Page 25 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 25

Exchange Traded Funds (ETFs) on the JSE Profile’s Stock Exchange Handbook: 2022 – Issue 1

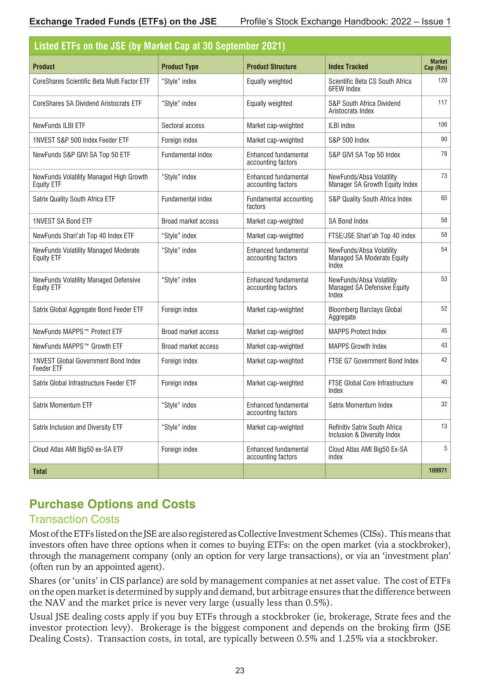

Listed ETFs on the JSE (by Market Cap at 30 September 2021)

Market

Product Product Type Product Structure Index Tracked Cap (Rm)

CoreShares Scientific Beta Multi Factor ETF “Style” index Equally weighted Scientific Beta CS South Africa 120

6FEW Index

CoreShares SA Dividend Aristocrats ETF “Style” index Equally weighted S&P South Africa Dividend 117

Aristocrats Index

NewFunds ILBI ETF Sectoral access Market cap-weighted ILBI index 106

1NVEST S&P 500 Index Feeder ETF Foreign index Market cap-weighted S&P 500 Index 90

NewFunds S&P GIVI SA Top 50 ETF Fundamental index Enhanced fundamental S&P GIVI SA Top 50 Index 78

accounting factors

NewFunds Volatility Managed High Growth “Style” index Enhanced fundamental NewFunds/Absa Volatility 73

Equity ETF accounting factors Manager SA Growth Equity Index

Satrix Quality South Africa ETF Fundamental index Fundamental accounting S&P Quality South Africa Index 65

factors

1NVEST SA Bond ETF Broad market access Market cap-weighted SA Bond Index 58

NewFunds Shari’ah Top 40 Index ETF “Style” index Market cap-weighted FTSE/JSE Shari’ah Top 40 index 58

NewFunds Volatility Managed Moderate “Style” index Enhanced fundamental NewFunds/Absa Volatility 54

Equity ETF accounting factors Managed SA Moderate Equity

Index

NewFunds Volatility Managed Defensive “Style” index Enhanced fundamental NewFunds/Absa Volatility 53

Equity ETF accounting factors Managed SA Defensive Equity

Index

Satrix Global Aggregate Bond Feeder ETF Foreign index Market cap-weighted Bloomberg Barclays Global 52

Aggregate

NewFunds MAPPS™ Protect ETF Broad market access Market cap-weighted MAPPS Protect Index 45

NewFunds MAPPS™ Growth ETF Broad market access Market cap-weighted MAPPS Growth Index 43

1NVEST Global Government Bond Index Foreign index Market cap-weighted FTSE G7 Government Bond Index 42

Feeder ETF

Satrix Global Infrastructure Feeder ETF Foreign index Market cap-weighted FTSE Global Core Infrastructure 40

Index

Satrix Momentum ETF “Style” index Enhanced fundamental Satrix Momentum Index 32

accounting factors

Satrix Inclusion and Diversity ETF “Style” index Market cap-weighted Refinitiv Satrix South Africa 13

Inclusion & Diversity Index

Cloud Atlas AMI Big50 ex-SA ETF Foreign index Enhanced fundamental Cloud Atlas AMI Big50 Ex-SA 5

accounting factors index

Total 109971

Exchange Traded Funds ( ETFs) on the JSE

Purchase Options and Costs

Transaction Costs

MostoftheETFslistedontheJSEarealsoregisteredasCollectiveInvestmentSchemes(CISs). Thismeansthat

investors often have three options when it comes to buying ETFs: on the open market (via a stockbroker),

through the management company (only an option for very large transactions), or via an ‘investment plan’

(often run by an appointed agent).

Shares (or ‘units’ in CIS parlance) are sold by management companies at net asset value. The cost of ETFs

on the open market is determined by supply and demand, but arbitrage ensures that the difference between

the NAV and the market price is never very large (usually less than 0.5%).

Usual JSE dealing costs apply if you buy ETFs through a stockbroker (ie, brokerage, Strate fees and the

investor protection levy). Brokerage is the biggest component and depends on the broking firm (JSE

Dealing Costs). Transaction costs, in total, are typically between 0.5% and 1.25% via a stockbroker.

23