Page 192 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 192

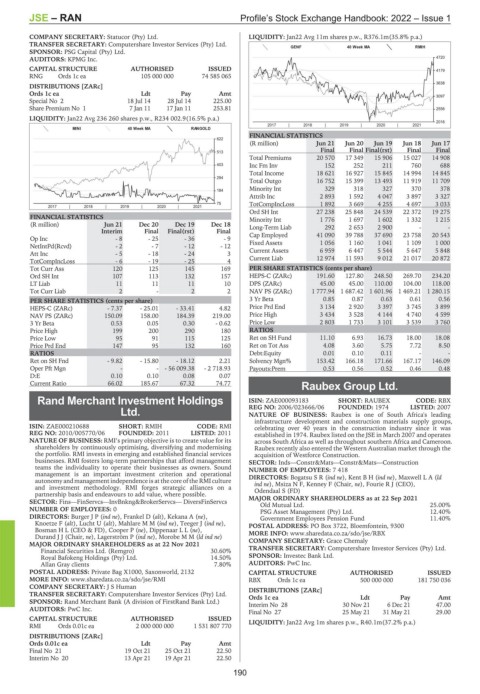

JSE – RAN Profile’s Stock Exchange Handbook: 2022 – Issue 1

COMPANY SECRETARY: Statucor (Pty) Ltd. LIQUIDITY: Jan22 Avg 11m shares p.w., R376.1m(35.8% p.a.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

GENF 40 Week MA RMIH

SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: KPMG Inc. 4720

CAPITAL STRUCTURE AUTHORISED ISSUED 4179

RNG Ords 1c ea 105 000 000 74 585 065

3638

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

3097

Special No 2 18 Jul 14 28 Jul 14 225.00

Share Premium No 1 7 Jan 11 17 Jan 11 253.81 2556

LIQUIDITY: Jan22 Avg 236 260 shares p.w., R234 002.9(16.5% p.a.)

2016

2017 | 2018 | 2019 | 2020 | 2021

MINI 40 Week MA RANGOLD

FINANCIAL STATISTICS

622

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final(rst) Final Final

513

Total Premiums 20 570 17 349 15 906 15 027 14 908

403 Inc Fm Inv 152 252 211 760 688

Total Income 18 621 16 927 15 845 14 994 14 845

294

Total Outgo 16 752 15 399 13 493 11 919 11 709

Minority Int 329 318 327 370 378

184

Attrib Inc 2 893 1 592 4 047 3 897 3 327

75 TotCompIncLoss 1 892 3 669 4 255 4 697 3 033

2017 | 2018 | 2019 | 2020 | 2021

Ord SH Int 27 238 25 848 24 539 22 372 19 275

FINANCIAL STATISTICS Minority Int 1 776 1 697 1 602 1 332 1 215

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Long-Term Liab 292 2 653 2 900 - -

Interim Final Final(rst) Final

Op Inc - 8 - 25 - 36 - 9 Cap Employed 41 090 39 788 37 690 23 758 20 543

1 000

1 056

1 109

1 041

1 160

Fixed Assets

NetIntPd(Rcvd) - 2 - 7 - 12 - 12

AttInc -5 -18 - 24 3 Current Assets 6 959 6 447 5 544 5 647 5 848

TotCompIncLoss - 6 - 19 - 25 4 Current Liab 12 974 11 593 9 012 21 017 20 872

Tot Curr Ass 120 125 145 169 PER SHARE STATISTICS (cents per share)

Ord SH Int 107 113 132 157 HEPS-C (ZARc) 191.60 127.80 248.50 269.70 234.20

LT Liab 11 11 11 10 DPS (ZARc) 45.00 45.00 110.00 104.00 118.00

Tot Curr Liab 2 - 2 2 NAV PS (ZARc) 1 777.94 1 687.42 1 601.96 1 469.21 1 280.15

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.85 0.87 0.63 0.61 0.56

HEPS-C (ZARc) - 7.37 - 25.01 - 33.41 4.82 Price Prd End 3 134 2 920 3 397 3 745 3 899

NAV PS (ZARc) 150.09 158.00 184.39 219.00 Price High 3 434 3 528 4 144 4 740 4 599

3 Yr Beta 0.53 0.05 0.30 - 0.62 Price Low 2 803 1 733 3 101 3 539 3 760

Price High 199 200 290 180 RATIOS

Price Low 95 91 115 125 Ret on SH Fund 11.10 6.93 16.73 18.00 18.08

Price Prd End 147 95 132 160 Ret on Tot Ass 4.08 3.60 5.75 7.72 8.50

RATIOS Debt:Equity 0.01 0.10 0.11 - -

Ret on SH Fnd - 9.82 - 15.80 - 18.12 2.21 Solvency Mgn% 153.42 166.18 171.66 167.17 146.09

Oper Pft Mgn - - - 56 009.38 - 2 718.93 Payouts:Prem 0.53 0.56 0.52 0.46 0.48

D:E 0.10 0.10 0.08 0.07

Current Ratio 66.02 185.67 67.32 74.77 Raubex Group Ltd.

RAU

Rand Merchant Investment Holdings ISIN: ZAE000093183 SHORT: RAUBEX CODE: RBX

Ltd. REG NO: 2006/023666/06 FOUNDED: 1974 LISTED: 2007

NATURE OF BUSINESS: Raubex is one of South Africa's leading

RAN infrastructure development and construction materials supply groups,

ISIN: ZAE000210688 SHORT: RMIH CODE: RMI celebrating over 40 years in the construction industry since it was

REG NO: 2010/005770/06 FOUNDED: 2011 LISTED: 2011 established in 1974. Raubex listed on the JSE in March 2007 and operates

NATURE OF BUSINESS: RMI’s primary objective is to create value for its across South Africa as well as throughout southern Africa and Cameroon.

shareholders by continuously optimising, diversifying and modernising Raubex recently also entered the Western Australian market through the

the portfolio. RMI invests in emerging and established financial services acquisition of Westforce Construction.

businesses. RMI fosters long-term partnerships that afford management SECTOR: Inds—Constr&Mats—Constr&Mats—Construction

teams the individuality to operate their businesses as owners. Sound NUMBER OF EMPLOYEES: 7 418

management is an important investment criterion and operational DIRECTORS: BogatsuSR(ind ne), KentBH(ind ne), MaxwellLA(ld

autonomy and management independence is at the core of the RMI culture ind ne), Msiza N F, Kenney F (Chair, ne), Fourie R J (CEO),

and investment methodology. RMI forges strategic alliances on a Odendaal S (FD)

partnership basis and endeavours to add value, where possible.

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs MAJOR ORDINARY SHAREHOLDERS as at 22 Sep 2021 25.00%

Old Mutual Ltd.

NUMBER OF EMPLOYEES: 0 PSG Asset Management (Pty) Ltd. 12.40%

DIRECTORS: BurgerJP(ind ne), Frankel D (alt), Kekana A (ne), Government Employees Pension Fund 11.40%

Knoetze F (alt), Lucht U (alt), MahlareMM(ind ne), Teeger J (ind ne), POSTAL ADDRESS: PO Box 3722, Bloemfontein, 9300

Bosman H L (CEO & FD), Cooper P (ne), DippenaarLL(ne), MORE INFO: www.sharedata.co.za/sdo/jse/RBX

Durand J J (Chair, ne), Lagerström P (ind ne), MorobeMM(ld ind ne)

MAJOR ORDINARY SHAREHOLDERS as at 22 Nov 2021 COMPANY SECRETARY: Grace Chemaly

Financial Securities Ltd. (Remgro) 30.60% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Royal Bafokeng Holdings (Pty) Ltd. 14.50% SPONSOR: Investec Bank Ltd.

Allan Gray clients 7.80% AUDITORS: PwC Inc.

POSTAL ADDRESS: Private Bag X1000, Saxonworld, 2132 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/RMI RBX Ords 1c ea 500 000 000 181 750 036

COMPANY SECRETARY: J S Human DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords 1c ea Ldt Pay Amt

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) Interim No 28 30 Nov 21 6 Dec 21 47.00

AUDITORS: PwC Inc.

Final No 27 25 May 21 31 May 21 29.00

CAPITAL STRUCTURE AUTHORISED ISSUED

RMI Ords 0.01c ea 2 000 000 000 1 531 807 770 LIQUIDITY: Jan22 Avg 1m shares p.w., R40.1m(37.2% p.a.)

DISTRIBUTIONS [ZARc]

Ords 0.01c ea Ldt Pay Amt

Final No 21 19 Oct 21 25 Oct 21 22.50

Interim No 20 13 Apr 21 19 Apr 21 22.50

190