Page 100 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 100

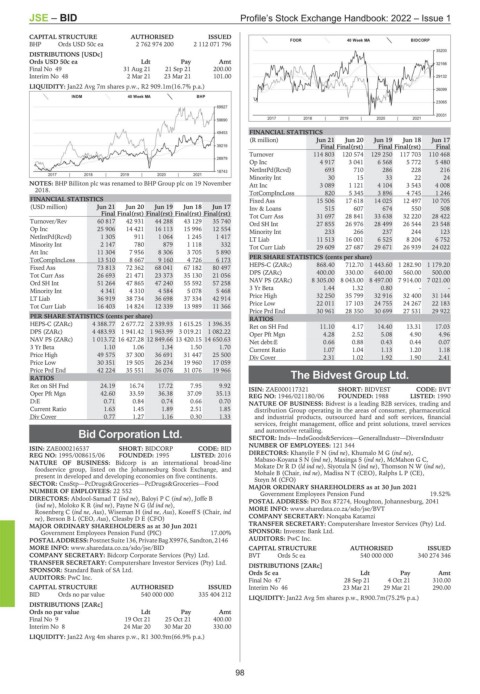

JSE – BID Profile’s Stock Exchange Handbook: 2022 – Issue 1

CAPITAL STRUCTURE AUTHORISED ISSUED

BHP Ords USD 50c ea 2 762 974 200 2 112 071 796 FOOR 40 Week MA BIDCORP

35200

DISTRIBUTIONS [USDc]

Ords USD 50c ea Ldt Pay Amt 32166

Final No 49 31 Aug 21 21 Sep 21 200.00

Interim No 48 2 Mar 21 23 Mar 21 101.00 29132

LIQUIDITY: Jan22 Avg 7m shares p.w., R2 909.1m(16.7% p.a.)

26099

INDM 40 Week MA BHP

23065

69927

20031

2017 | 2018 | 2019 | 2020 | 2021

59690

49453 FINANCIAL STATISTICS

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

39216 Final Final(rst) Final Final(rst) Final

Turnover 114 803 120 574 129 250 117 703 110 468

28979

Op Inc 4 917 3 041 6 568 5 772 5 480

18743 NetIntPd(Rcvd) 693 710 286 228 216

2017 | 2018 | 2019 | 2020 | 2021

Minority Int 30 15 33 22 24

NOTES: BHP Billiton plc was renamed to BHP Group plc on 19 November Att Inc 3 089 1 121 4 104 3 543 4 008

2018.

TotCompIncLoss 820 5 345 3 896 4 745 1 246

FINANCIAL STATISTICS Fixed Ass 15 506 17 618 14 025 12 497 10 705

(USD million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 Inv & Loans 515 607 674 550 508

Final Final(rst) Final(rst) Final(rst) Final(rst) Tot Curr Ass 31 697 28 841 33 638 32 220 28 422

Turnover/Rev 60 817 42 931 44 288 43 129 35 740 Ord SH Int 27 855 26 976 28 499 26 544 23 548

Op Inc 25 906 14 421 16 113 15 996 12 554 Minority Int 233 266 237 244 123

NetIntPd(Rcvd) 1 305 911 1 064 1 245 1 417 LT Liab 11 513 16 001 6 525 8 204 6 752

Minority Int 2 147 780 879 1 118 332 Tot Curr Liab 29 609 27 687 29 671 26 939 24 022

Att Inc 11 304 7 956 8 306 3 705 5 890

TotCompIncLoss 13 510 8 667 9 160 4 726 6 173 PER SHARE STATISTICS (cents per share)

Fixed Ass 73 813 72 362 68 041 67 182 80 497 HEPS-C (ZARc) 868.40 712.70 1 443.60 1 282.90 1 179.20

Tot Curr Ass 26 693 21 471 23 373 35 130 21 056 DPS (ZARc) 400.00 330.00 640.00 560.00 500.00

Ord SH Int 51 264 47 865 47 240 55 592 57 258 NAV PS (ZARc) 8 305.00 8 043.00 8 497.00 7 914.00 7 021.00

Minority Int 4 341 4 310 4 584 5 078 5 468 3 Yr Beta 1.44 1.32 0.80 - -

LT Liab 36 919 38 734 36 698 37 334 42 914 Price High 32 250 35 799 32 916 32 400 31 144

Tot Curr Liab 16 403 14 824 12 339 13 989 11 366 Price Low 22 011 17 103 24 755 24 267 22 183

Price Prd End 30 961 28 350 30 699 27 531 29 922

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 4 388.77 2 677.72 2 339.93 1 615.25 1 396.35

Ret on SH Fnd 11.10 4.17 14.40 13.31 17.03

DPS (ZARc) 4 483.93 1 941.42 1 963.99 3 019.21 1 082.22 Oper Pft Mgn 4.28 2.52 5.08 4.90 4.96

NAV PS (ZARc) 1 013.72 16 427.28 12 849.66 13 420.15 14 650.63 Net debt:E 0.66 0.88 0.43 0.44 0.07

3 Yr Beta 1.10 1.06 1.34 1.50 1.70 Current Ratio 1.07 1.04 1.13 1.20 1.18

Price High 49 575 37 300 36 691 31 447 25 500 Div Cover 2.31 1.02 1.92 1.90 2.41

Price Low 30 351 19 505 26 234 19 960 17 059

Price Prd End 42 224 35 551 36 076 31 076 19 966

RATIOS The Bidvest Group Ltd.

Ret on SH Fnd 24.19 16.74 17.72 7.95 9.92 ISIN: ZAE000117321 SHORT: BIDVEST CODE: BVT

BID

Oper Pft Mgn 42.60 33.59 36.38 37.09 35.13 REG NO: 1946/021180/06 FOUNDED: 1988 LISTED: 1990

D:E 0.71 0.84 0.74 0.66 0.70 NATURE OF BUSINESS: Bidvest is a leading B2B services, trading and

Current Ratio 1.63 1.45 1.89 2.51 1.85 distribution Group operating in the areas of consumer, pharmaceutical

Div Cover 0.77 1.27 1.16 0.30 1.33 and industrial products, outsourced hard and soft services, financial

services, freight management, office and print solutions, travel services

and automotive retailing.

Bid Corporation Ltd. SECTOR: Inds—IndsGoods&Services—GeneralIndustr—DiversIndustr

BID NUMBER OF EMPLOYEES: 121 344

ISIN: ZAE000216537 SHORT: BIDCORP CODE: BID

REG NO: 1995/008615/06 FOUNDED: 1995 LISTED: 2016 DIRECTORS: KhanyileFN(ind ne), KhumaloMG(ind ne),

NATURE OF BUSINESS: Bidcorp is an international broad-line Mabaso-KoyanaSN(ind ne), Masinga S (ind ne), McMahon G C,

foodservice group, listed on the Johannesburg Stock Exchange, and Mokate DrRD(ld ind ne), Siyotula N (ind ne), ThomsonNW(ind ne),

Mohale B (Chair, ind ne), Madisa N T (CEO), Ralphs L P (CE),

present in developed and developing economies on five continents.

Steyn M (CFO)

SECTOR: CnsStp—PcDrugs&Groceries—PcDrugs&Groceries—Food MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021

NUMBER OF EMPLOYEES: 22 552 Government Employees Pension Fund 19.52%

DIRECTORS: Abdool-Samad T (ind ne), BaloyiPC(ind ne), Joffe B POSTAL ADDRESS: PO Box 87274, Houghton, Johannesburg, 2041

(ind ne), MolokoKR(ind ne), PayneNG(ld ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/BVT

Rosenberg C (ind ne, Aus), Wiseman H (ind ne, Aus), Koseff S (Chair, ind

ne), Berson B L (CEO, Aus), Cleasby D E (CFO) COMPANY SECRETARY: Nonqaba Katamzi

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Government Employees Pension Fund (PIC) 17.00% SPONSOR: Investec Bank Ltd.

POSTAL ADDRESS:PostnetSuite136, PrivateBagX9976, Sandton,2146 AUDITORS: PwC Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/BID CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Bidcorp Corporate Services (Pty) Ltd. BVT Ords 5c ea 540 000 000 340 274 346

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DISTRIBUTIONS [ZARc]

SPONSOR: Standard Bank of SA Ltd. Ords 5c ea Ldt Pay Amt

AUDITORS: PwC Inc.

Final No 47 28 Sep 21 4 Oct 21 310.00

CAPITAL STRUCTURE AUTHORISED ISSUED Interim No 46 23 Mar 21 29 Mar 21 290.00

BID Ords no par value 540 000 000 335 404 212

LIQUIDITY: Jan22 Avg 5m shares p.w., R900.7m(75.2% p.a.)

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

Final No 9 19 Oct 21 25 Oct 21 400.00

Interim No 8 24 Mar 20 30 Mar 20 330.00

LIQUIDITY: Jan22 Avg 4m shares p.w., R1 300.9m(66.9% p.a.)

98