Page 115 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 115

Investment Risk

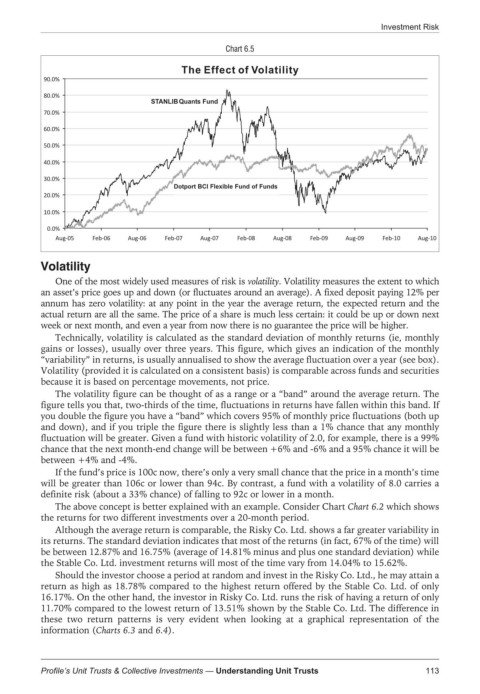

Chart 6.5

The Effect of Volatility

90.0%

80.0%

STANLIBQuants Fund

70.0%

60.0%

50.0%

40.0%

30.0%

Dotport MET Flexible FoF of Funds

Dotport BCI Flexible Fund

20.0%

10.0%

0.0%

Aug-05 Feb-06 Aug-06 Feb-07 Aug-07 Feb-08 Aug-08 Feb-09 Aug-09 Feb-10 Aug-10

Volatility

One of the most widely used measures of risk is volatility. Volatility measures the extent to which

an asset’s price goes up and down (or fluctuates around an average). A fixed deposit paying 12% per

annum has zero volatility: at any point in the year the average return, the expected return and the

actual return are all the same. The price of a share is much less certain: it could be up or down next

week or next month, and even a year from now there is no guarantee the price will be higher.

Technically, volatility is calculated as the standard deviation of monthly returns (ie, monthly

gains or losses), usually over three years. This figure, which gives an indication of the monthly

“variability” in returns, is usually annualised to show the average fluctuation over a year (see box).

Volatility (provided it is calculated on a consistent basis) is comparable across funds and securities

because it is based on percentage movements, not price.

The volatility figure can be thought of as a range or a “band” around the average return. The

figure tells you that, two-thirds of the time, fluctuations in returns have fallen within this band. If

you double the figure you have a “band” which covers 95% of monthly price fluctuations (both up

and down), and if you triple the figure there is slightly less than a 1% chance that any monthly

fluctuation will be greater. Given a fund with historic volatility of 2.0, for example, there is a 99%

chance that the next month-end change will be between +6% and -6% and a 95% chance it will be

between +4% and -4%.

If the fund’s price is 100c now, there’s only a very small chance that the price in a month’s time

will be greater than 106c or lower than 94c. By contrast, a fund with a volatility of 8.0 carries a

definite risk (about a 33% chance) of falling to 92c or lower in a month.

The above concept is better explained with an example. Consider Chart Chart 6.2 which shows

the returns for two different investments over a 20-month period.

Although the average return is comparable, the Risky Co. Ltd. shows a far greater variability in

its returns. The standard deviation indicates that most of the returns (in fact, 67% of the time) will

be between 12.87% and 16.75% (average of 14.81% minus and plus one standard deviation) while

the Stable Co. Ltd. investment returns will most of the time vary from 14.04% to 15.62%.

Should the investor choose a period at random and invest in the Risky Co. Ltd., he may attain a

return as high as 18.78% compared to the highest return offered by the Stable Co. Ltd. of only

16.17%. On the other hand, the investor in Risky Co. Ltd. runs the risk of having a return of only

11.70% compared to the lowest return of 13.51% shown by the Stable Co. Ltd. The difference in

these two return patterns is very evident when looking at a graphical representation of the

information (Charts 6.3 and 6.4).

113

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts