Page 187 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 187

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – PPC

DIRECTORS: Dzvova V (ne), Mngconkola P (ind ne),

PPC Ltd. Ramatlhodi Adv N (ind ne), Robertson B (CFO), Isaacs R (CEO), Mosia

RP(ind ne), AmodABA (Chair, ne), van der VenterCL(ld ind ne)

PPC

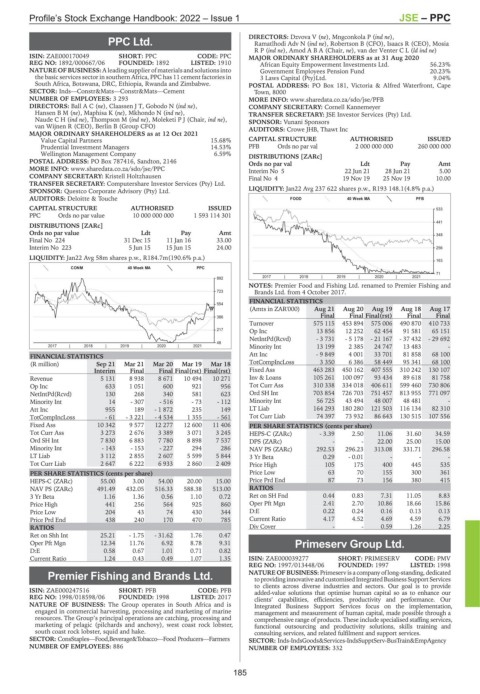

ISIN: ZAE000170049 SHORT: PPC CODE: PPC MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2020

REG NO: 1892/000667/06 FOUNDED: 1892 LISTED: 1910 African Equity Empowerment Investments Ltd. 56.23%

NATUREOF BUSINESS:Aleading supplier of materialsandsolutionsinto Government Employees Pension Fund 20.23%

the basic services sector in southern Africa, PPC has 11 cement factories in 3 Laws Capital (Pty)Ltd. 9.04%

South Africa, Botswana, DRC, Ethiopia, Rwanda and Zimbabwe. POSTAL ADDRESS: PO Box 181, Victoria & Alfred Waterfront, Cape

SECTOR: Inds—Constr&Mats—Constr&Mats—Cement Town, 8000

NUMBER OF EMPLOYEES: 3 293 MORE INFO: www.sharedata.co.za/sdo/jse/PFB

DIRECTORS: BallAC(ne), Claassen J T, Gobodo N (ind ne), COMPANY SECRETARY: Cornell Kannemeyer

HansenBM(ne), Maphisa K (ne), Mkhondo N (ind ne), TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

NaudeCH(ind ne), Thompson M (ind ne), Moleketi P J (Chair, ind ne), SPONSOR: Vunani Sponsors

van Wijnen R (CEO), Berlin B (Group CFO) AUDITORS: Crowe JHB, Thawt Inc

MAJOR ORDINARY SHAREHOLDERS as at 12 Oct 2021

Value Capital Partners 15.68% CAPITAL STRUCTURE AUTHORISED ISSUED

Prudential Investment Managers 14.53% PFB Ords no par val 2 000 000 000 260 000 000

Wellington Management Company 6.59% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 787416, Sandton, 2146 Ords no par val Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/PPC Interim No 5 22 Jun 21 28 Jun 21 5.00

COMPANY SECRETARY: Kristell Holtzhausen Final No 4 19 Nov 19 25 Nov 19 10.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Questco Corporate Advisory (Pty) Ltd. LIQUIDITY: Jan22 Avg 237 622 shares p.w., R193 148.1(4.8% p.a.)

AUDITORS: Deloitte & Touche FOOD 40 Week MA PFB

CAPITAL STRUCTURE AUTHORISED ISSUED 533

PPC Ords no par value 10 000 000 000 1 593 114 301

441

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 348

Final No 224 31 Dec 15 11 Jan 16 33.00

Interim No 223 5 Jun 15 15 Jun 15 24.00 256

LIQUIDITY: Jan22 Avg 58m shares p.w., R184.7m(190.6% p.a.)

163

CONM 40 Week MA PPC

71

892 2017 | 2018 | 2019 | 2020 | 2021

NOTES: Premier Food and Fishing Ltd. renamed to Premier Fishing and

723 Brands Ltd. from 4 October 2017.

FINANCIAL STATISTICS

554

(Amts in ZAR'000) Aug 21 Aug 20 Aug 19 Aug 18 Aug 17

386 Final Final Final(rst) Final Final

Turnover 575 115 453 894 575 006 490 870 410 733

Op Inc 13 856 12 252 62 454 91 581 65 151

217

NetIntPd(Rcvd) - 3 731 - 5 178 - 21 167 - 37 432 - 29 692

48

2017 | 2018 | 2019 | 2020 | 2021 Minority Int 13 199 2 385 24 747 13 483 -

FINANCIAL STATISTICS Att Inc - 9 849 4 001 33 701 81 858 68 100

(R million) Sep 21 Mar 21 Mar 20 Mar 19 Mar 18 TotCompIncLoss 3 350 6 386 58 449 95 341 68 100

Interim Final Final Final(rst) Final(rst) Fixed Ass 463 283 450 162 407 555 310 242 130 107

Revenue 5 131 8 938 8 671 10 494 10 271 Inv & Loans 105 261 100 097 93 434 89 618 81 758

Op Inc 633 1 051 600 921 956 Tot Curr Ass 310 338 334 018 406 611 599 460 730 806

NetIntPd(Rcvd) 130 268 340 581 623 Ord SH Int 703 854 726 703 751 457 813 955 771 097

Minority Int 14 - 307 - 516 - 73 - 112 Minority Int 56 725 43 494 48 007 48 481 -

Att Inc 955 189 - 1 872 235 149 LT Liab 164 293 180 280 121 503 116 134 82 310

TotCompIncLoss - 61 - 3 221 - 4 534 1 355 - 561 Tot Curr Liab 74 397 73 932 86 643 130 515 107 556

Fixed Ass 10 342 9 577 12 277 12 600 11 406 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 3 273 2 676 3 389 3 071 3 245 HEPS-C (ZARc) - 3.39 2.50 11.06 31.60 34.59

Ord SH Int 7 830 6 883 7 780 8 898 7 537 DPS (ZARc) - - 22.00 25.00 15.00

Minority Int - 143 - 153 - 227 294 286 NAV PS (ZARc) 292.53 296.23 313.08 331.71 296.58

LT Liab 3 112 2 855 2 607 5 599 5 844 3 Yr Beta 0.29 - 0.01 - - -

Tot Curr Liab 2 647 6 222 6 933 2 860 2 409 Price High 105 175 400 445 535

PER SHARE STATISTICS (cents per share) Price Low 63 70 155 300 361

HEPS-C (ZARc) 55.00 3.00 54.00 20.00 15.00 Price Prd End 87 73 156 380 415

NAV PS (ZARc) 491.49 432.05 516.33 588.38 513.00 RATIOS

3 Yr Beta 1.16 1.36 0.56 1.10 0.72 Ret on SH Fnd 0.44 0.83 7.31 11.05 8.83

Price High 441 256 564 925 860 Oper Pft Mgn 2.41 2.70 10.86 18.66 15.86

Price Low 204 43 74 430 344 D:E 0.22 0.24 0.16 0.13 0.13

Price Prd End 438 240 170 470 785 Current Ratio 4.17 4.52 4.69 4.59 6.79

RATIOS Div Cover - - 0.59 1.26 2.25

Ret on Shh Int 25.21 - 1.75 - 31.62 1.76 0.47

Oper Pft Mgn 12.34 11.76 6.92 8.78 9.31 Primeserv Group Ltd.

D:E 0.58 0.67 1.01 0.71 0.82

PRI

Current Ratio 1.24 0.43 0.49 1.07 1.35 ISIN: ZAE000039277 SHORT: PRIMESERV CODE: PMV

REG NO: 1997/013448/06 FOUNDED: 1997 LISTED: 1998

Premier Fishing and Brands Ltd. NATURE OF BUSINESS: Primeserv is a company of long-standing, dedicated

to providing innovative and customised Integrated BusinessSupport Services

PRE to clients across diverse industries and sectors. Our goal is to provide

ISIN: ZAE000247516 SHORT: PFB CODE: PFB added-value solutions that optimise human capital so as to enhance our

REG NO: 1998/018598/06 FOUNDED: 1998 LISTED: 2017 clients’ capabilities, efficiencies, productivity and performance. Our

NATURE OF BUSINESS: The Group operates in South Africa and is Integrated Business Support Services focus on the implementation,

engaged in commercial harvesting, processing and marketing of marine management and measurement of human capital, made possible through a

resources. The Group’s principal operations are catching, processing and comprehensive range of products. These include specialised staffing services,

marketing of pelagic (pilchards and anchovy), west coast rock lobster, functional outsourcing and productivity solutions, skills training and

south coast rock lobster, squid and hake. consulting services, and related fulfilment and support services.

SECTOR: ConsStaples—Food,Beverage&Tobacco—Food Producers—Farmers SECTOR: Inds-IndsGoods&Services-IndsSupptServ-BusTrain&EmpAgency

NUMBER OF EMPLOYEES: 886 NUMBER OF EMPLOYEES: 332

185