Page 210 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 210

JSE – SCH Profile’s Stock Exchange Handbook: 2022 – Issue 1

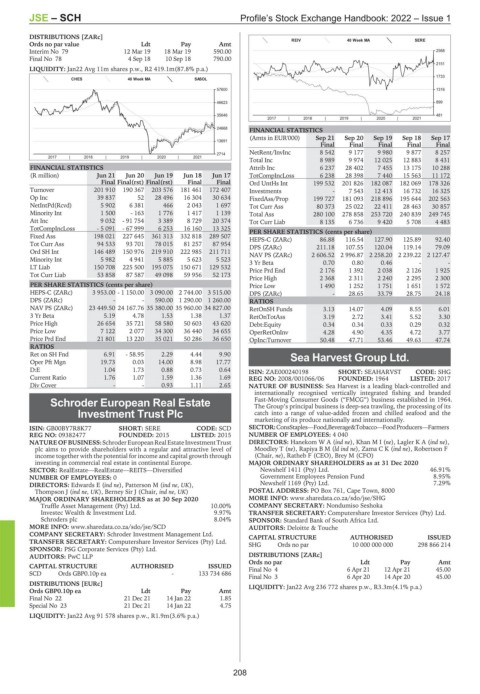

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt REIV 40 Week MA SERE

Interim No 79 12 Mar 19 18 Mar 19 590.00 2568

Final No 78 4 Sep 18 10 Sep 18 790.00

2151

LIQUIDITY: Jan22 Avg 11m shares p.w., R2 419.1m(87.8% p.a.)

1733

CHES 40 Week MA SASOL

57600 1316

46623 899

35646 481

2017 | 2018 | 2019 | 2020 | 2021

24668 FINANCIAL STATISTICS

(Amts in EUR'000) Sep 21 Sep 20 Sep 19 Sep 18 Sep 17

13691

Final Final Final Final Final

2714 NetRent/InvInc 8 542 9 177 9 980 9 877 8 257

2017 | 2018 | 2019 | 2020 | 2021

Total Inc 8 989 9 974 12 025 12 883 8 431

FINANCIAL STATISTICS Attrib Inc 6 237 28 402 7 455 13 175 10 288

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 TotCompIncLoss 6 238 28 398 7 440 15 563 11 172

Final Final(rst) Final(rst) Final Final Ord UntHs Int 199 532 201 826 182 087 182 069 178 326

Turnover 201 910 190 367 203 576 181 461 172 407 Investments - 7 543 12 413 16 732 16 325

Op Inc 39 837 52 28 496 16 304 30 634 FixedAss/Prop 199 727 181 093 218 896 195 644 202 563

NetIntPd(Rcvd) 5 902 6 381 466 2 043 1 697 Tot Curr Ass 80 373 25 022 22 411 28 463 30 857

Minority Int 1 500 - 163 1 776 1 417 1 139 Total Ass 280 100 278 858 253 720 240 839 249 745

Att Inc 9 032 - 91 754 3 389 8 729 20 374 Tot Curr Liab 8 135 6 736 9 420 5 708 4 483

TotCompIncLoss - 5 091 - 67 999 6 253 16 160 13 325 PER SHARE STATISTICS (cents per share)

Fixed Ass 198 021 227 645 361 313 332 818 289 507 HEPS-C (ZARc) 86.88 116.54 127.90 125.89 92.40

Tot Curr Ass 94 533 93 701 78 015 81 257 87 954 DPS (ZARc) 211.18 107.55 120.04 119.14 79.09

Ord SH Int 146 489 150 976 219 910 222 985 211 711 NAV PS (ZARc) 2 606.52 2 996.87 2 258.20 2 239.22 2 127.47

Minority Int 5 982 4 941 5 885 5 623 5 523 3 Yr Beta 0.70 0.80 0.46 - -

LT Liab 150 708 225 500 195 075 150 671 129 532 Price Prd End 2 176 1 392 2 038 2 126 1 925

Tot Curr Liab 53 858 87 587 49 098 59 956 52 173

Price High 2 368 2 311 2 240 2 295 2 300

PER SHARE STATISTICS (cents per share) Price Low 1 490 1 252 1 751 1 651 1 572

HEPS-C (ZARc) 3 953.00 - 1 150.00 3 090.00 2 744.00 3 515.00 DPS (ZARc) - 28.65 33.79 28.75 24.18

DPS (ZARc) - - 590.00 1 290.00 1 260.00 RATIOS

NAV PS (ZARc) 23 449.50 24 167.76 35 380.00 35 960.00 34 827.00 RetOnSH Funds 3.13 14.07 4.09 8.55 6.01

3 Yr Beta 5.19 4.78 1.53 1.38 1.37 RetOnTotAss 3.19 2.72 3.41 5.52 3.30

Price High 26 654 35 721 58 580 50 603 43 620 Debt:Equity 0.34 0.34 0.33 0.29 0.32

Price Low 7 122 2 077 34 300 36 440 34 655 OperRetOnInv 4.28 4.90 4.35 4.72 3.77

Price Prd End 21 801 13 220 35 021 50 286 36 650 OpInc:Turnover 50.48 47.71 53.46 49.63 47.74

RATIOS

Ret on SH Fnd 6.91 - 58.95 2.29 4.44 9.90 Sea Harvest Group Ltd.

Oper Pft Mgn 19.73 0.03 14.00 8.98 17.77

SEA

D:E 1.04 1.73 0.88 0.73 0.64 ISIN: ZAE000240198 SHORT: SEAHARVST CODE: SHG

Current Ratio 1.76 1.07 1.59 1.36 1.69 REG NO: 2008/001066/06 FOUNDED: 1964 LISTED: 2017

Div Cover - - 0.93 1.11 2.65 NATURE OF BUSINESS: Sea Harvest is a leading black-controlled and

internationally recognised vertically integrated fishing and branded

Schroder European Real Estate Fast-Moving Consumer Goods (“FMCG”) business established in 1964.

The Group’s principal business is deep-sea trawling, the processing of its

Investment Trust Plc catch into a range of value-added frozen and chilled seafood and the

marketing of its produce nationally and internationally.

SCH

ISIN: GB00BY7R8K77 SHORT: SERE CODE: SCD SECTOR:ConsStaples—Food,Beverage&Tobacco—FoodProducers—Farmers

REG NO: 09382477 FOUNDED: 2015 LISTED: 2015 NUMBER OF EMPLOYEES: 4 040

NATUREOF BUSINESS:SchroderEuropeanRealEstateInvestmentTrust DIRECTORS: HanekomWA(ind ne), KhanMI(ne), LaglerKA(ind ne),

plc aims to provide shareholders with a regular and attractive level of Moodley T (ne), RapiyaBM(ld ind ne), ZamaCK(ind ne), Robertson F

income together with the potential for income and capital growth through (Chair, ne), Ratheb F (CEO), Brey M (CFO)

investing in commercial real estate in continental Europe. MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

SECTOR: RealEstate—RealEstate—REITS—Diversified Newshelf 1411 (Pty) Ltd. 46.91%

NUMBER OF EMPLOYEES: 0 Government Employees Pension Fund 8.95%

DIRECTORS: Edwards E (ind ne), Patterson M (ind ne, UK), Newshelf 1169 (Pty) Ltd. 7.29%

Thompson J (ind ne, UK), Berney Sir J (Chair, ind ne, UK) POSTAL ADDRESS: PO Box 761, Cape Town, 8000

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020 MORE INFO: www.sharedata.co.za/sdo/jse/SHG

Truffle Asset Management (Pty) Ltd. 10.00% COMPANY SECRETARY: Nondumiso Seshoka

Investec Wealth & Investment Ltd. 9.97% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Schroders plc 8.04% SPONSOR: Standard Bank of South Africa Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/SCD AUDITORS: Deloitte & Touche

COMPANY SECRETARY: Schroder Investment Management Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SHG Ords no par 10 000 000 000 298 866 214

SPONSOR: PSG Corporate Services (Pty) Ltd.

AUDITORS: PwC LLP DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 4 6 Apr 21 12 Apr 21 45.00

SCD Ords GBP0.10p ea - 133 734 686

Final No 3 6 Apr 20 14 Apr 20 45.00

DISTRIBUTIONS [EURc] LIQUIDITY: Jan22 Avg 236 772 shares p.w., R3.3m(4.1% p.a.)

Ords GBP0.10p ea Ldt Pay Amt

Final No 22 21 Dec 21 14 Jan 22 1.85

Special No 23 21 Dec 21 14 Jan 22 4.75

LIQUIDITY: Jan22 Avg 91 578 shares p.w., R1.9m(3.6% p.a.)

208