Page 98 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 98

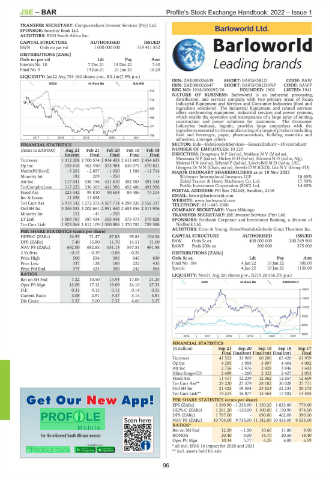

JSE – BAR Profile’s Stock Exchange Handbook: 2022 – Issue 1

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd. Barloworld Ltd.

AUDITORS: BDO South Africa Inc. BAR

CAPITAL STRUCTURE AUTHORISED ISSUED

BWN Ords no par val 1 000 000 000 519 411 852

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

Interim No 10 7 Dec 21 13 Dec 21 7.40

Final No 9 14 Jun 21 21 Jun 21 16.20

LIQUIDITY: Jan22 Avg 793 160 shares p.w., R3.1m(7.9% p.a.)

ISIN: ZAE000026639 SHORT: BARWORLD CODE: BAW

REDS 40 Week MA BALWIN

ISIN: ZAE000026647 SHORT: BARWORLD6%P CODE: BAWP

915 REG NO: 1918/000095/06 FOUNDED: 1902 LISTED: 1941

NATURE OF BUSINESS: Barloworld is an industrial processing,

772 distribution, and services company with two primary areas of focus:

Industrial Equipment and Services and Consumer Industries (food and

628 ingredient solutions). The Industrial Equipment and related services

offers earthmoving equipment, industrial services and power systems,

485 which enable the operation and maintenance of a large array of mining,

construction and power solutions for customers. The Consumer

341 Industries business, Ingrain, provides large enterprises with the

ingredients essential to the manufacturing of a range of products including

198 food and beverages, paper, pharmaceuticals, building materials and

2017 | 2018 | 2019 | 2020 | 2021

adhesives, amongst others.

FINANCIAL STATISTICS SECTOR: Inds—IndsGoods&Services—GeneralIndustr—DiversIndustr

(Amts in ZAR'000) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18 NUMBER OF EMPLOYEES: 10 229

Interim Final Final Final Final DIRECTORS: Dongwana N P (ind ne), Mokhesi N V (ld ind ne),

Turnover 1 312 208 2 700 574 2 914 453 2 613 905 2 454 635 Mnxasana N P (ind ne), Hickey H H (ind ne), Edozien N O (ind ne, Nig),

Molotsi H N (ind ne), Schmid P (ind ne), Lynch-Bell M D (ind ne, UK),

Op Inc 158 618 462 450 573 984 630 075 670 821 Gwagwa Dr N N (Chair, ind ne), Sewela D M (CEO), Lila N V (Group FD)

NetIntPd(Rcvd) - 3 261 - 2 857 - 1 030 1 586 - 11 714 MAJOR ORDINARY SHAREHOLDERS as at 19 Nov 2021

Minority Int 192 209 - 250 - - Silchester International Investors LLP 18.60%

Att Inc 117 041 336 156 411 610 452 383 491 345 Zahid Tractor & Heavy Machinery Co. Ltd. 17.70%

TotCompIncLoss 117 223 336 365 411 396 452 486 491 996 Public Investment Corporation (SOC) Ltd. 14.60%

Fixed Ass 223 542 99 810 90 654 89 486 73 214 POSTAL ADDRESS: PO Box 782248, Sandton, 2146

Inv & Loans 11 658 11 658 - - - EMAIL: bawir@barloworld.com

Tot Curr Ass 5 919 142 5 272 372 4 507 714 4 298 926 3 556 337 WEBSITE: www.barloworld.com

TELEPHONE: 011-445-1000

Ord SH Int 3 246 533 3 202 661 2 951 640 2 653 856 2 311 906 COMPANY SECRETARY: Vasta Mhlongo

Minority Int 151 - 41 - 250 - - TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

LT Liab 1 003 767 387 434 355 444 375 473 579 628 SPONSORS: Nedbank Corporate and Investment Banking, a division of

Tot Curr Liab 1 923 064 1 811 109 1 300 906 1 370 782 739 588 Nedbank Ltd.

AUDITORS: Ernst & Young, SizweNtsalubaGobodo Grant Thornton Inc.

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 24.95 71.47 87.83 95.84 104.56 CAPITAL STRUCTURE AUTHORISED ISSUED

DPS (ZARc) 7.40 35.80 11.70 14.51 31.00 BAW Ords 5c ea 400 000 000 200 249 906

NAV PS (ZARc) 692.00 682.83 631.13 567.51 491.98 BAWP Prefs 200c ea 500 000 375 000

3 Yr Beta - 0.15 - 0.19 - 0.08 - 0.26 - DISTRIBUTIONS [ZARc]

Price High 500 534 396 640 830 Ords 5c ea Ldt Pay Amt

Price Low 337 128 180 222 435 Final No 184 4 Jan 22 10 Jan 22 300.00

Price Prd End 375 425 350 242 564 Special 4 Jan 22 10 Jan 22 1150.00

RATIOS LIQUIDITY: Nov21 Avg 2m shares p.w., R219.2m(56.2% p.a.)

Ret on SH Fnd 7.22 10.50 13.94 17.05 21.25

GENI 40 Week MA BARWORLD

Oper Pft Mgn 12.09 17.12 19.69 24.10 27.33

D:E 0.31 0.12 0.12 0.14 0.25 18451

Current Ratio 3.08 2.91 3.47 3.14 4.81

15487

Div Cover 3.37 2.00 7.52 6.60 3.37

12522

9558

6594

3630

2016 | 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS

(R million) Sep 21 Sep 20 Sep 19 Sep 18 Sep 17

Final Final(rst) Final(rst) Final(rst) Final

Turnover 41 553 33 909 60 206 63 420 61 959

Op Inc 4 295 1 958 3 897 4 404 4 082

Att Inc 2 756 - 2 476 2 428 3 846 1 643

Hline Erngs-CO 2 499 - 260 2 322 2 427 2 053

Fixed Ass 11 417 12 239 12 062 12 657 12 659

Tot Curr Ass** 29 220 27 379 28 182 30 028 27 711

Ord SH Int 21 422 19 504 23 623 22 233 20 275

Tot Curr Liab** 19 214 16 877 15 563 17 592 14 595

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 1 390.90 - 1 236.00 1 150.20 1 823.80 779.60

HEPS-C (ZARc) 1 261.20 - 130.00 1 100.00 1 150.90 974.50

DPS (ZARc) 1 787.00 - 690.00 462.00 390.00

NAV PS (ZARc) 10 704.00 9 736.00 11 182.00 10 453.00 9 533.00

RATIOS*

Ret on SH Fnd 12.20 - 1.50 10.60 11.80 9.50

RONOA 20.40 9.00 18.70 20.50 18.40

Oper Pft Mgn 10.34 5.77 6.28 6.80 6.59

* all incl. IFRS 16 impact for 2020 and 2021

** incl. assets held for sale

96