Page 80 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 80

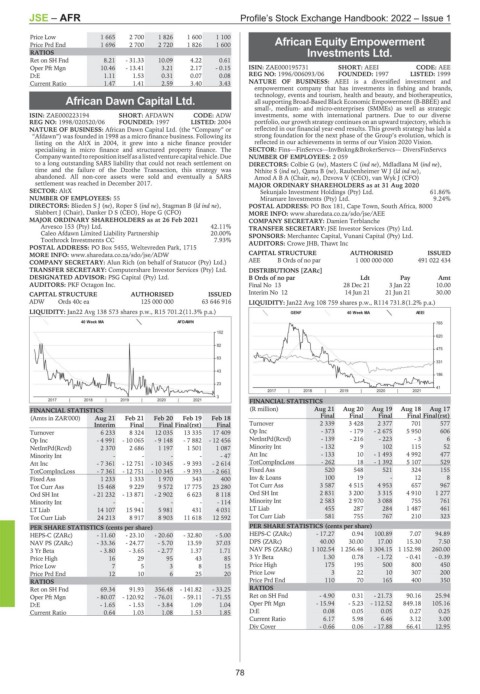

JSE – AFR Profile’s Stock Exchange Handbook: 2022 – Issue 1

Price Low 1 665 2 700 1 826 1 600 1 100

Price Prd End 1 696 2 700 2 720 1 826 1 600 African Equity Empowerment

RATIOS Investments Ltd.

Ret on SH Fnd 8.21 - 31.33 10.09 4.22 0.61 AFR

Oper Pft Mgn 10.46 - 13.41 3.21 2.17 - 0.15 ISIN: ZAE000195731 SHORT: AEEI CODE: AEE

D:E 1.11 1.53 0.31 0.07 0.08 REG NO: 1996/006093/06 FOUNDED: 1997 LISTED: 1999

Current Ratio 1.47 1.41 2.59 3.40 3.43 NATURE OF BUSINESS: AEEI is a diversified investment and

empowerment company that has investments in fishing and brands,

technology, events and tourism, health and beauty, and biotherapeutics,

African Dawn Capital Ltd. all supporting Broad-Based Black Economic Empowerment (B-BBEE) and

small-, medium- and micro-enterprises (SMMEs) as well as strategic

AFR

ISIN: ZAE000223194 SHORT: AFDAWN CODE: ADW investments, some with international partners. Due to our diverse

REG NO: 1998/020520/06 FOUNDED: 1997 LISTED: 2004 portfolio, our growth strategy continues on an upward trajectory, which is

NATURE OF BUSINESS: African Dawn Capital Ltd. (the “Company” or reflected in our financial year-end results. This growth strategy has laid a

“Afdawn”) was founded in 1998 as a micro finance business. Following its strong foundation for the next phase of the Group’s evolution, which is

listing on the AltX in 2004, it grew into a niche finance provider reflected in our achievements in terms of our Vision 2020 Vision.

specialising in micro finance and structured property finance. The SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

Companywantedtorepositionitselfasalistedventurecapitalvehicle. Due NUMBER OF EMPLOYEES: 2 059

to a long outstanding SARS liability that could not reach settlement on DIRECTORS: Colbie G (ne), Masters C (ind ne), Mdladlana M (ind ne),

time and the failure of the Dzothe Transaction, this strategy was Nthite S (ind ne), Qama B (ne), RaubenheimerWJ(ld ind ne),

abandoned. All non-core assets were sold and eventually a SARS AmodABA (Chair, ne), Dzvova V (CEO), van Wyk J (CFO)

settlement was reached in December 2017. MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2020

SECTOR: AltX Sekunjalo Investment Holdings (Pty) Ltd. 61.86%

NUMBER OF EMPLOYEES: 55 Miramare Investments (Pty) Ltd. 9.24%

DIRECTORS: BliedenSJ(ne), Roper S (ind ne), Stagman B (ld ind ne), POSTAL ADDRESS: PO Box 181, Cape Town, South Africa, 8000

Slabbert J (Chair), Danker D S (CEO), Hope G (CFO) MORE INFO: www.sharedata.co.za/sdo/jse/AEE

MAJOR ORDINARY SHAREHOLDERS as at 26 Feb 2021 COMPANY SECRETARY: Damien Terblanche

Arvesco 153 (Pty) Ltd. 42.11% TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Caleo Afdawn Limited Liability Partnership 20.00% SPONSORS: Merchantec Capital, Vunani Capital (Pty) Ltd.

Toothrock Investments CC 7.93% AUDITORS: Crowe JHB, Thawt Inc

POSTAL ADDRESS: PO Box 5455, Weltevreden Park, 1715

MORE INFO: www.sharedata.co.za/sdo/jse/ADW CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Alun Rich (on behalf of Statucor (Pty) Ltd.) AEE B Ords of no par 1 000 000 000 491 022 434

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DISTRIBUTIONS [ZARc]

DESIGNATED ADVISOR: PSG Capital (Pty) Ltd. B Ords of no par Ldt Pay Amt

AUDITORS: PKF Octagon Inc. Final No 13 28 Dec 21 3 Jan 22 10.00

CAPITAL STRUCTURE AUTHORISED ISSUED Interim No 12 14 Jun 21 21 Jun 21 30.00

ADW Ords 40c ea 125 000 000 63 646 916 LIQUIDITY: Jan22 Avg 108 759 shares p.w., R114 731.8(1.2% p.a.)

LIQUIDITY: Jan22 Avg 138 573 shares p.w., R15 701.2(11.3% p.a.) GENF 40 Week MA AEEI

40 Week MA AFDAWN 765

102

620

82

475

63

331

43

186

23

41

2017 | 2018 | 2019 | 2020 | 2021

3

2017 | 2018 | 2019 | 2020 | 2021 FINANCIAL STATISTICS

FINANCIAL STATISTICS (R million) Aug 21 Aug 20 Aug 19 Aug 18 Aug 17

(Amts in ZAR'000) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18 Final Final Final Final Final(rst)

Interim Final Final Final(rst) Final Turnover 2 339 3 428 2 377 701 577

Turnover 6 233 8 324 12 035 13 335 17 409 Op Inc - 373 - 179 - 2 675 5 950 606

Op Inc - 4 991 - 10 065 - 9 148 - 7 882 - 12 456 NetIntPd(Rcvd) - 139 - 216 - 223 - 3 6

NetIntPd(Rcvd) 2 370 2 686 1 197 1 501 1 087 Minority Int - 132 9 102 115 52

Minority Int - - - - - 47 Att Inc - 133 10 - 1 493 4 992 477

Att Inc - 7 361 - 12 751 - 10 345 - 9 393 - 2 614 TotCompIncLoss - 262 18 - 1 392 5 107 529

TotCompIncLoss - 7 361 - 12 751 - 10 345 - 9 393 - 2 661 Fixed Ass 520 548 521 324 155

Fixed Ass 1 233 1 333 1 970 343 400 Inv & Loans 100 19 - 12 8

Tot Curr Ass 15 468 9 229 9 572 17 775 23 280 Tot Curr Ass 3 587 4 515 4 953 657 967

Ord SH Int - 21 232 - 13 871 - 2 902 6 623 8 118 Ord SH Int 2 831 3 200 3 315 4 910 1 277

Minority Int - - - - - 114 Minority Int 2 583 2 970 3 088 755 761

LT Liab 14 107 15 941 5 981 431 4 031 LT Liab 455 287 284 1 487 461

Tot Curr Liab 24 213 8 917 8 903 11 618 12 592 Tot Curr Liab 581 755 767 210 323

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 11.60 - 23.10 - 20.60 - 32.80 - 5.00 HEPS-C (ZARc) - 17.27 0.94 100.89 7.07 94.89

NAV PS (ZARc) - 33.36 - 24.77 - 5.70 13.59 37.03 DPS (ZARc) 40.00 30.00 17.00 15.30 7.50

3 Yr Beta - 3.80 - 3.65 - 2.77 1.37 1.71 NAV PS (ZARc) 1 102.54 1 256.46 1 304.15 1 152.98 260.00

Price High 16 29 95 43 85 3 Yr Beta 1.30 0.78 - 1.72 - 0.41 - 0.39

Price Low 7 5 3 8 15 Price High 175 195 500 800 450

Price Prd End 12 10 6 25 20 Price Low 3 22 10 307 200

RATIOS Price Prd End 110 70 165 400 350

Ret on SH Fnd 69.34 91.93 356.48 - 141.82 - 33.25 RATIOS

Oper Pft Mgn - 80.07 - 120.92 - 76.01 - 59.11 - 71.55 Ret on SH Fnd - 4.90 0.31 - 21.73 90.16 25.94

D:E - 1.65 - 1.53 - 3.84 1.09 1.04 Oper Pft Mgn - 15.94 - 5.23 - 112.52 849.18 105.16

Current Ratio 0.64 1.03 1.08 1.53 1.85 D:E 0.08 0.05 0.05 0.27 0.25

Current Ratio 6.17 5.98 6.46 3.12 3.00

Div Cover - 0.66 0.06 - 17.88 66.41 12.95

78