Page 188 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 188

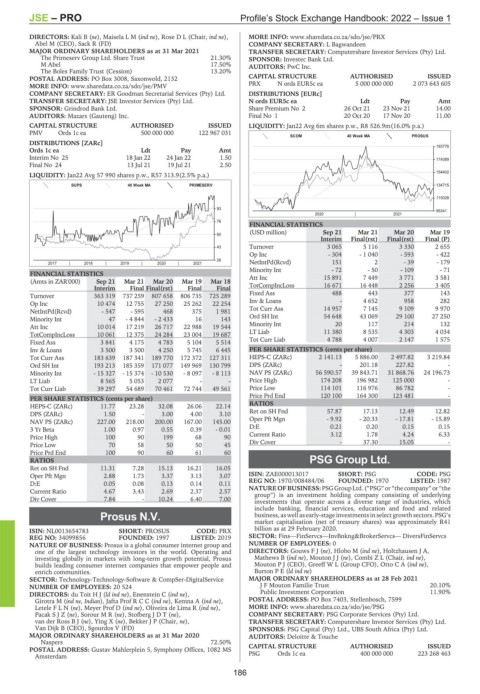

JSE – PRO Profile’s Stock Exchange Handbook: 2022 – Issue 1

DIRECTORS: Kali B (ne), MaiselaLM(ind ne), Rose D L (Chair, ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/PRX

Abel M (CEO), Sack R (FD) COMPANY SECRETARY: L Bagwandeen

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

The Primeserv Group Ltd. Share Trust 21.30% SPONSOR: Investec Bank Ltd.

M Abel 17.50% AUDITORS: PwC Inc.

The Boles Family Trust (Cession) 13.20%

POSTAL ADDRESS: PO Box 3008, Saxonwold, 2132 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/PMV PRX N ords EUR5c ea 5 000 000 000 2 073 643 605

COMPANY SECRETARY: ER Goodman Secretarial Services (Pty) Ltd. DISTRIBUTIONS [EURc]

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. N ords EUR5c ea Ldt Pay Amt

SPONSOR: Grindrod Bank Ltd. Share Premium No 2 26 Oct 21 23 Nov 21 14.00

AUDITORS: Mazars (Gauteng) Inc. Final No 1 20 Oct 20 17 Nov 20 11.00

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jan22 Avg 6m shares p.w., R8 526.9m(16.0% p.a.)

PMV Ords 1c ea 500 000 000 122 967 031

SCOM 40 Week MA PROSUS

DISTRIBUTIONS [ZARc]

193776

Ords 1c ea Ldt Pay Amt

Interim No 25 18 Jan 22 24 Jan 22 1.50 174089

Final No 24 13 Jul 21 19 Jul 21 2.50

154402

LIQUIDITY: Jan22 Avg 57 990 shares p.w., R57 313.9(2.5% p.a.)

SUPS 40 Week MA PRIMESERV 134715

115028

93 95341

2020 | 2021

76

FINANCIAL STATISTICS

(USD million) Sep 21 Mar 21 Mar 20 Mar 19

60

Interim Final(rst) Final(rst) Final (P)

43 Turnover 3 065 5 116 3 330 2 655

Op Inc - 304 - 1 040 - 593 - 422

26 NetIntPd(Rcvd) 151 2 - 39 - 179

2017 | 2018 | 2019 | 2020 | 2021

Minority Int - 72 - 50 - 109 - 71

FINANCIAL STATISTICS

(Amts in ZAR'000) Sep 21 Mar 21 Mar 20 Mar 19 Mar 18 Att Inc 15 891 7 449 3 771 3 581

Interim Final Final(rst) Final Final TotCompIncLoss 16 671 16 448 2 256 3 405

Fixed Ass 488 443 377 143

Turnover 363 319 737 259 807 658 806 735 725 289

Op Inc 10 474 12 755 27 250 25 262 22 254 Inv & Loans - 4 652 958 282

NetIntPd(Rcvd) - 547 - 595 468 375 1 981 Tot Curr Ass 14 957 7 145 9 109 9 970

Minority Int 47 - 4 844 - 2 433 16 143 Ord SH Int 54 648 43 069 29 100 27 250

Att Inc 10 014 17 219 26 717 22 988 19 544 Minority Int 20 117 214 132

TotCompIncLoss 10 061 12 375 24 284 23 004 19 687 LT Liab 11 380 8 535 4 303 4 034

Fixed Ass 3 841 4 175 4 783 5 104 5 514 Tot Curr Liab 4 788 4 007 2 147 1 575

Inv & Loans 3 500 3 500 4 250 5 745 6 445 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 183 639 187 341 189 770 172 372 127 311 HEPS-C (ZARc) 2 141.13 5 886.00 2 497.82 3 219.84

Ord SH Int 193 213 185 359 171 077 149 969 130 799 DPS (ZARc) - 201.18 227.82 -

Minority Int - 15 327 - 15 374 - 10 530 - 8 097 - 8 113 NAV PS (ZARc) 56 590.57 39 843.71 31 868.76 24 196.73

LT Liab 8 565 5 053 2 077 - - Price High 174 208 196 982 125 000 -

Tot Curr Liab 39 297 54 689 70 461 72 744 49 561 Price Low 114 101 116 976 86 782 -

Price Prd End 120 100 164 300 123 481 -

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 11.77 23.28 32.08 26.06 22.14 RATIOS

DPS (ZARc) 1.50 - 3.00 4.00 3.10 Ret on SH Fnd 57.87 17.13 12.49 12.82

NAV PS (ZARc) 227.00 218.00 200.00 167.00 145.00 Oper Pft Mgn - 9.92 - 20.33 - 17.81 - 15.89

3 Yr Beta 1.00 0.97 0.55 0.39 - 0.01 D:E 0.21 0.20 0.15 0.15

Price High 100 90 199 68 90 Current Ratio 3.12 1.78 4.24 6.33

Price Low 70 58 50 50 45 Div Cover - 37.30 15.05 -

Price Prd End 100 90 60 61 60

RATIOS PSG Group Ltd.

Ret on SH Fnd 11.31 7.28 15.13 16.21 16.05 PSG

Oper Pft Mgn 2.88 1.73 3.37 3.13 3.07 ISIN: ZAE000013017 SHORT: PSG CODE: PSG

D:E 0.05 0.08 0.13 0.14 0.11 REG NO: 1970/008484/06 FOUNDED: 1970 LISTED: 1987

Current Ratio 4.67 3.43 2.69 2.37 2.57 NATUREOF BUSINESS:PSGGroupLtd.(“PSG”or“the company”or“the

group”) is an investment holding company consisting of underlying

Div Cover 7.84 - 10.24 6.40 7.00

investments that operate across a diverse range of industries, which

include banking, financial services, education and food and related

Prosus N.V. business, as well as early-stage investmentsin select growth sectors. PSG’s

market capitalisation (net of treasury shares) was approximately R41

PRO

ISIN: NL0013654783 SHORT: PROSUS CODE: PRX billion as at 29 February 2020.

REG NO: 34099856 FOUNDED: 1997 LISTED: 2019 SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

NATURE OF BUSINESS: Prosus is a global consumer internet group and NUMBER OF EMPLOYEES: 0

one of the largest technology investors in the world. Operating and DIRECTORS: GouwsFJ(ne), Hlobo M (ind ne), Holtzhausen J A,

investing globally in markets with long-term growth potential, Prosus Mathews B (ind ne), MoutonJJ(ne), Combi Z L (Chair, ind ne),

builds leading consumer internet companies that empower people and Mouton P J (CEO), Greeff W L (Group CFO), OttoCA(ind ne),

enrich communities. BurtonPE(ld ind ne)

SECTOR: Technology-Technology-Software & CompSer-DigitalService MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021

NUMBER OF EMPLOYEES: 20 524 J F Mouton Familie Trust 20.10%

DIRECTORS: du ToitHJ(ld ind ne), Enenstein C (ind ne), Public Investment Corporation 11.90%

Girotra M (ind ne, Indian), Jafta ProfRCC(ind ne), Kemna A (ind ne), POSTAL ADDRESS: PO Box 7403, Stellenbosch, 7599

LeteleFLN(ne), Meyer Prof D (ind ne), Oliveira de Lima R (ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/PSG

PacakSJZ(ne), SorourMR(ne), StofbergJDT(ne), COMPANY SECRETARY: PSG Corporate Services (Pty) Ltd.

van der RossBJ(ne), Ying X (ne), Bekker J P (Chair, ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Van Dijk B (CEO), Sgourdos V (FD) SPONSORS: PSG Capital (Pty) Ltd., UBS South Africa (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 AUDITORS: Deloitte & Touche

Naspers 72.50%

ISSUED

POSTAL ADDRESS: Gustav Mahlerplein 5, Symphony Offices, 1082 MS CAPITAL STRUCTURE AUTHORISED 223 268 463

PSG

Ords 1c ea

400 000 000

Amsterdam

186