Page 184 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 184

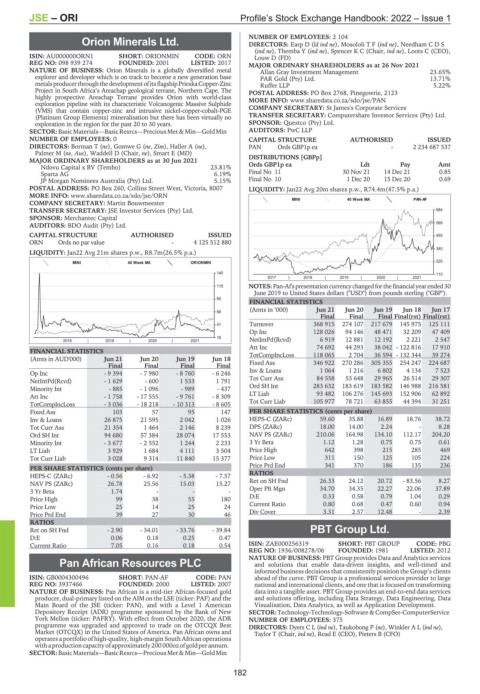

JSE – ORI Profile’s Stock Exchange Handbook: 2022 – Issue 1

NUMBER OF EMPLOYEES: 2 104

Orion Minerals Ltd. DIRECTORS: Earp D (ld ind ne), MosololiTF(ind ne), NeedhamCDS

ORI (ind ne), Themba Y (ind ne), Spencer K C (Chair, ind ne), Loots C (CEO),

ISIN: AU000000ORN1 SHORT: ORIONMIN CODE: ORN Louw D (FD)

REG NO: 098 939 274 FOUNDED: 2001 LISTED: 2017 MAJOR ORDINARY SHAREHOLDERS as at 26 Nov 2021

NATURE OF BUSINESS: Orion Minerals is a globally diversified metal Allan Gray Investment Management 23.65%

explorer and developer which is on track to become a new generation base PAR Gold (Pty) Ltd. 13.71%

metalsproducerthroughthedevelopmentofitsflagshipPrieskaCopper-Zinc Ruffer LLP 5.22%

Project in South Africa’s Areachap geological terrane, Northern Cape. The POSTAL ADDRESS: PO Box 2768, Pinegowrie, 2123

highly prospective Areachap Terrane provides Orion with world-class MORE INFO: www.sharedata.co.za/sdo/jse/PAN

exploration pipeline with its characteristic Volcanogenic Massive Sulphide

(VMS) that contain copper-zinc and intrusive nickel-copper-cobalt-PGE COMPANY SECRETARY: St James's Corporate Services

(Platinum Group Elements) mineralisation but there has been virtually no TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

exploration in the region for the past 20 to 30 years. SPONSOR: Questco (Pty) Ltd.

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin AUDITORS: PwC LLP

NUMBER OF EMPLOYEES: 0 CAPITAL STRUCTURE AUTHORISED ISSUED

DIRECTORS: Borman T (ne), Gomwe G (ne, Zim), Haller A (ne), PAN Ords GBP1p ea - 2 234 687 537

Palmer M (ne, Aus), Waddell D (Chair, ne), Smart E (MD)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021 DISTRIBUTIONS [GBPp] Ldt Pay Amt

Ords GBP1p ea

Ndovu Capital x BV (Tembo) 23.81%

Sparta AG 6.19% Final No 11 30 Nov 21 14 Dec 21 0.85

JP Morgan Nominees Australia (Pty) Ltd. 5.15% Final No 10 1 Dec 20 15 Dec 20 0.69

POSTAL ADDRESS: PO Box 260, Collins Street West, Victoria, 8007 LIQUIDITY: Jan22 Avg 20m shares p.w., R74.4m(47.5% p.a.)

MORE INFO: www.sharedata.co.za/sdo/jse/ORN

COMPANY SECRETARY: Martin Bouwmeester MINI 40 Week MA PAN-AF

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. 684

SPONSOR: Merchantec Capital

AUDITORS: BDO Audit (Pty) Ltd. 569

CAPITAL STRUCTURE AUTHORISED ISSUED 455

ORN Ords no par value - 4 125 512 880

340

LIQUIDITY: Jan22 Avg 21m shares p.w., R8.7m(26.5% p.a.)

225

MINI 40 Week MA ORIONMIN

140 110

2017 | 2018 | 2019 | 2020 | 2021

115 NOTES: Pan-Af'spresentationcurrencychangedforthefinancialyearended30

June 2019 to United States dollars ("USD") from pounds sterling ("GBP").

90

FINANCIAL STATISTICS

(Amts in ‘000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

66

Final Final Final Final(rst) Final(rst)

41 Turnover 368 915 274 107 217 679 145 975 125 111

Op Inc 128 026 94 146 48 471 32 209 47 409

16 NetIntPd(Rcvd) 6 919 12 881 12 192 2 221 2 547

2018 | 2019 | 2020 | 2021

Att Inc 74 692 44 293 38 042 - 122 816 17 910

FINANCIAL STATISTICS TotCompIncLoss 118 065 2 704 36 594 - 132 344 39 274

(Amts in AUD'000) Jun 21 Jun 20 Jun 19 Jun 18

Final Final Final Final Fixed Ass 346 922 270 286 305 355 254 247 224 687

Op Inc - 9 394 - 7 980 - 8 760 - 6 246 Inv & Loans 1 064 1 216 6 802 4 134 7 523

NetIntPd(Rcvd) - 1 629 - 600 1 533 1 791 Tot Curr Ass 84 558 53 648 29 965 26 514 29 307

Minority Int - 885 - 1 096 - 989 - 437 Ord SH Int 283 632 183 619 183 582 146 988 216 581

Att Inc - 1 758 - 17 555 - 9 761 - 8 309 LT Liab 93 482 106 276 145 693 152 906 62 892

TotCompIncLoss - 3 036 - 18 218 - 10 313 - 8 605 Tot Curr Liab 105 977 78 721 63 855 44 394 31 251

Fixed Ass 103 57 95 147 PER SHARE STATISTICS (cents per share)

Inv & Loans 26 875 21 595 2 042 1 026 HEPS-C (ZARc) 59.60 35.88 16.89 18.76 38.72

Tot Curr Ass 21 354 1 464 2 146 8 239 DPS (ZARc) 18.00 14.00 2.24 - 8.28

Ord SH Int 94 680 57 384 28 074 17 553 NAV PS (ZARc) 210.06 164.98 134.10 112.17 204.20

Minority Int - 3 677 - 2 552 1 244 2 233 3 Yr Beta 1.12 1.28 0.75 0.75 0.61

LT Liab 3 929 1 684 4 111 3 504 Price High 642 398 215 285 469

Tot Curr Liab 3 028 9 314 11 840 15 377 Price Low 311 150 125 105 224

Price Prd End 341 370 186 135 236

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 0.56 - 6.92 - 5.38 - 7.57 RATIOS

NAV PS (ZARc) 26.78 25.56 15.03 15.27 Ret on SH Fnd 26.33 24.12 20.72 - 83.56 8.27

3 Yr Beta 1.74 - - - Oper Pft Mgn 34.70 34.35 22.27 22.06 37.89

Price High 99 38 55 180 D:E 0.33 0.58 0.79 1.04 0.29

Price Low 25 14 25 24 Current Ratio 0.80 0.68 0.47 0.60 0.94

Price Prd End 39 27 30 46 Div Cover 3.31 2.57 12.48 - 2.39

RATIOS

Ret on SH Fnd - 2.90 - 34.01 - 33.76 - 39.84 PBT Group Ltd.

D:E 0.06 0.18 0.25 0.47 PBT

Current Ratio 7.05 0.16 0.18 0.54 ISIN: ZAE000256319 SHORT: PBT GROUP CODE: PBG

REG NO: 1936/008278/06 FOUNDED: 1981 LISTED: 2012

NATURE OF BUSINESS: PBT Group provides Data and Analytics services

Pan African Resources PLC and solutions that enable data-driven insights, and well-timed and

informed business decisions that consistently position the Group’s clients

PAN

ISIN: GB0004300496 SHORT: PAN-AF CODE: PAN ahead of the curve. PBT Group is a professional services provider to large

REG NO: 3937466 FOUNDED: 2000 LISTED: 2007 national and international clients, and one that is focused on transforming

NATURE OF BUSINESS: Pan African is a mid-tier African-focused gold data into a tangible asset. PBT Group provides an end-to-end data services

producer, dual-primary listed on the AIM on the LSE (ticker: PAF) and the and solutions offering, including Data Strategy, Data Engineering, Data

Main Board of the JSE (ticker: PAN), and with a Level 1 American Visualisation, Data Analytics, as well as Application Development.

Depository Receipt (ADR) programme sponsored by the Bank of New SECTOR:Technology-Technology-Software &CompSer-ComputerService

York Mellon (ticker: PAFRY). With effect from October 2020, the ADR NUMBER OF EMPLOYEES: 375

programme was upgraded and approved to trade on the OTCQX Best DIRECTORS: Dyers C L (ind ne), Taukobong P (ne), Winkler A L (ind ne),

Market (OTCQX) in the United States of America. Pan African owns and Taylor T (Chair, ind ne), Read E (CEO), Pieters B (CFO)

operates a portfolio of high-quality, high-margin South African operations

withaproductioncapacity ofapproximately200 000ozofgoldperannum.

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin

182