Page 114 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 114

Investment Risk

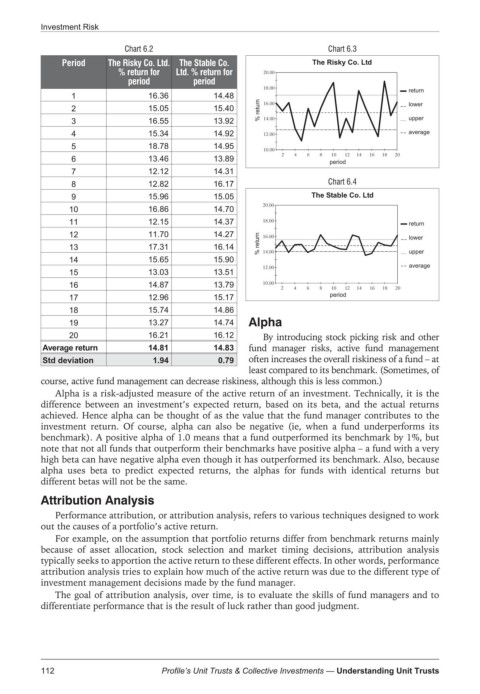

Chart 6.2 Chart 6.3

Period The Risky Co. Ltd. TheStableCo. The Risky Co. Ltd

%returnfor Ltd. % return for

period period

return

1 16.36 14.48

2 15.05 15.40 % return lower

3 16.55 13.92 upper

4 15.34 14.92 average

5 18.78 14.95

6 13.46 13.89 period

7 12.12 14.31

8 12.82 16.17 Chart 6.4

9 15.96 15.05 The Stable Co. Ltd

10 16.86 14.70

11 12.15 14.37 return

12 11.70 14.27 lower

13 17.31 16.14 % return upper

14 15.65 15.90

average

15 13.03 13.51

16 14.87 13.79

17 12.96 15.17 period

18 15.74 14.86

19 13.27 14.74 Alpha

20 16.21 16.12 By introducing stock picking risk and other

fund manager risks, active fund management

Average return 14.81 14.83

often increases the overall riskiness of a fund – at

Std deviation 1.94 0.79

least compared to its benchmark. (Sometimes, of

course, active fund management can decrease riskiness, although this is less common.)

Alpha is a risk-adjusted measure of the active return of an investment. Technically, it is the

difference between an investment’s expected return, based on its beta, and the actual returns

achieved. Hence alpha can be thought of as the value that the fund manager contributes to the

investment return. Of course, alpha can also be negative (ie, when a fund underperforms its

benchmark). A positive alpha of 1.0 means that a fund outperformed its benchmark by 1%, but

note that not all funds that outperform their benchmarks have positive alpha – a fund with a very

high beta can have negative alpha even though it has outperformed its benchmark. Also, because

alpha uses beta to predict expected returns, the alphas for funds with identical returns but

different betas will not be the same.

Attribution Analysis

Performance attribution, or attribution analysis, refers to various techniques designed to work

out the causes of a portfolio’s active return.

For example, on the assumption that portfolio returns differ from benchmark returns mainly

because of asset allocation, stock selection and market timing decisions, attribution analysis

typically seeks to apportion the active return to these different effects. In other words, performance

attribution analysis tries to explain how much of the active return was due to the different type of

investment management decisions made by the fund manager.

The goal of attribution analysis, over time, is to evaluate the skills of fund managers and to

differentiate performance that is the result of luck rather than good judgment.

112 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts