Page 195 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 195

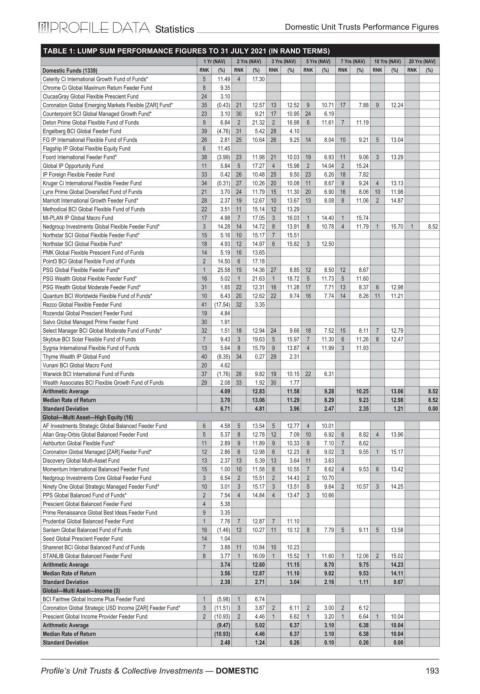

Statistics Domestic Unit Trusts Performance Figures

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JULY 2021 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1339) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Celerity Ci International Growth Fund of Funds* 5 11.49 4 17.30

Chrome Ci Global Maximum Return Feeder Fund 8 9.35

ClucasGray Global Flexible Prescient Fund 24 3.10

Coronation Global Emerging Markets Flexible [ZAR] Fund* 35 (0.43) 21 12.57 13 12.52 9 10.71 17 7.88 9 12.24

Counterpoint SCI Global Managed Growth Fund* 23 3.10 30 9.21 17 10.95 24 6.19

Deton Prime Global Flexible Fund of Funds 9 6.84 2 21.32 2 16.98 6 11.61 7 11.19

Engelberg BCI Global Feeder Fund 39 (4.76) 31 5.42 28 4.10

FG IP International Flexible Fund of Funds 26 2.81 25 10.64 26 9.25 14 8.04 10 9.21 5 13.04

Flagship IP Global Flexible Equity Fund 6 11.45

Foord International Feeder Fund* 38 (3.99) 23 11.98 21 10.03 19 6.93 11 9.06 3 13.29

Global IP Opportunity Fund 11 5.84 5 17.27 4 15.98 2 14.04 2 15.24

IP Foreign Flexible Feeder Fund 33 0.42 26 10.48 25 9.50 23 6.26 18 7.82

Kruger Ci International Flexible Feeder Fund 34 (0.31) 27 10.26 20 10.08 11 8.67 9 9.24 4 13.13

Lynx Prime Global Diversified Fund of Funds 21 3.70 24 11.79 15 11.30 20 6.90 16 8.06 10 11.98

Marriott International Growth Feeder Fund* 28 2.37 19 12.67 10 13.67 13 8.08 8 11.06 2 14.87

Methodical BCI Global Flexible Fund of Funds 22 3.51 11 15.14 12 13.29

MI-PLAN IP Global Macro Fund 17 4.98 7 17.05 3 16.03 1 14.40 1 15.74

Nedgroup Investments Global Flexible Feeder Fund* 3 14.28 14 14.72 8 13.91 8 10.78 4 11.79 1 15.70 1 8.52

Northstar SCI Global Flexible Feeder Fund* 15 5.16 10 15.17 7 15.51

Northstar SCI Global Flexible Fund* 18 4.93 12 14.97 6 15.82 3 12.50

PMK Global Flexible Prescient Fund of Funds 14 5.19 16 13.65

Point3 BCI Global Flexible Fund of Funds 2 14.50 6 17.18

PSG Global Flexible Feeder Fund* 1 25.58 15 14.36 27 8.85 12 8.50 12 8.67

PSG Wealth Global Flexible Feeder Fund* 16 5.02 1 21.63 1 18.72 5 11.73 5 11.60

PSG Wealth Global Moderate Feeder Fund* 31 1.65 22 12.31 16 11.28 17 7.71 13 8.37 6 12.98

Quantum BCI Worldwide Flexible Fund of Funds* 10 6.43 20 12.62 22 9.74 16 7.74 14 8.26 11 11.21

Rezco Global Flexible Feeder Fund 41 (17.54) 32 3.35

Rozendal Global Prescient Feeder Fund 19 4.84

Salvo Global Managed Prime Feeder Fund 30 1.91

Select Manager BCI Global Moderate Fund of Funds* 32 1.51 18 12.94 24 9.66 18 7.52 15 8.11 7 12.79

Skyblue BCI Solar Flexible Fund of Funds 7 9.43 3 19.63 5 15.97 7 11.30 6 11.26 8 12.47

Sygnia International Flexible Fund of Funds 13 5.64 8 15.79 9 13.87 4 11.99 3 11.93

Thyme Wealth IP Global Fund 40 (8.35) 34 0.27 29 2.31

Vunani BCI Global Macro Fund 20 4.62

Warwick BCI International Fund of Funds 37 (1.76) 28 9.82 19 10.15 22 6.31

Wealth Associates BCI Flexible Growth Fund of Funds 29 2.08 33 1.92 30 1.77

Arithmetic Average 4.09 12.83 11.58 9.28 10.25 13.06 8.52

Median Rate of Return 3.70 13.06 11.29 8.29 9.23 12.98 8.52

Standard Deviation 6.71 4.81 3.96 2.47 2.35 1.21 0.00

Global—Multi Asset—High Equity (16)

AF Investments Strategic Global Balanced Feeder Fund 6 4.58 5 13.54 5 12.77 4 10.01

Allan Gray-Orbis Global Balanced Feeder Fund 5 5.37 8 12.78 12 7.09 10 6.92 6 8.82 4 13.96

Ashburton Global Flexible Fund* 11 2.89 9 11.89 9 10.33 9 7.10 7 8.62

Coronation Global Managed [ZAR] Feeder Fund* 12 2.86 6 12.98 6 12.23 6 9.02 3 9.55 1 15.17

Discovery Global Multi-Asset Fund 13 2.37 13 5.39 13 3.64 11 3.63

Momentum International Balanced Feeder Fund 15 1.00 10 11.58 8 10.55 7 8.62 4 9.53 6 13.42

Nedgroup Investments Core Global Feeder Fund 3 6.54 2 15.51 2 14.43 2 10.70

Ninety One Global Strategic Managed Feeder Fund* 10 3.01 3 15.17 3 13.51 5 9.64 2 10.57 3 14.25

PPS Global Balanced Fund of Funds* 2 7.54 4 14.84 4 13.47 3 10.66

Prescient Global Balanced Feeder Fund 4 5.38

Prime Renaissance Global Best Ideas Feeder Fund 9 3.35

Prudential Global Balanced Feeder Fund 1 7.76 7 12.87 7 11.10

Sanlam Global Balanced Fund of Funds 16 (1.46) 12 10.27 11 10.12 8 7.79 5 9.11 5 13.58

Seed Global Prescient Feeder Fund 14 1.04

Sharenet BCI Global Balanced Fund of Funds 7 3.88 11 10.84 10 10.23

STANLIB Global Balanced Feeder Fund 8 3.77 1 16.09 1 15.52 1 11.60 1 12.06 2 15.02

Arithmetic Average 3.74 12.60 11.15 8.70 9.75 14.23

Median Rate of Return 3.56 12.87 11.10 9.02 9.53 14.11

Standard Deviation 2.38 2.71 3.04 2.16 1.11 0.67

Global—Multi Asset—Income (3)

BCI Fairtree Global Income Plus Feeder Fund 1 (5.98) 1 6.74

Coronation Global Strategic USD Income [ZAR] Feeder Fund* 3 (11.51) 3 3.87 2 6.11 2 3.00 2 6.12

Prescient Global Income Provider Feeder Fund 2 (10.93) 2 4.46 1 6.62 1 3.20 1 6.64 1 10.04

Arithmetic Average (9.47) 5.02 6.37 3.10 6.38 10.04

Median Rate of Return (10.93) 4.46 6.37 3.10 6.38 10.04

Standard Deviation 2.48 1.24 0.26 0.10 0.26 0.00

193

Profile’s Unit Trusts & Collective Investments — DOMESTIC