Page 96 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 96

JSE – AST Profile’s Stock Exchange Handbook: 2022 – Issue 1

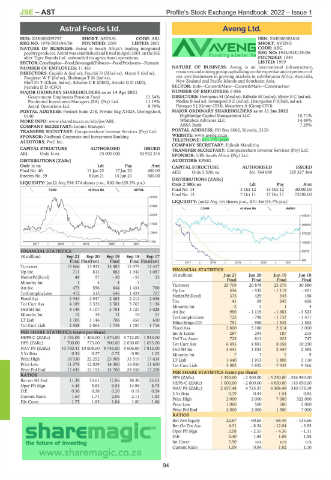

Astral Foods Ltd. Aveng Ltd.

AST AVE

ISIN: ZAE000029757 SHORT: ASTRAL CODE: ARL ISIN: ZAE000302618

REG NO: 1978/003194/06 FOUNDED: 2001 LISTED: 2001 SHORT: AVENG

NATURE OF BUSINESS: Astral is South Africa’s leading integrated CODE: AEG

poultryproducer. Astralwasestablished andlistedinApril2001 onthe JSE REG NO: 1944/018119/06

after Tiger Brands Ltd. unbundled its agricultural operations. FOUNDED: 1944

SECTOR:ConsStaples—Food,Beverage&Tobacco—FoodProducers—Farmers LISTED: 1999

NUMBER OF EMPLOYEES: 11 461 NATURE OF BUSINESS: Aveng is an international infrastructure,

DIRECTORS: Cupido A (ind ne), Fouché D (ld ind ne), Mayet S (ind ne), resources and mining group capitalising on the expertise and experience of

PotgieterWF(ind ne), ShabanguTM(ind ne), our core businesses in growing markets in sub-Saharan Africa, Australia,

Eloff Dr T (Chair, ind ne), Schutte C E (CEO), Arnold G D (MD), New Zealand and Pacific Islands and Southeast Asia.

Ferreira D D (CFO) SECTOR: Inds—Constr&Mats—Constr&Mats—Construction

MAJOR ORDINARY SHAREHOLDERS as at 14 Apr 2021 NUMBER OF EMPLOYEES: 6 086

Government Employees Pension Fund 13.54% DIRECTORS: Hermanus M (ld ind ne), Kilbride M (ind ne), Meyer B C (ind ne),

Prudential Investment Managers (SA) (Pty) Ltd. 11.19% Modise B (ind ne), Swanepoel B Z (ind ne), Hourquebie P (Chair, ind ne),

Astral Operations Ltd. 9.79% Flanagan S J (Group CEO), Macartney A (Group CFO)

POSTAL ADDRESS: Postnet Suite 278, Private Bag X1028, Doringkloof, MAJOR ORDINARY SHAREHOLDERS as at 11 Jan 2022

0140 Highbridge Capital Management LLC 15.71%

MORE INFO: www.sharedata.co.za/sdo/jse/ARL Whitebox Advisors LLC 14.49%

COMPANY SECRETARY: Leonie Marupen ABSA Bank 7.29%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: PO Box 6062, Rivonia, 2128

SPONSOR: Nedbank Corporate and Investment Banking WEBSITE: www.aveng.co.za

AUDITORS: PwC Inc. TELEPHONE: 011-779-2800

COMPANY SECRETARY: Edinah Mandizha

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ARL Ords 1c ea 75 000 000 42 922 235 SPONSOR: UBS South Africa (Pty) Ltd.

DISTRIBUTIONS [ZARc] AUDITORS: KPMG

Ords 1c ea Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 40 11 Jan 22 17 Jan 22 400.00 AEG Ords 2 500c ea 361 764 069 125 327 364

Interim No 39 8 Jun 21 14 Jun 21 300.00

DISTRIBUTIONS [ZARc]

LIQUIDITY: Jan22 Avg 538 374 shares p.w., R82.0m(65.2% p.a.) Ords 2 500c ea Ldt Pay Amt

FOOD 40 Week MA ASTRAL Final No 14 5 Oct 12 15 Oct 12 30000.00

Final No 13 7 Oct 11 17 Oct 11 72500.00

32165

LIQUIDITY: Jan22 Avg 1m shares p.w., R31.4m(54.7% p.a.)

27285

CONM 40 Week MA AVENG

22405 458381

17525 366805

12645 275229

7765 183653

2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS 92076

(R million) Sep 21 Sep 20 Sep 19 Sep 18 Sep 17

Final Final(rst) Final Final Final(rst) 2017 | 2018 | 2019 | 2020 | 2021 500

Turnover 15 866 13 932 13 485 12 979 12 417

Op Inc 711 813 882 1 942 1 087 FINANCIAL STATISTICS

NetIntPd(Rcvd) 49 57 - 30 - 53 15 (R million) Jun 21 Jun 20 Jun 19 Jun 18

Final

Final

Final

Final

Minority Int 1 5 4 3 - Turnover 25 709 20 878 25 676 30 580

Att Inc 473 556 644 1 431 760 Op Inc 536 - 532 - 1 119 - 401

TotCompIncLoss 472 513 646 1 424 767 NetIntPd(Rcvd) 375 429 343 188

Fixed Ass 2 943 2 947 2 463 2 212 2 036 Tax 41 69 245 426

Tot Curr Ass 4 189 3 535 3 581 3 765 3 136 Minority Int - 2 3 1 4

Ord SH Int 4 149 4 107 3 784 3 727 3 028

Att Inc 990 - 1 119 - 1 681 - 3 523

Minority Int 12 15 11 10 11 TotCompIncLoss 723 - 798 - 1 733 - 3 471

LT Liab 1 105 1 146 706 650 610 Hline Erngs-CO 751 - 950 - 1 545 - 1 563

Tot Curr Liab 2 558 2 063 1 738 1 787 1 716

Fixed Ass 2 800 3 180 2 814 3 010

PER SHARE STATISTICS (cents per share) Inv & Loans 287 294 187 215

HEPS-C (ZARc) 1 194.00 1 404.00 1 674.00 3 712.00 1 914.00 Def Tax Asset 725 813 622 747

DPS (ZARc) 700.00 775.00 900.00 2 050.00 1 055.00 Tot Curr Ass 6 495 4 881 8 058 10 290

NAV PS (ZARc) 10 760.41 10 608.00 9 745.00 9 606.00 7 815.00 Ord SH Int 3 441 1 833 2 447 2 585

3 Yr Beta 0.34 0.27 0.72 0.96 1.02 Minority Int 7 7 7 9

Price High 18 530 22 252 25 908 33 519 17 634 LT Liab 1 440 1 913 1 896 3 110

Price Low 11 079 12 029 14 300 16 850 11 600 Tot Curr Liab 5 982 5 832 7 932 9 366

Price Prd End 17 643 13 153 14 700 24 658 17 208 PER SHARE STATISTICS (cents per share)

RATIOS EPS (ZARc) 1 350.00 - 2 300.00 - 5 250.00 - 326 950.00

Ret on SH Fnd 11.38 13.61 17.06 38.38 25.03 HEPS-C (ZARc) 1 000.00 - 2 000.00 - 4 850.00 - 145 050.00

Oper Pft Mgn 4.48 5.83 6.54 14.96 8.75 NAV PS (ZARc) 2 657.48 4 725.57 6 308.49 310 175.19

D:E 0.36 0.28 0.20 0.18 0.24 3 Yr Beta 0.79 0.44 - 1.54 0.85

Current Ratio 1.64 1.71 2.06 2.11 1.83 Price High 2 000 2 000 7 000 322 000

Div Cover 1.75 1.85 1.84 1.80 1.86

Price Low 1 000 500 500 5 000

Price Prd End 2 000 2 000 1 500 7 000

RATIOS

Ret Ave Equity 22.67 - 60.65 - 68.46 - 135.66

Ret On Tot Ass 4.31 - 8.34 - 12.04 - 3.95

Oper Pft Mgn 2.08 - 2.55 - 4.36 - 1.31

D:E 0.40 1.85 1.06 1.55

Int Cover 3.90 n/a n/a n/a

Current Ratio 1.09 0.84 1.02 1.10

94