Page 103 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 103

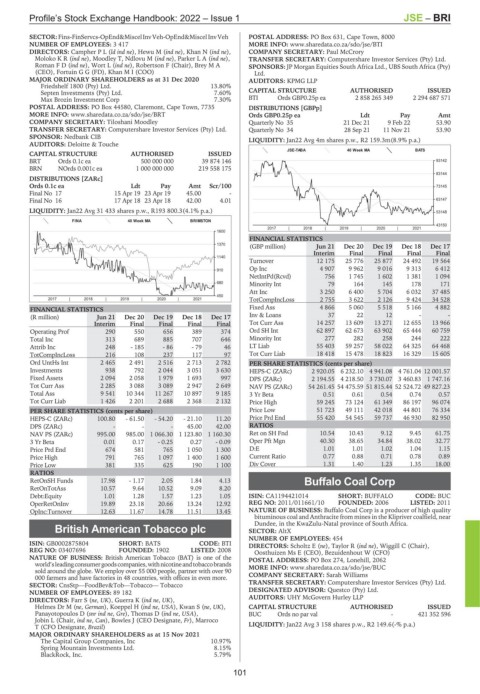

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – BRI

SECTOR:Fins-FinServcs-OpEnd&MiscelInvVeh-OpEnd&MiscelInvVeh POSTAL ADDRESS: PO Box 631, Cape Town, 8000

NUMBER OF EMPLOYEES: 3 417 MORE INFO: www.sharedata.co.za/sdo/jse/BTI

DIRECTORS: CampherPL(ld ind ne), Hewu M (ind ne), Khan N (ind ne), COMPANY SECRETARY: Paul McCrory

MolokoKR(ind ne), Moodley T, Ndlovu M (ind ne), ParkerLA(ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

RomanFD(ind ne), Wort L (ind ne), Robertson F (Chair), Brey M A SPONSORS: JP Morgan Equities South Africa Ltd., UBS South Africa (Pty)

(CEO), Fortuin G G (FD), Khan M I (COO) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020 AUDITORS: KPMG LLP

Friedshelf 1800 (Pty) Ltd. 13.80%

Septen Investments (Pty) Ltd. 7.60% CAPITAL STRUCTURE AUTHORISED ISSUED

Max Brozin Investment Corp 7.30% BTI Ords GBP0.25p ea 2 858 265 349 2 294 687 571

POSTAL ADDRESS: PO Box 44580, Claremont, Cape Town, 7735 DISTRIBUTIONS [GBPp]

MORE INFO: www.sharedata.co.za/sdo/jse/BRT Ords GBP0.25p ea Ldt Pay Amt

COMPANY SECRETARY: Tiloshani Moodley Quarterly No 35 21 Dec 21 9 Feb 22 53.90

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Quarterly No 34 28 Sep 21 11 Nov 21 53.90

SPONSOR: Nedbank CIB LIQUIDITY: Jan22 Avg 4m shares p.w., R2 159.3m(8.9% p.a.)

AUDITORS: Deloitte & Touche

JSE-TABA 40 Week MA BATS

CAPITAL STRUCTURE AUTHORISED ISSUED

BRT Ords 0.1c ea 500 000 000 39 874 146 93142

BRN NOrds 0.001c ea 1 000 000 000 219 558 175

83144

DISTRIBUTIONS [ZARc]

Ords 0.1c ea Ldt Pay Amt Scr/100 73145

Final No 17 15 Apr 19 23 Apr 19 45.00 -

Final No 16 17 Apr 18 23 Apr 18 42.00 4.01 63147

LIQUIDITY: Jan22 Avg 31 433 shares p.w., R193 800.3(4.1% p.a.) 53148

FINA 40 Week MA BRIMSTON

43150

2017 | 2018 | 2019 | 2020 | 2021

1600

FINANCIAL STATISTICS

1370 (GBP million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

Interim Final Final Final Final

1140

Turnover 12 175 25 776 25 877 24 492 19 564

910 Op Inc 4 907 9 962 9 016 9 313 6 412

NetIntPd(Rcvd) 756 1 745 1 602 1 381 1 094

680 Minority Int 79 164 145 178 171

Att Inc 3 250 6 400 5 704 6 032 37 485

450

2017 | 2018 | 2019 | 2020 | 2021 TotCompIncLoss 2 755 3 622 2 126 9 424 34 528

FINANCIAL STATISTICS Fixed Ass 4 866 5 060 5 518 5 166 4 882

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 Inv & Loans 37 22 12 - -

Interim Final Final Final Final Tot Curr Ass 14 257 13 609 13 271 12 655 13 966

Operating Prof 290 550 656 389 374 Ord SH Int 62 897 62 673 63 902 65 444 60 759

Total Inc 313 689 885 707 646 Minority Int 277 282 258 244 222

Attrib Inc 248 - 185 - 86 - 79 46 LT Liab 55 403 59 257 58 022 64 325 64 468

TotCompIncLoss 216 108 237 117 97 Tot Curr Liab 18 418 15 478 18 823 16 329 15 605

Ord UntHs Int 2 465 2 491 2 516 2 713 2 782 PER SHARE STATISTICS (cents per share)

Investments 938 792 2 044 3 051 3 630 HEPS-C (ZARc) 2 920.05 6 232.10 4 941.08 4 761.04 12 001.57

Fixed Assets 2 094 2 058 1 979 1 693 997 DPS (ZARc) 2 194.55 4 218.50 3 730.07 3 460.83 1 747.16

Tot Curr Ass 2 285 3 088 3 089 2 947 2 649 NAV PS (ZARc) 54 261.45 54 475.59 51 815.44 52 524.72 49 827.23

Total Ass 9 541 10 344 11 267 10 897 9 185 3 Yr Beta 0.51 0.61 0.54 0.74 0.57

Tot Curr Liab 1 426 2 201 2 688 2 368 2 132 Price High 59 245 73 124 61 349 86 197 96 074

PER SHARE STATISTICS (cents per share) Price Low 51 723 49 111 42 018 44 801 76 334

HEPS-C (ZARc) 100.80 - 61.50 - 54.20 - 21.10 11.20 Price Prd End 55 420 54 545 59 737 46 930 82 950

DPS (ZARc) - - - 45.00 42.00 RATIOS

NAV PS (ZARc) 995.00 985.00 1 066.30 1 123.80 1 160.30 Ret on SH Fnd 10.54 10.43 9.12 9.45 61.75

3 Yr Beta 0.01 0.17 - 0.25 0.27 - 0.09 Oper Pft Mgn 40.30 38.65 34.84 38.02 32.77

Price Prd End 674 581 765 1 050 1 300 D:E 1.01 1.01 1.02 1.04 1.15

Price High 791 765 1 097 1 400 1 600 Current Ratio 0.77 0.88 0.71 0.78 0.89

Price Low 381 335 625 190 1 100 Div Cover 1.31 1.40 1.23 1.35 18.00

RATIOS

RetOnSH Funds 17.98 - 1.17 2.05 1.84 4.13 Buffalo Coal Corp

RetOnTotAss 10.57 9.64 10.52 9.09 8.20

BUF

Debt:Equity 1.01 1.28 1.57 1.23 1.05 ISIN: CA1194421014 SHORT: BUFFALO CODE: BUC

OperRetOnInv 19.89 23.18 20.66 13.24 12.92 REG NO: 2011/011661/10 FOUNDED: 2006 LISTED: 2011

OpInc:Turnover 12.63 11.67 14.78 11.51 13.45 NATURE OF BUSINESS: Buffalo Coal Corp is a producer of high quality

bituminous coal and Anthracite from mines in the Klipriver coalfield, near

Dundee, in the KwaZulu-Natal province of South Africa.

British American Tobacco plc SECTOR: AltX

NUMBER OF EMPLOYEES: 454

BRI

ISIN: GB0002875804 SHORT: BATS CODE: BTI DIRECTORS: Scholtz E (ne), Taylor R (ind ne), Wiggill C (Chair),

REG NO: 03407696 FOUNDED: 1902 LISTED: 2008 Oosthuizen Ms E (CEO), Bezuidenhout W (CFO)

NATURE OF BUSINESS: British American Tobacco (BAT) is one of the POSTAL ADDRESS: PO Box 274, Lonehill, 2062

world’sleadingconsumergoodscompanies,withnicotineandtobaccobrands MORE INFO: www.sharedata.co.za/sdo/jse/BUC

sold around the globe. We employ over 55 000 people, partner with over 90

000 farmers and have factories in 48 countries, with offices in even more. COMPANY SECRETARY: Sarah Williams

SECTOR: CnsStp—FoodBev&Tob—Tobacco— Tobacco TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 89 182 DESIGNATED ADVISOR: Questco (Pty) Ltd.

DIRECTORS: Farr S (ne, UK), Guerra K (ind ne, UK), AUDITORS: UHY McGovern Hurley LLP

Helmes Dr M (ne, German), Koeppel H (ind ne, USA), Kwan S (ne, UK), CAPITAL STRUCTURE AUTHORISED ISSUED

Panayotopoulos D (snr ind ne, Gre), Thomas D (ind ne, USA), BUC Ords no par val - 421 352 596

Jobin L (Chair, ind ne, Can), Bowles J (CEO Designate, Fr), Marroco

T (CFO Designate, Brazil) LIQUIDITY: Jan22 Avg 3 158 shares p.w., R2 149.6(-% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 15 Nov 2021

The Capital Group Companies, Inc 10.97%

Spring Mountain Investments Ltd. 8.15%

BlackRock, Inc. 5.79%

101