Page 180 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 180

JSE – NVE Profile’s Stock Exchange Handbook: 2022 – Issue 1

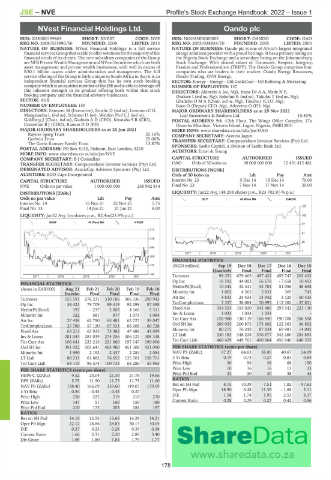

NVest Financial Holdings Ltd. Oando plc

NVE OAN

ISIN: ZAE000199865 SHORT: NVEST CODE: NVE ISIN: NGOANDO00002 SHORT: OANDO CODE: OAO

REG NO: 2008/015990/06 FOUNDED: 2008 LISTED: 2015 REG NO: 2005/038824/10 FOUNDED: 2005 LISTED: 2005

NATURE OF BUSINESS: NVest Financial Holdings is a full service NATURE OF BUSINESS: Oando plc is one of Africa’s largest integrated

financialservicesGroupthatisabletooffersolutionsforthemajorityofthe energy solutions provider with a proud heritage. It has a primary listing on

financial needs of its clients. The core subsidiary companies of the Group the Nigeria Stock Exchange and a secondary listing on the Johannesburg

are NFB Private Wealth Management and NVest Securities which are both Stock Exchange. With shared values of Teamwork, Respect, Integrity,

asset management and private wealth businesses, with well in excess of Passion and Professionalism (TRIPP). The Oando Group comprises four

R30.1 billion assets under administration and management. The full companies who are leaders in their market: Oando Energy Resources,

service offering of the Group is fairly unique in South Africa in that it is an Oando Trading, OVH Energy.

independent financial services Group that has its own stock broking SECTOR: Energy—Energy—Oil,Gas&Coal—Oil Refining & Marketing

company which is an equities member of the JSE and is able to leverage off NUMBER OF EMPLOYEES: 137

this inherent strength in its product offering both within that stock DIRECTORS: Akinrele A (ne, Nig), Irune Dr A A, Mede N F,

broking company and the financial advisory businesses. Osakwe I (ind ne, Nig), Sokefun R (ind ne), Yakubu T (ind ne, Nig),

SECTOR: AltX GbadeboOMA (Chair, ind ne, Nig), Tinubu J (CEO, Nig),

NUMBER OF EMPLOYEES: 159 Boyo O (Deputy CEO, Nig), Adeyemo O (FD, Nig)

DIRECTORS: Estment M (Executive), Emslie D (ind ne), Lemmon C G, MAJOR ORDINARY SHAREHOLDERS as at 29 Nov 2021

Mangxamba L (ind ne), Schemel D (ne), Weldon ProfLJ(ind ne), Leaf Investment & Realtors Ltd. 15.83%

Goldberg J (Chair, ind ne), Godwin A D (CEO), Kwatsha S R (CIO), POSTAL ADDRESS: 9th -12th Floor, The Wings Office Complex, 17a

Connellan B J (COO), Ramoo D D (FD) Ozumba Mbadiwe, Victoria Island, Lagos, Nigeria, PMB12801

MAJOR ORDINARY SHAREHOLDERS as at 25 Jun 2021 MORE INFO: www.sharedata.co.za/sdo/jse/OAO

Rayner Sparg Trust 25.16% COMPANY SECRETARY: Ayotola Jagun

Godwin Trust 25.06% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

The Gavin Ramsay Family Trust 13.87% SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd.

POSTAL ADDRESS: PO Box 8132, Nahoon, East London, 5210

MORE INFO: www.sharedata.co.za/sdo/jse/NVE AUDITORS: Ernst & Young

COMPANY SECRETARY: B J Connellan CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. OAO Ords of 50 kobo ea 30 000 000 000 12 431 412 481

DESIGNATED ADVISOR: AcaciaCap Advisors Sponsors (Pty) Ltd. DISTRIBUTIONS [NGNk]

AUDITORS: BDO Cape Incorporated Ords of 50 kobo ea Ldt Pay Amt

CAPITAL STRUCTURE AUTHORISED ISSUED Interim No 23 5 Dec 14 15 Dec 14 70.00

NVE Ords no par value 1 000 000 000 245 942 814 Final No 22 7 Nov 14 17 Nov 14 30.00

DISTRIBUTIONS [ZARc] LIQUIDITY: Jan22 Avg 148 258 shares p.w., R23 702.9(-% p.a.)

Ords no par value Ldt Pay Amt OILP 40 Week MA OANDO

Interim No 14 16 Nov 21 22 Nov 21 5.75

127

Final No 13 14 Jun 21 21 Jun 21 6.00

LIQUIDITY: Jan22 Avg 1m shares p.w., R2.4m(23.9% p.a.) 102

GENF 40 Week MA NVEST

77

313

51

278

26

244

1

2017 | 2018 | 2019 | 2020 | 2021

209

FINANCIAL STATISTICS

175 (NGN million) Sep 19 Dec 18 Dec 17 Dec 16 Dec 15

Quarterly Final Final Final Final

140 Turnover 98 351 679 465 497 422 455 747 203 432

2017 | 2018 | 2019 | 2020 | 2021

Op Inc 18 592 44 002 56 678 - 7 658 10 403

FINANCIAL STATISTICS

(Amts in ZAR'000) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18 NetIntPd(Rcvd) 10 344 32 441 33 784 51 056 48 638

Interim Final Final Final Final Minority Int 1 062 4 365 5 831 369 745

Turnover 155 591 276 231 310 186 306 336 290 943 Att Inc 4 833 24 433 13 942 3 125 - 50 435

Op Inc 34 421 79 709 89 419 92 298 87 398 TotCompIncLoss 7 357 38 084 70 995 112 382 - 37 831

NetIntPd(Rcvd) 197 - 237 2 003 4 166 5 311 Fixed Ass 354 524 355 020 343 466 293 542 223 130

Minority Int 322 581 977 1 073 1 084 Inv & Loans 1 033 1 033 1 033 - -

Att Inc 27 458 62 790 65 481 63 727 59 047 Tot Curr Ass 128 980 130 119 106 940 190 708 356 598

TotCompIncLoss 27 780 57 120 67 333 66 106 60 728 Ord SH Int 209 055 200 875 175 602 122 363 36 852

Fixed Ass 63 211 63 935 73 382 47 488 41 099 Minority Int 80 275 76 242 87 834 69 981 14 042

LT Liab 330 183 348 228 376 677 342 260 254 893

Inv & Loans 281 043 281 039 274 256 306 122 308 338

Tot Curr Ass 106 641 223 213 221 660 197 147 190 006 Tot Curr Liab 460 429 449 765 400 064 456 940 640 535

Ord SH Int 391 922 503 641 483 980 451 308 421 090 PER SHARE STATISTICS (cents per share)

Minority Int 1 990 2 192 2 437 2 284 2 054 NAV PS (ZARc) 67.27 64.63 58.06 40.67 24.69

LT Liab 88 231 61 882 76 652 125 701 158 701 3 Yr Beta 0.19 0.73 0.27 0.81 0.84

Tot Curr Liab 64 119 96 574 100 733 68 286 55 965 Price High 30 56 38 68 150

Price Low 10 16 16 13 33

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 9.52 20.04 21.30 21.78 19.66 Price Prd End 22 20 30 38 44

DPS (ZARc) 5.75 11.50 11.75 11.75 11.00 RATIOS

NAV PS (ZARc) 138.40 166.09 159.60 149.07 139.09 Ret on SH Fnd 8.15 10.39 7.51 1.82 - 97.63

3 Yr Beta - 0.54 - 0.44 - 0.43 0.37 - Oper Pft Mgn 18.90 6.48 11.39 - 1.68 5.11

Price High 250 222 219 210 270 D:E 1.58 1.74 1.95 2.53 8.37

Price Low 147 51 160 150 180 Current Ratio 0.28 0.29 0.27 0.42 0.56

Price Prd End 210 175 203 184 197

RATIOS

Ret on SH Fnd 14.10 12.53 13.66 14.29 14.21

Oper Pft Mgn 22.12 28.86 28.83 30.13 30.04

D:E 0.27 0.23 0.28 0.35 0.38

Current Ratio 1.66 2.31 2.20 2.89 3.40

Div Cover 1.69 1.80 1.84 1.79 1.77

178