 5 6.73 5 6.59 4 13.32

Nedgroup Investments Mining & Resource Fund* 3 37.35 4 37.16 4 29.79 4 23.15 4 12.15 4 11.59 3 16.37

Ninety One Commodity Fund* 6 25.03 3 39.19 2 37.39 3 24.27 2 14.40 1 13.70 2 17.25

Satrix RESI ETF 4 31.98 5 30.44 5 23.60 5 21.14 6 5.61 6 6.33

SIM Resources Fund 2 56.63 2 45.70 1 38.20 2 26.72 3 13.41 3 11.71

Arithmetic Average 40.21 38.09 30.52 23.40 11.27 10.51 16.27

Median Rate of Return 34.67 38.18 32.53 23.71 12.78 11.65 16.81

Standard Deviation 15.38 6.88 7.21 4.01 3.75 2.96 1.82

South African—Equity—Unclassified (2)

Counterpoint SCI Preference Share Fund 21.34 1.43 7.78 6.22 5.25 5.45

Krugerrand Custodial Certificates ETF (20.56) 14.32 17.66

Arithmetic Average 0.39 7.88 12.72 6.22 5.25 5.45

Median Rate of Return 0.39 7.88 12.72 6.22 5.25 5.45

Standard Deviation 20.95 6.45 4.94 0.00 0.00 0.00

South African—Interest Bearing—Money Market (35)

27Four Money Market Fund 7 4.30 7 5.64 6 6.44

Afena Money Market Prescient Fund 32 3.51 32 4.85 29 5.58 27 6.12

Allan Gray Money Market Fund 2 4.41 3 5.75 5 6.44 4 7.03 3 6.97 4 6.51 1 7.77

Ashburton Money Market Fund 22 3.91 17 5.35 15 6.13 12 6.78 9 6.77

BCI Money Market Fund 13 4.11 13 5.43 9 6.23 6 6.94 8 6.78 8 6.28

Cadiz BCI Money Market Fund 1 5.00 1 5.97 1 6.57 2 7.12 2 7.07 1 6.66

Cannon Money Market H4 Fund 6 4.31 8 5.57

Cartesian BCI Money Market Fund 12 4.14 24 5.22 26 5.85 24 6.37

Citadel SA Money Market H4 Fund 25 3.87 15 5.39 13 6.16 10 6.82 11 6.71

Coronation Money Market Fund* 17 3.96 14 5.42 11 6.21 8 6.88 6 6.85 5 6.40 3 7.69

Counterpoint SCI Money Market Fund 9 4.26 6 5.65 7 6.35 7 6.88 5 6.88 3 6.51

Discovery Money Market Fund 26 3.86 28 5.18 25 5.87 22 6.52 18 6.54 16 6.13

Fairtree Money Market Prescient Fund 29 3.78 26 5.19

Glacier Money Market Fund* 24 3.88 22 5.28 17 6.01 18 6.63 17 6.62 10 6.24 12 7.29

Granate SCI Money Market Fund 20 3.94 12 5.43 12 6.18 9 6.85

Gryphon Money Market Fund 10 4.18 10 5.56 10 6.21 11 6.81 7 6.79 6 6.39 2 7.75

Hollard Prime Money Market Fund 4 4.39 4 5.73 4 6.44 5 7.01 22 6.28

Marriott Money Market Fund 30 3.73 29 5.11 23 5.90 21 6.53 19 6.53 15 6.16

Momentum Money Market Fund 18 3.95 11 5.45 14 6.14 14 6.71 12 6.69 9 6.25 6 7.57

199

Profile’s Unit Trusts & Collective Investments — DOMESTIC