Page 75 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 75

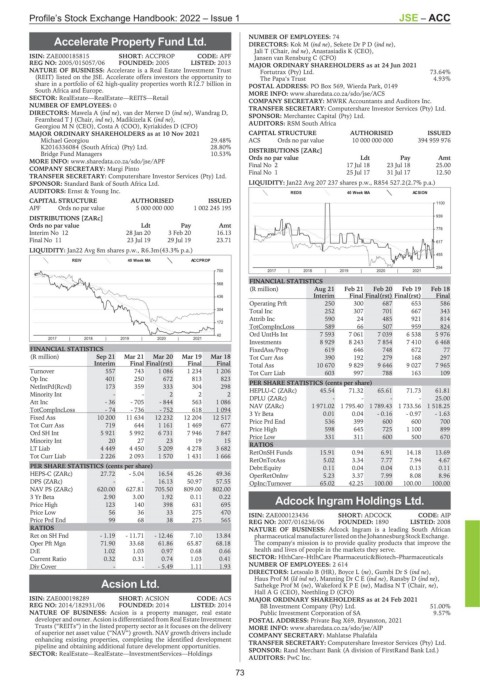

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – ACC

NUMBER OF EMPLOYEES: 74

Accelerate Property Fund Ltd. DIRECTORS: KokM(ind ne), Sekete DrPD(ind ne),

ACC Jali T (Chair, ind ne), Anastasiadis K (CEO),

ISIN: ZAE000185815 SHORT: ACCPROP CODE: APF Jansen van Rensburg C (CFO)

REG NO: 2005/015057/06 FOUNDED: 2005 LISTED: 2013 MAJOR ORDINARY SHAREHOLDERS as at 24 Jun 2021

NATURE OF BUSINESS: Accelerate is a Real Estate Investment Trust Fortutrax (Pty) Ltd. 73.64%

(REIT) listed on the JSE. Accelerate offers investors the opportunity to The Papa’s Trust 4.93%

share in a portfolio of 62 high-quality properties worth R12.7 billion in POSTAL ADDRESS: PO Box 569, Wierda Park, 0149

South Africa and Europe. MORE INFO: www.sharedata.co.za/sdo/jse/ACS

SECTOR: RealEstate—RealEstate—REITS—Retail COMPANY SECRETARY: MWRK Accountants and Auditors Inc.

NUMBER OF EMPLOYEES: 0 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Mawela A (ind ne), van der Merwe D (ind ne), Wandrag D, SPONSOR: Merchantec Capital (Pty) Ltd.

Fearnhead T J (Chair, ind ne), Madikizela K (ind ne),

Georgiou M N (CEO), Costa A (COO), Kyriakides D (CFO) AUDITORS: RSM South Africa

MAJOR ORDINARY SHAREHOLDERS as at 10 Nov 2021 CAPITAL STRUCTURE AUTHORISED ISSUED

Michael Georgiou 29.48% ACS Ords no par value 10 000 000 000 394 959 976

K2016336084 (South Africa) (Pty) Ltd. 28.80%

Bridge Fund Managers 10.53% DISTRIBUTIONS [ZARc]

Ldt

Amt

Pay

MORE INFO: www.sharedata.co.za/sdo/jse/APF Ords no par value 17 Jul 18 23 Jul 18 25.00

Final No 2

COMPANY SECRETARY: Margi Pinto Final No 1 25 Jul 17 31 Jul 17 12.50

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Standard Bank of South Africa Ltd. LIQUIDITY: Jan22 Avg 207 237 shares p.w., R854 527.2(2.7% p.a.)

AUDITORS: Ernst & Young Inc. REDS 40 Week MA ACSION

CAPITAL STRUCTURE AUTHORISED ISSUED 1100

APF Ords no par value 5 000 000 000 1 002 245 195

DISTRIBUTIONS [ZARc] 939

Ords no par value Ldt Pay Amt

778

Interim No 12 28 Jan 20 3 Feb 20 16.13

Final No 11 23 Jul 19 29 Jul 19 23.71 617

LIQUIDITY: Jan22 Avg 8m shares p.w., R6.3m(43.3% p.a.)

455

REIV 40 Week MA ACCPROP

294

700 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS

568

(R million) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18

436 Interim Final Final(rst) Final(rst) Final

Operating Prft 250 300 687 653 586

304 Total Inc 252 307 701 667 343

Attrib Inc 590 24 485 921 814

172

TotCompIncLoss 589 66 507 959 824

40 Ord UntHs Int 7 593 7 061 7 039 6 538 5 976

2017 | 2018 | 2019 | 2020 | 2021

Investments 8 929 8 243 7 854 7 410 6 468

FINANCIAL STATISTICS FixedAss/Prop 619 646 748 672 77

(R million) Sep 21 Mar 21 Mar 20 Mar 19 Mar 18 Tot Curr Ass 390 192 279 168 297

Interim Final Final(rst) Final Final Total Ass 10 670 9 829 9 646 9 027 7 965

Turnover 557 743 1 086 1 234 1 206 Tot Curr Liab 603 997 788 163 109

Op Inc 401 250 672 813 823

NetIntPd(Rcvd) 173 359 333 304 298 PER SHARE STATISTICS (cents per share) 65.61 71.73 61.81

71.32

HEPLU-C (ZARc)

45.54

Minority Int - - 2 2 2 DPLU (ZARc) - - - - 25.00

Att Inc - 36 - 705 - 844 563 1 086

TotCompIncLoss - 74 - 736 - 752 618 1 094 NAV (ZARc) 1 971.02 1 795.40 1 789.43 1 733.56 1 518.25

- 0.16

- 0.97

3 Yr Beta

0.01

- 1.63

0.04

Fixed Ass 10 200 11 634 12 232 12 204 12 517

600

Tot Curr Ass 719 644 1 161 1 469 677 Price Prd End 536 399 600 1 100 700

598

Price High

899

725

645

Ord SH Int 5 921 5 992 6 731 7 946 7 847 Price Low 331 311 600 500 670

Minority Int 20 27 23 19 15 RATIOS

LT Liab 4 449 4 450 5 209 4 278 3 682 RetOnSH Funds 15.91 0.94 6.91 14.18 13.69

Tot Curr Liab 2 226 2 093 1 570 1 431 1 666

RetOnTotAss 5.02 3.34 7.77 7.94 4.67

PER SHARE STATISTICS (cents per share) Debt:Equity 0.11 0.04 0.04 0.13 0.11

HEPS-C (ZARc) 27.72 - 5.04 16.54 45.26 49.36 OperRetOnInv 5.23 3.37 7.99 8.08 8.96

DPS (ZARc) - - 16.13 50.97 57.55 OpInc:Turnover 65.02 42.25 100.00 100.00 100.00

NAV PS (ZARc) 620.00 627.81 705.50 809.00 802.00

3 Yr Beta 2.90 3.00 1.92 0.11 0.22

Price High 123 140 398 631 695 Adcock Ingram Holdings Ltd.

Price Low 56 36 33 275 470 ADC

ISIN: ZAE000123436 SHORT: ADCOCK CODE: AIP

Price Prd End 99 68 38 275 565 REG NO: 2007/016236/06 FOUNDED: 1890 LISTED: 2008

RATIOS NATURE OF BUSINESS: Adcock Ingram is a leading South African

Ret on SH Fnd - 1.19 - 11.71 - 12.46 7.10 13.84 pharmaceutical manufacturerlistedontheJohannesburgStockExchange.

Oper Pft Mgn 71.90 33.68 61.86 65.87 68.18 The company's mission is to provide quality products that improve the

D:E 1.02 1.03 0.97 0.68 0.66 health and lives of people in the markets they serve.

Current Ratio 0.32 0.31 0.74 1.03 0.41 SECTOR: HlthCare–HtlhCare Pharmaceutic&Biotech–Pharmaceuticals

Div Cover - - - 5.49 1.11 1.93 NUMBER OF EMPLOYEES: 2 614

DIRECTORS: Letsoalo B (HR), Boyce L (ne), Gumbi Dr S (ind ne),

Haus Prof M (ld ind ne), Manning DrCE(ind ne), Ransby D (ind ne),

Acsion Ltd. Sathekge Prof M (ne), WakefordKPE(ne), Madisa N T (Chair, ne),

Hall A G (CEO), Neethling D (CFO)

ACS

ISIN: ZAE000198289 SHORT: ACSION CODE: ACS MAJOR ORDINARY SHAREHOLDERS as at 24 Feb 2021

REG NO: 2014/182931/06 FOUNDED: 2014 LISTED: 2014 BB Investment Company (Pty) Ltd. 51.00%

NATURE OF BUSINESS: Acsion is a property manager, real estate Public Investment Corporation of SA 9.57%

developer and owner. Acsion is differentiated from Real Estate Investment POSTAL ADDRESS: Private Bag X69, Bryanston, 2021

Trusts (“REITs”) in the listed property sector as it focuses on the delivery MORE INFO: www.sharedata.co.za/sdo/jse/AIP

of superior net asset value (“NAV”) growth. NAV growth drivers include COMPANY SECRETARY: Mahlatse Phalafala

enhancing existing properties, completing the identified development TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

pipeline and obtaining additional future development opportunities.

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: PwC Inc.

73