Page 142 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 142

JSE – HYP Profile’s Stock Exchange Handbook: 2022 – Issue 1

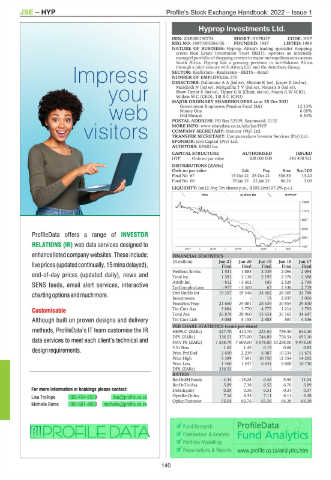

Hyprop Investments Ltd.

HYP

ISIN: ZAE000190724 SHORT: HYPROP CODE: HYP

REG NO: 1987/005284/06 FOUNDED: 1987 LISTED: 1988

NATURE OF BUSINESS: Hyprop, Africa's leading specialist shopping

centre Real Estate Investment Trust (REIT), operates an internally

managed portfolio of shopping centres in major metropolitan areas across

South Africa. Hyprop has a growing presence in sub-Saharan Africa,

through a joint venture with Attacq Ltd. and the Atterbury Group.

SECTOR: RealEstate—RealEstate—REITS—Retail

NUMBER OF EMPLOYEES: 270

DIRECTORS: DallamoreAA(ind ne), Ellerine K (ne), Jasper Z (ind ne),

Mandindi N (ind ne), MokgatlhaTV(ind ne), Noussis S (ind ne),

Shaw-Taylor S (ind ne), Tipper G R (Chair, ind ne), Nauta A W (CIO),

Wilken M C (CEO), Till B C (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 25 Oct 2021

Government Employees Pension Fund (SA) 12.13%

Ninety One 6.05%

Old Mutual 5.54%

POSTAL ADDRESS: PO Box 52509, Saxonwold, 2132

MORE INFO: www.sharedata.co.za/sdo/jse/HYP

COMPANY SECRETARY: Statucor (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital (Pty) Ltd.

AUDITORS: KPMG Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

HYP Ords no par value 500 000 000 343 438 921

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt Scr/100

Final No 67 19 Oct 21 25 Oct 21 336.53 13.20

Final No 66 19 Jan 21 25 Jan 21 66.26 3.00

LIQUIDITY: Jan22 Avg 7m shares p.w., R203.2m(107.2% p.a.)

REIV 40 Week MA HYPROP

13400

11013

8627

6240

3854

1467

2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final Final Final

NetRent/InvInc 1 531 1 885 2 039 2 064 2 094

Total Inc 1 581 2 138 2 195 2 376 2 388

Attrib Inc - 812 - 3 402 165 2 529 2 768

TotCompIncLoss - 977 - 3 500 67 2 536 2 719

Ord UntHs Int 19 357 19 346 24 452 26 305 24 788

Investments - - 19 2 937 3 006

FixedAss/Prop 21 660 24 081 28 639 30 854 29 830

Tot Curr Ass 3 884 3 770 4 777 1 214 1 793

Total Ass 26 878 28 960 33 654 35 165 34 647

Tot Curr Liab 3 088 5 158 2 583 567 4 336

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 327.70 410.70 223.50 759.30 644.40

DPS (ZARc) 336.53 375.00 744.89 756.54 695.10

NAV PS (ZARc) 7 538.79 7 609.00 9 578.00 10 298.00 9 978.00

3 Yr Beta 1.62 1.45 0.19 0.68 0.83

Price Prd End 2 650 2 239 6 987 10 234 11 675

Price High 3 399 7 391 10 750 12 354 14 292

Price Low 1 460 1 447 6 641 9 800 10 730

DPS (ZARc) 336.53 - - - -

RATIOS

RetOnSH Funds - 4.34 - 18.28 0.46 9.55 11.04

RetOnTotAss 5.89 7.38 6.52 6.76 6.89

Debt:Equity 0.29 0.36 0.31 0.31 0.37

OperRetOnInv 7.16 8.33 7.11 6.11 6.38

OpInc:Turnover 55.04 60.76 63.36 66.28 66.10

Fund Research

Comparison & Analysis

Portfolio Modelling

Presentations & Reports www.profile.co.za/analytics.htm

140