Page 205 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 205

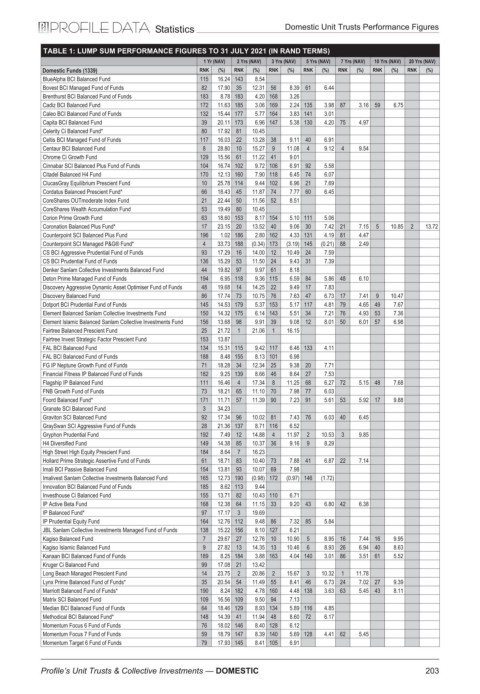

Statistics Domestic Unit Trusts Performance Figures

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JULY 2021 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1339) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

BlueAlpha BCI Balanced Fund 115 16.24 143 8.54

Bovest BCI Managed Fund of Funds 82 17.90 35 12.31 56 8.39 61 6.44

Brenthurst BCI Balanced Fund of Funds 183 8.78 183 4.20 168 3.26

Cadiz BCI Balanced Fund 172 11.63 185 3.06 169 2.24 135 3.98 87 3.16 59 6.75

Caleo BCI Balanced Fund of Funds 132 15.44 177 5.77 164 3.83 141 3.01

Capita BCI Balanced Fund 39 20.11 173 6.96 147 5.38 130 4.20 75 4.97

Celerity Ci Balanced Fund* 80 17.92 81 10.45

Celtis BCI Managed Fund of Funds 117 16.03 22 13.28 38 9.11 40 6.91

Centaur BCI Balanced Fund 8 28.80 10 15.27 9 11.08 4 9.12 4 9.54

Chrome Ci Growth Fund 129 15.56 61 11.22 41 9.01

Cinnabar SCI Balanced Plus Fund of Funds 104 16.74 102 9.72 106 6.91 92 5.58

Citadel Balanced H4 Fund 170 12.13 160 7.90 118 6.45 74 6.07

ClucasGray Equilibrium Prescient Fund 10 25.78 114 9.44 102 6.96 21 7.69

Cordatus Balanced Prescient Fund* 66 18.43 45 11.87 74 7.77 60 6.45

CoreShares OUTmoderate Index Fund 21 22.44 50 11.56 52 8.51

CoreShares Wealth Accumulation Fund 53 19.49 80 10.45

Corion Prime Growth Fund 63 18.60 153 8.17 154 5.10 111 5.06

Coronation Balanced Plus Fund* 17 23.15 20 13.52 40 9.06 30 7.42 21 7.15 5 10.85 2 13.72

Counterpoint SCI Balanced Plus Fund 196 1.02 186 2.80 162 4.33 131 4.19 81 4.47

Counterpoint SCI Managed P&G® Fund* 4 33.73 188 (0.34) 173 (3.19) 145 (0.21) 88 2.49

CS BCI Aggressive Prudential Fund of Funds 93 17.29 16 14.00 12 10.49 24 7.59

CS BCI Prudential Fund of Funds 136 15.29 53 11.50 24 9.43 31 7.39

Denker Sanlam Collective Investments Balanced Fund 44 19.82 97 9.97 61 8.18

Deton Prime Managed Fund of Funds 194 6.95 118 9.36 115 6.59 84 5.86 48 6.10

Discovery Aggressive Dynamic Asset Optimiser Fund of Funds 48 19.68 14 14.25 22 9.49 17 7.83

Discovery Balanced Fund 86 17.74 73 10.75 76 7.63 47 6.73 17 7.41 9 10.47

Dotport BCI Prudential Fund of Funds 145 14.53 179 5.37 153 5.17 117 4.81 79 4.65 49 7.67

Element Balanced Sanlam Collective Investments Fund 150 14.32 175 6.14 143 5.51 34 7.21 76 4.93 53 7.36

Element Islamic Balanced Sanlam Collective Investments Fund 156 13.68 98 9.91 39 9.08 12 8.01 50 6.01 57 6.98

Fairtree Balanced Prescient Fund 25 21.72 1 21.06 1 16.15

Fairtree Invest Strategic Factor Prescient Fund 153 13.87

FAL BCI Balanced Fund 134 15.31 115 9.42 117 6.46 133 4.11

FAL BCI Balanced Fund of Funds 188 8.48 155 8.13 101 6.98

FG IP Neptune Growth Fund of Funds 71 18.28 34 12.34 25 9.38 20 7.71

Financial Fitness IP Balanced Fund of Funds 182 9.25 139 8.66 46 8.64 27 7.53

Flagship IP Balanced Fund 111 16.46 4 17.34 8 11.25 68 6.27 72 5.15 48 7.68

FNB Growth Fund of Funds 73 18.21 65 11.10 70 7.98 77 6.03

Foord Balanced Fund* 171 11.71 57 11.39 90 7.23 91 5.61 53 5.92 17 9.88

Granate SCI Balanced Fund 3 34.23

Graviton SCI Balanced Fund 92 17.34 96 10.02 81 7.43 76 6.03 40 6.45

GraySwan SCI Aggressive Fund of Funds 28 21.36 137 8.71 116 6.52

Gryphon Prudential Fund 192 7.49 12 14.88 4 11.97 2 10.53 3 9.85

H4 Diversified Fund 149 14.38 85 10.37 36 9.16 9 8.29

High Street High Equity Prescient Fund 184 8.64 7 16.23

Hollard Prime Strategic Assertive Fund of Funds 61 18.71 83 10.40 73 7.88 41 6.87 22 7.14

Imali BCI Passive Balanced Fund 154 13.81 93 10.07 69 7.98

Imalivest Sanlam Collective Investments Balanced Fund 165 12.73 190 (0.98) 172 (0.97) 146 (1.72)

Innovation BCI Balanced Fund of Funds 185 8.62 113 9.44

Investhouse Ci Balanced Fund 155 13.71 82 10.43 110 6.71

IP Active Beta Fund 168 12.38 64 11.15 33 9.20 43 6.80 42 6.38

IP Balanced Fund* 97 17.17 3 19.69

IP Prudential Equity Fund 164 12.76 112 9.48 86 7.32 85 5.84

JBL Sanlam Collective Investments Managed Fund of Funds 138 15.22 156 8.10 127 6.21

Kagiso Balanced Fund 7 29.67 27 12.76 10 10.90 5 8.95 16 7.44 16 9.95

Kagiso Islamic Balanced Fund 9 27.82 13 14.35 13 10.46 6 8.93 26 6.94 40 8.63

Kanaan BCI Balanced Fund of Funds 189 8.25 184 3.88 163 4.04 140 3.01 86 3.51 61 5.52

Kruger Ci Balanced Fund 99 17.08 21 13.42

Long Beach Managed Prescient Fund 14 23.75 2 20.86 2 15.67 3 10.32 1 11.78

Lynx Prime Balanced Fund of Funds* 35 20.54 54 11.49 55 8.41 46 6.73 24 7.02 27 9.39

Marriott Balanced Fund of Funds* 190 8.24 182 4.78 160 4.48 138 3.63 63 5.45 43 8.11

Matrix SCI Balanced Fund 109 16.56 109 9.50 94 7.13

Median BCI Balanced Fund of Funds 64 18.46 129 8.93 134 5.89 116 4.85

Methodical BCI Balanced Fund* 148 14.39 41 11.94 48 8.60 72 6.17

Momentum Focus 6 Fund of Funds 76 18.02 146 8.40 128 6.12

Momentum Focus 7 Fund of Funds 59 18.79 147 8.39 140 5.69 128 4.41 62 5.45

Momentum Target 6 Fund of Funds 79 17.93 145 8.41 105 6.91

203

Profile’s Unit Trusts & Collective Investments — DOMESTIC