Page 99 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 99

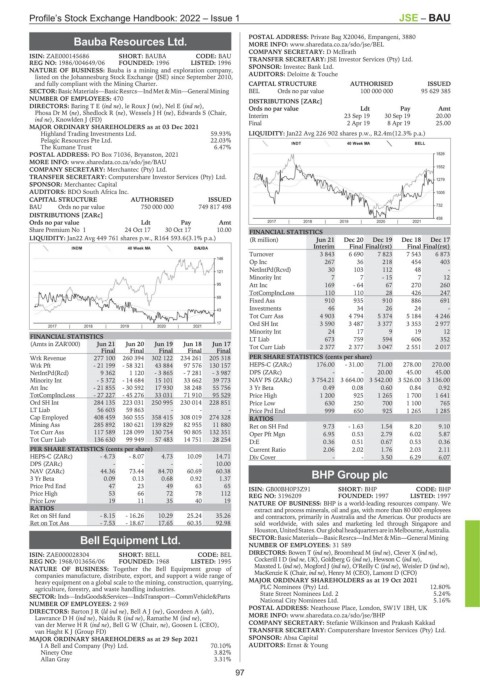

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – BAU

POSTAL ADDRESS: Private Bag X20046, Empangeni, 3880

Bauba Resources Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/BEL

BAU COMPANY SECRETARY: D McIlrath

ISIN: ZAE000145686 SHORT: BAUBA CODE: BAU TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

REG NO: 1986/004649/06 FOUNDED: 1996 LISTED: 1996 SPONSOR: Investec Bank Ltd.

NATURE OF BUSINESS: Bauba is a mining and exploration company,

listed on the Johannesburg Stock Exchange (JSE) since September 2010, AUDITORS: Deloitte & Touche

and fully compliant with the Mining Charter. CAPITAL STRUCTURE AUTHORISED ISSUED

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining BEL Ords no par value 100 000 000 95 629 385

NUMBER OF EMPLOYEES: 470 DISTRIBUTIONS [ZARc]

DIRECTORS: BaringTE(ind ne), le Roux J (ne), Nel E (ind ne), Ords no par value Ldt Pay Amt

Phosa Dr M (ne), Shedlock R (ne), WesselsJH(ne), Edwards S (Chair, Interim 23 Sep 19 30 Sep 19 20.00

ind ne), Knowlden J (FD)

MAJOR ORDINARY SHAREHOLDERS as at 03 Dec 2021 Final 2 Apr 19 8 Apr 19 25.00

Highland Trading Investments Ltd. 59.93% LIQUIDITY: Jan22 Avg 226 902 shares p.w., R2.4m(12.3% p.a.)

Pelagic Resources Pte Ltd. 22.03%

The Kumane Trust 6.47% INDT 40 Week MA BELL

POSTAL ADDRESS: PO Box 71036, Bryanston, 2021 1826

MORE INFO: www.sharedata.co.za/sdo/jse/BAU

COMPANY SECRETARY: Merchantec (Pty) Ltd. 1552

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

1279

SPONSOR: Merchantec Capital

AUDITORS: BDO South Africa Inc. 1005

CAPITAL STRUCTURE AUTHORISED ISSUED

BAU Ords no par value 750 000 000 749 817 498 732

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 2017 | 2018 | 2019 | 2020 | 2021 458

Share Premium No 1 24 Oct 17 30 Oct 17 10.00 FINANCIAL STATISTICS

LIQUIDITY: Jan22 Avg 449 761 shares p.w., R164 593.6(3.1% p.a.) (R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

Interim Final Final(rst) Final Final(rst)

INDM 40 Week MA BAUBA

Turnover 3 843 6 690 7 823 7 543 6 873

146

Op Inc 267 36 218 454 403

NetIntPd(Rcvd) 30 103 112 48 -

121

Minority Int 7 7 - 15 7 12

95 Att Inc 169 - 64 67 270 260

TotCompIncLoss 110 110 28 426 247

69

Fixed Ass 910 935 910 886 691

43 Investments 46 34 26 24 -

Tot Curr Ass 4 903 4 794 5 374 5 184 4 246

17 Ord SH Int 3 590 3 487 3 377 3 353 2 977

2017 | 2018 | 2019 | 2020 | 2021

Minority Int 24 17 9 19 12

FINANCIAL STATISTICS LT Liab 673 759 594 606 352

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 Tot Curr Liab 2 377 2 377 3 047 2 551 2 017

Final Final Final Final Final

Wrk Revenue 277 100 260 394 302 122 234 261 205 318 PER SHARE STATISTICS (cents per share)

Wrk Pft - 21 199 - 58 321 43 884 97 576 130 157 HEPS-C (ZARc) 176.00 - 31.00 71.00 278.00 270.00

NetIntPd(Rcd) 9 362 1 120 - 3 865 - 7 281 - 3 987 DPS (ZARc) - - 20.00 45.00 45.00

Minority Int - 5 372 - 14 684 15 101 33 662 39 773 NAV PS (ZARc) 3 754.21 3 664.00 3 542.00 3 526.00 3 136.00

Att Inc - 21 855 - 30 592 17 930 38 248 55 756 3 Yr Beta 0.49 0.08 0.60 0.84 0.92

TotCompIncLoss - 27 227 - 45 276 33 031 71 910 95 529 Price High 1 200 925 1 265 1 700 1 641

Ord SH Int 284 135 223 031 250 995 230 014 228 851 Price Low 630 250 700 1 100 765

LT Liab 56 603 59 863 - - - Price Prd End 999 650 925 1 265 1 285

Cap Employed 408 459 360 555 358 415 308 019 274 328 RATIOS

Mining Ass 285 892 180 621 139 829 82 955 11 880 Ret on SH Fnd 9.73 - 1.63 1.54 8.20 9.10

Tot Curr Ass 117 589 128 099 130 754 90 805 132 351 Oper Pft Mgn 6.95 0.53 2.79 6.02 5.87

Tot Curr Liab 136 630 99 949 57 483 14 751 28 254 D:E 0.36 0.51 0.67 0.53 0.36

PER SHARE STATISTICS (cents per share) Current Ratio 2.06 2.02 1.76 2.03 2.11

HEPS-C (ZARc) - 4.73 - 8.07 4.73 10.09 14.71 Div Cover - - 3.50 6.29 6.07

DPS (ZARc) - - - - 10.00

NAV (ZARc) 44.36 73.44 84.70 60.69 60.38 BHP Group plc

3 Yr Beta 0.09 0.13 0.68 0.92 1.37

BHP

Price Prd End 47 23 49 63 65 ISIN: GB00BH0P3Z91 SHORT: BHP CODE: BHP

Price High 53 66 72 78 112 REG NO: 3196209 FOUNDED: 1997 LISTED: 1997

Price Low 19 11 35 40 19 NATURE OF BUSINESS: BHP is a world-leading resources company. We

RATIOS extract and process minerals, oil and gas, with more than 80 000 employees

Ret on SH fund - 8.15 - 16.26 10.29 25.24 35.26 and contractors, primarily in Australia and the Americas. Our products are

Ret on Tot Ass - 7.53 - 18.67 17.65 60.35 92.98 sold worldwide, with sales and marketing led through Singapore and

Houston,UnitedStates.OurglobalheadquartersareinMelbourne,Australia.

Bell Equipment Ltd. SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining

NUMBER OF EMPLOYEES: 31 589

BEL

ISIN: ZAE000028304 SHORT: BELL CODE: BEL DIRECTORS: Bowen T (ind ne), Broomhead M (ind ne), Clever X (ind ne),

REG NO: 1968/013656/06 FOUNDED: 1968 LISTED: 1995 Cockerill I D (ind ne, UK), Goldberg G (ind ne), Hewson C (ind ne),

NATURE OF BUSINESS: Together the Bell Equipment group of Maxsted L (ind ne), MogfordJ(ind ne), O’Reilly C (ind ne), Weisler D (ind ne),

companies manufacture, distribute, export, and support a wide range of MacKenzie K (Chair, ind ne), Henry M (CEO), Lamont D (CFO)

heavy equipment on a global scale to the mining, construction, quarrying, MAJOR ORDINARY SHAREHOLDERS as at 19 Oct 2021

agriculture, forestry, and waste handling industries. PLC Nominees (Pty) Ltd. 12.80%

SECTOR: Inds—IndsGoods&Services—IndsTransport—CommVehicle&Parts State Street Nominees Ltd. 2 5.24%

National City Nominees Ltd.

5.16%

NUMBER OF EMPLOYEES: 2 969

DIRECTORS: BartonJR(ld ind ne), BellAJ(ne), Goordeen A (alt), POSTAL ADDRESS: Neathouse Place, London, SW1V 1BH, UK

LawranceDH(ind ne), Naidu R (ind ne), Ramathe M (ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/BHP

van der MerweHR(ind ne), Bell G W (Chair, ne), Goosen L (CEO), COMPANY SECRETARY: Stefanie Wilkinson and Prakash Kakkad

van Haght K J (Group FD) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 29 Sep 2021 SPONSOR: Absa Capital

I A Bell and Company (Pty) Ltd. 70.10% AUDITORS: Ernst & Young

Ninety One 3.82%

Allan Gray 3.31%

97