Page 76 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 76

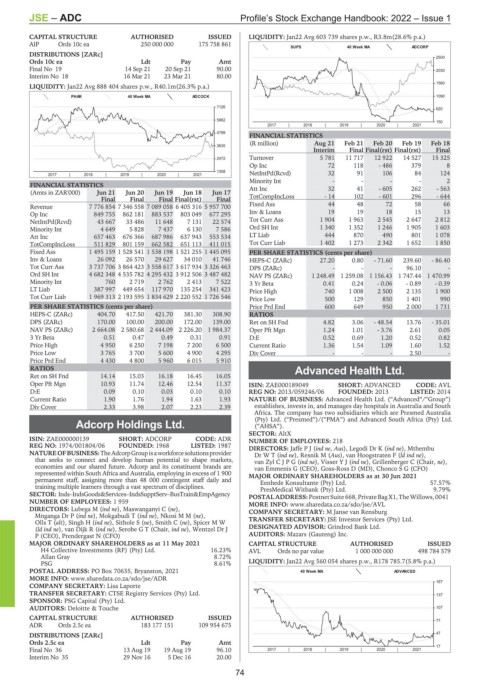

JSE – ADC Profile’s Stock Exchange Handbook: 2022 – Issue 1

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jan22 Avg 603 739 shares p.w., R3.8m(28.6% p.a.)

AIP Ords 10c ea 250 000 000 175 758 861

SUPS 40 Week MA ADCORP

DISTRIBUTIONS [ZARc]

2500

Ords 10c ea Ldt Pay Amt

Final No 19 14 Sep 21 20 Sep 21 90.00 2030

Interim No 18 16 Mar 21 23 Mar 21 80.00

1560

LIQUIDITY: Jan22 Avg 888 404 shares p.w., R40.1m(26.3% p.a.)

PHAR 40 Week MA ADCOCK 1090

7126

620

5962 150

2017 | 2018 | 2019 | 2020 | 2021

4799

FINANCIAL STATISTICS

(R million) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18

3635

Interim Final Final(rst) Final(rst) Final

2472 Turnover 5 781 11 717 12 922 14 527 15 325

Op Inc 72 118 - 486 379 8

1308 NetIntPd(Rcvd) 32 91 106 84 124

2017 | 2018 | 2019 | 2020 | 2021

Minority Int - - - - 2

FINANCIAL STATISTICS Att Inc 32 41 - 605 262 - 563

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final Final(rst) Final TotCompIncLoss - 14 102 - 601 296 - 644

Revenue 7 776 854 7 346 558 7 089 058 6 405 316 5 957 700 Fixed Ass 44 48 72 58 66

Op Inc 849 755 862 181 883 537 803 049 677 295 Inv & Loans 19 19 18 15 13

NetIntPd(Rcvd) 43 667 33 486 11 648 7 131 22 574 Tot Curr Ass 1 904 1 963 2 545 2 647 2 812

Minority Int 4 649 5 828 7 437 6 130 7 586 Ord SH Int 1 340 1 352 1 246 1 905 1 603

Att Inc 657 463 676 366 687 986 637 943 553 534 LT Liab 444 870 490 801 1 078

TotCompIncLoss 511 829 801 159 662 582 651 113 411 015 Tot Curr Liab 1 402 1 273 2 342 1 652 1 850

Fixed Ass 1 495 159 1 528 541 1 538 198 1 521 255 1 445 095 PER SHARE STATISTICS (cents per share)

Inv & Loans 26 092 26 570 29 627 34 010 41 746 HEPS-C (ZARc) 27.20 0.80 - 71.60 239.60 - 86.40

Tot Curr Ass 3 737 706 3 864 423 3 558 617 3 617 934 3 326 463 DPS (ZARc) - - - 96.10 -

Ord SH Int 4 682 348 4 535 782 4 295 432 3 912 506 3 487 482 NAV PS (ZARc) 1 248.49 1 259.08 1 156.43 1 747.44 1 470.99

Minority Int 760 2 719 2 762 2 413 7 522 3 Yr Beta 0.41 0.24 - 0.06 - 0.89 - 0.39

LT Liab 387 997 449 654 117 970 135 254 341 423 Price High 740 1 008 2 500 2 135 1 900

Tot Curr Liab 1 969 313 2 193 595 1 834 629 2 220 552 1 726 546 Price Low 500 129 850 1 401 990

PER SHARE STATISTICS (cents per share) Price Prd End 600 649 950 2 000 1 731

HEPS-C (ZARc) 404.70 417.50 421.70 381.30 308.90 RATIOS

DPS (ZARc) 170.00 100.00 200.00 172.00 139.00 Ret on SH Fnd 4.82 3.06 - 48.54 13.76 - 35.01

NAV PS (ZARc) 2 664.08 2 580.68 2 444.09 2 226.20 1 984.37 Oper Pft Mgn 1.24 1.01 - 3.76 2.61 0.05

3 Yr Beta 0.51 0.47 0.49 0.31 0.91 D:E 0.52 0.69 1.20 0.52 0.82

Price High 4 950 6 250 7 198 7 200 6 500 Current Ratio 1.36 1.54 1.09 1.60 1.52

Price Low 3 765 3 700 5 600 4 900 4 295 Div Cover - - - 2.50 -

Price Prd End 4 430 4 800 5 960 6 015 5 910

RATIOS Advanced Health Ltd.

Ret on SH Fnd 14.14 15.03 16.18 16.45 16.05

ADV

Oper Pft Mgn 10.93 11.74 12.46 12.54 11.37 ISIN: ZAE000189049 SHORT: ADVANCED CODE: AVL

D:E 0.09 0.10 0.03 0.10 0.10 REG NO: 2013/059246/06 FOUNDED: 2013 LISTED: 2014

Current Ratio 1.90 1.76 1.94 1.63 1.93 NATURE OF BUSINESS: Advanced Health Ltd. (“Advanced”/“Group”)

Div Cover 2.33 3.98 2.07 2.23 2.39 establishes, invests in, and manages day hospitals in Australia and South

Africa. The company has two subsidiaries which are Presmed Australia

(Pty) Ltd. (“Presmed”)/(“PMA”) and Advanced South Africa (Pty) Ltd.

Adcorp Holdings Ltd. (“AHSA”).

ADC SECTOR: AltX

ISIN: ZAE000000139 SHORT: ADCORP CODE: ADR NUMBER OF EMPLOYEES: 218

REG NO: 1974/001804/06 FOUNDED: 1968 LISTED: 1987 DIRECTORS: JaffePJ(ind ne, Aus), Legodi Dr K (ind ne), Mthembu

NATUREOFBUSINESS:TheAdcorpGroupisaworkforcesolutionsprovider DrWT(ind ne), Resnik M (Aus), van Hoogstraten F (ld ind ne),

that seeks to connect and develop human potential to shape markets, van ZylCJPG(ind ne), VisserYJ(ind ne), Grillenberger C (Chair, ne),

economies and our shared future. Adcorp and its constituent brands are van Emmenis G (CEO), Goss-Ross D (MD), Chonco S G (CFO)

represented within South Africa and Australia, employing in excess of 1 900 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021

permanent staff, assigning more than 48 000 contingent staff daily and Eenhede Konsultante (Pty) Ltd. 57.57%

training multiple learners through avastspectrumofdisciplines. PresMedical Witbank (Pty) Ltd. 9.79%

SECTOR: Inds–IndsGoods&Services–IndsSupptServ–BusTrain&EmpAgency POSTAL ADDRESS:PostnetSuite668, PrivateBagX1,TheWillows,0041

NUMBER OF EMPLOYEES: 1 959 MORE INFO: www.sharedata.co.za/sdo/jse/AVL

DIRECTORS: Lubega M (ind ne), Maswanganyi C (ne), COMPANY SECRETARY: M Janse van Rensburg

Mnganga Dr P (ind ne), Mokgabudi T (ind ne), NkosiMM(ne),

Olls T (alt), Singh H (ind ne), Sithole S (ne), Smith C (ne), Spicer M W TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

(ld ind ne), van Dijk R (ind ne), Serobe G T (Chair, ind ne), Wentzel Dr J DESIGNATED ADVISOR: Grindrod Bank Ltd.

P (CEO), Prendergast N (CFO) AUDITORS: Mazars (Gauteng) Inc.

MAJOR ORDINARY SHAREHOLDERS as at 11 May 2021 CAPITAL STRUCTURE AUTHORISED ISSUED

H4 Collective Investments (RF) (Pty) Ltd. 16.23% AVL Ords no par value 1 000 000 000 498 784 579

Allan Gray 8.72%

PSG 8.61% LIQUIDITY: Jan22 Avg 560 054 shares p.w., R178 785.7(5.8% p.a.)

POSTAL ADDRESS: PO Box 70635, Bryanston, 2021 40 Week MA ADVANCED

MORE INFO: www.sharedata.co.za/sdo/jse/ADR

167

COMPANY SECRETARY: Lisa Laporte

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd. 137

SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: Deloitte & Touche 107

CAPITAL STRUCTURE AUTHORISED ISSUED

77

ADR Ords 2.5c ea 183 177 151 109 954 675

47

DISTRIBUTIONS [ZARc]

Ords 2.5c ea Ldt Pay Amt

17

Final No 36 13 Aug 19 19 Aug 19 96.10 2017 | 2018 | 2019 | 2020 | 2021

Interim No 35 29 Nov 16 5 Dec 16 20.00

74