Page 74 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 74

JSE – ABS Profile’s Stock Exchange Handbook: 2022 – Issue 1

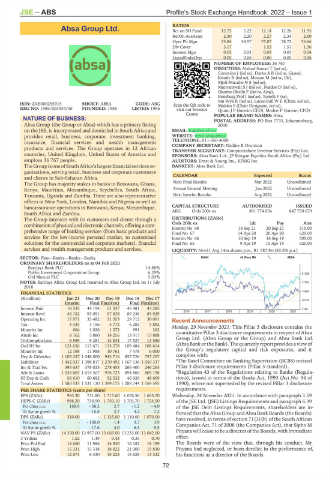

RATIOS

Absa Group Ltd. Ret on SH Fund 12.75 5.22 12.14 12.26 11.95

RetOn AveAsset 2.30 2.20 2.27 2.34 2.60

ABS

Oper Pft Mgn 73.84 38.57 75.07 78.72 76.66

Div Cover 3.17 - 1.53 1.51 1.56

Interest Mgn 0.03 0.03 0.03 0.03 0.04

LiquidFnds:Dep 0.05 0.06 0.06 0.05 0.06

NUMBER OF EMPLOYEES: 36 767

DIRECTORS: Abdool-Samad T (ind ne),

Cummins J (ind ne), Darko A B (ind ne, Ghana),

Keanly R (ind ne), Merson M (ind ne, UK),

Mjoli-Mncube N S (ind ne),

Munyantwali S J (ind ne), Naidoo D (ind ne),

Okomo-Okello F (ind ne, Keny),

Rensburg Prof I (ind ne), Tonelli F (ne),

van Wyk R (ind ne), Lucas-Bull W E (Chair, ind ne),

ISIN: ZAE000255915 SHORT: ABSA CODE: ABG Scan the QR code to Moloko S (Chair Designate, ind ne),

REG NO: 1986/003934/06 FOUNDED: 1986 LISTED: 1986 visit our Investor Quinn J P (Interim CEO), Modise P (Interim CFO)

Centre POPULAR BRAND NAMES: Absa

NATURE OF BUSINESS: POSTAL ADDRESS: PO Box 7735, Johannesburg,

Absa Group (the Group or Absa) which has a primary listing 2000

on the JSE, is incorporated and domiciled in South Africa and EMAIL: ir@absa.africa

provides retail, business, corporate, investment banking, WEBSITE: www.absa.africa

insurance, financial services and wealth management TELEPHONE: 011-350-4000

products and services. The Group operates in 12 African COMPANY SECRETARY: Nadine R Drutman

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

countries, United Kingdom, United States of America and SPONSORS: Absa Bank Ltd., JP Morgan Equities South Africa (Pty) Ltd.

employs 36 767 people. AUDITORS: Ernst & Young Inc., KPMG Inc.

TheGroup isoneofSouthAfrica’s largestfinancialservicesor- BANKERS: Absa Bank Ltd.

ganisations, serving retail, business and corporate customers

and clients in Sub-Saharan Africa. CALENDAR Expected Status

The Group has majority stakes in banks in Botswana, Ghana, Next Final Results Mar 2022 Unconfirmed

Kenya, Mauritius, Mozambique, Seychelles, South Africa, Annual General Meeting Jun 2022 Unconfirmed

Tanzania, Uganda and Zambia. There are also representative Next Interim Results Aug 2022 Unconfirmed

offices in New York, London, Namibia and Nigeria as well as

bancassurance operations in Botswana, Kenya, Mozambique, CAPITAL STRUCTURE AUTHORISED ISSUED

ABG Ords 200c ea 891 774 054 847 750 679

South Africa and Zambia.

The Group interacts with its customers and clients through a DISTRIBUTIONS [ZARc]

Pay

Amt

Ldt

combination of physical and electronic channels, offering a com- Ords 200c ea 14 Sep 21 20 Sep 21 310.00

Interim No 68

prehensive range of banking services (from basic products and Final No 67 14 Apr 20 20 Apr 20 620.00

services for the low-income personal market, to customised Interim No 66 10 Sep 19 16 Sep 19 505.00

solutions for the commercial and corporate markets), financial Final No 65 9 Apr 19 15 Apr 19 620.00

services and wealth management products and services. LIQUIDITY: Nov21 Avg 14m shares p.w., R1 787.9m(83.2% p.a.)

SECTOR: Fins—Banks—Banks—Banks BANK 40 Week MA ABSA

ORDINARY SHAREHOLDERS as at 04 Feb 2021

Barclays Bank PLC 14.88%

Public Investment Corporation Group 6.29% 21329

Old Mutual PLC 5.03%

NOTES: Barclays Africa Group Ltd. renamed to Absa Group Ltd. on 11 July 17797

2018

14264

FINANCIAL STATISTICS

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

Interim Final Final(rst) Final Final(rst) 10732

Interest Paid 18 535 44 194 51 337 45 481 43 285 7199

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Interest Rcvd 44 132 93 051 97 838 89 236 85 929

Operating Inc 17 971 33 482 31 353 29 712 30 091 Recent Announcements

Tax 3 335 3 156 5 772 6 282 5 882 Monday, 29 November 2021: This Pillar 3 disclosure contains the

Minority Int 664 1 026 1 372 991 362 quantitative Pillar 3 disclosure requirements in respect of Absa

Attrib Inc 8 162 5 880 14 256 13 917 13 888

TotCompIncLoss 6 559 9 281 14 834 17 527 13 580 Group Ltd. (Absa Group or the Group) and Absa Bank Ltd.

Ord SH Int 121 656 115 671 113 278 109 484 108 614 (Absa Bank or the Bank). The quarterly report provides a view of

Minority Int 12 198 11 988 10 761 7 478 6 000 the Group’s regulatory capital and risk exposures, and it

Dep & OtherAcc 1 105 237 1 048 000 943 716 857 726 757 257 complies with:

Liabilities 1 442 037 1 398 817 1 270 492 1 167 138 1 050 337 *The Basel Committee on Banking Supervision (BCBS) revised

Inv & Trad Sec 395 637 378 025 278 453 266 400 246 265 Pillar 3 disclosure requirements (Pillar 3 standard).

Adv & Loans 1 036 603 1 014 507 976 723 894 860 805 198 *Regulation 43 of the Regulations relating to Banks (Regula-

ST Dep & Cash 56 610 60 682 52 532 46 929 48 669 tions), issued in terms of the Banks Act, 1990 (Act No. 94 of

Total Assets 1 580 535 1 531 120 1 399 175 1 288 744 1 169 595 1990), where not superseded by the revised Pillar 3 disclosure

PER SHARE STATISTICS (cents per share) requirements.

EPS (ZARc) 983.30 711.80 1 717.60 1 676.50 1 665.70 Wednesday, 24 November 2021: In accordance with paragraph 3.59

HEPS-C (ZARc) 986.20 730.90 1 750.10 1 703.70 1 724.50 of the JSE Ltd. (JSE) Listings Requirements and paragraph 6.39

Pct chng p.a. 169.9 - 58.2 2.7 - 1.2 - 4.0 of the JSE Debt Listings Requirements, shareholders are in-

Tr 5yr av grwth % - - 10.8 2.7 4.2 7.2 formed that the Absa Group and Absa Bank Boards (the Boards)

DPS (ZARc) 310.00 - 1 125.00 1 110.00 1 070.00 have resolved, in terms of section 71(3)(b) of the South African

Pct chng p.a. - - 100.0 1.4 3.7 3.9 Companies Act, 71 of 2008 (the Companies Act), that Sipho M

Tr 5yr av grwth % - - 17.6 4.0 6.3 9.5

NAV PS (ZARc) 14 350.00 13 957.00 13 669.00 13 233.00 13 042.00 Pityana will cease to be a director of the Boards, with immediate

3 Yr Beta 1.52 1.49 0.43 0.35 0.70 effect.

Price Prd End 14 660 11 986 14 930 16 182 18 199 The Boards were of the view that, through his conduct, Mr

Price High 15 331 15 318 18 822 21 000 19 830 Pityana had neglected, or been derelict in the performance of,

Price Low 12 671 6 330 14 223 13 628 13 322 his functions as a director of the Boards.

72