Page 137 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 137

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – HAR

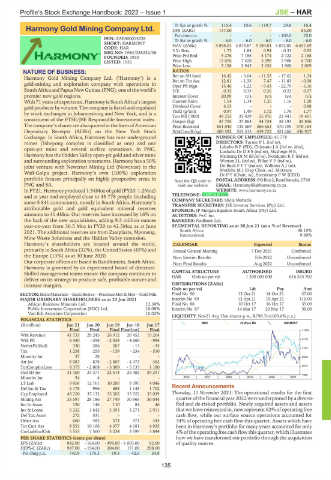

Tr 5yr av grwth % 115.4 10.6 - 119.7 29.8 18.4

Harmony Gold Mining Company Ltd. DPS (ZARc) 137.00 - - - 85.00

HAR Pct chng p.a. - - - - 100.0 70.0

ISIN: ZAE000015228 Tr 5yr av grwth% -6.0 -6.0 -6.0 -6.0 -6.0

SHORT: HARMONY NAV (ZARc) 5 058.01 3 874.87 4 189.01 5 073.85 6 657.69

CODE: HAR

REG NO: 1950/038232/06 3 Yr Beta 1.73 1.84 0.94 - 0.33 0.92

FOUNDED: 1950 Price Prd End 5 276 7 186 3 174 2 122 2 168

LISTED: 1951 Price High 12 676 7 428 3 298 2 908 6 700

Price Low 5 138 2 945 2 036 1 900 2 009

NATURE OF BUSINESS: RATIOS

1.24

Harmony Gold Mining Company Ltd. (‘Harmony’) is a Ret on SH fund 16.42 - 3.64 - 11.53 - 17.62 - 0.38

- 1.33

12.81

7.47

- 11.83

Ret on Tot Ass

gold-mining and exploration company with operations in Oper Pft Mgn 15.46 - 1.22 - 9.43 - 22.79 - 5.16

SouthAfricaandPapuaNew Guinea(PNG), oneoftheworld’s D:E 0.33 0.33 0.26 0.22 0.07

premier new gold regions. Interest Cover 20.09 n/a n/a n/a n/a

With 71years ofexperience, Harmonyis SouthAfrica’s largest Current Ratio 1.54 1.34 1.35 1.16 1.28

gold producer by volume. The company is listed and regulated Dividend Cover 6.15 - - - 0.98

1.77

0.97

1.76

1.49

1.72

by stock exchanges in Johannesburg and New York, and is a Yield (g/ton) 49 253 25 429 25 976 22 441 19 401

Ton Mll (‘000)

constituent of the FTSE/JSE Responsible Investment index. Output (kg) 47 755 37 863 44 734 38 193 33 836

The company’s shares are also quoted in the form ofAmerican Price Received 851 045 735 569 586 653 570 709 570 164

Depositary Receipts (ADRs) on the New York Stock WrkCost(R/kg) 600 592 553 513 439 722 421 260 436 917

Exchange. In South Africa, Harmony has nine underground NUMBER OF EMPLOYEES: 45 778

mines (Tshepong complex is classified as one) and one DIRECTORS: TurnerPL(ind ne),

open-pit mine and several surface operations. In PNG, Lekubo B P (FD), ChissanoJA(ind ne, Moz),

Lushaba DrDSS(ind ne), Mashego H E,

Harmony has the Hidden Valley open-pit gold and silver mine MsimangDrM(ld ind ne), Nondumo K T (ind ne),

and surrounding exploration tenements. Harmony has a 50% WettonJL(ind ne), PillayVP(ind ne),

joint venture with Newcrest Mining Ltd (Newcrest) in the De BuckFFT(ind ne), WilkensAJ(ne),

Wafi-Golpu project. Harmony’s own (100%) exploration Motloba M J (Dep Chair, ne), Motsepe

Dr P T (Chair, ne), Steenkamp P W (CEO)

portfolio focuses principally on highly prospective areas in Scan the QR code to POSTAL ADDRESS:POBox2,Randfontein,1760

PNG and SA. visit our website EMAIL: HarmonyIR@harmony.co.za

In FY21, Harmony produced 1.54Moz of gold (FY20: 1.2Moz) WEBSITE: www.harmony.co.za

and at year end employed close to 45 778 people (including TELEPHONE: 011-411-2000

some 5 841 contractors), mostly in South Africa. Harmony’s COMPANY SECRETARY: Shela Mohatla

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

attributable gold and gold equivalent mineral reserves SPONSOR: JP Morgan Equities South Africa (Pty) Ltd.

amounts to 31.4Moz. Our reserves have increased by 16% on AUDITORS: PwC Inc.

the back of the new acquisitions, adding 9.3 million ounces BANKERS: Nedbank Ltd.

year-on-year from 36.5 Moz in FY20 to 42.5Moz as at June SEGMENTAL REPORTING as at 30 Jun 21 (asa%of Revenue)

2021. The additional reserves are from Zaaiplaats, Mponeng, South Africa 90.10%

Mine Waste Solutions and the Hidden Valley extension. International 9.90%

Harmony’s shareholders are located around the world, CALENDAR Expected Status

primarily in South Africa (32%), the United States (45%) and Annual General Meeting 7 Dec 2021 Confirmed

the Europe (13%) as at 30 June 2020. Next Interim Results Feb 2022 Unconfirmed

Our corporate offices are based in Randfontein, South Africa. Next Final Results Aug 2022 Unconfirmed

Harmony is governed by an experienced board of directors.

Skilled management teams ensure the company continues to CAPITAL STRUCTURE AUTHORISED ISSUED

deliver on its strategy to produce safe, profitable ounces and HAR Ords no par val 1 200 000 000 616 525 702

increase margins. DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin Final No 90 12 Oct 21 18 Oct 21 27.00

MAJOR ORDINARY SHAREHOLDERS as at 23 Jun 2021 Interim No 89 13 Apr 21 19 Apr 21 110.00

African Rainbow Minerals Ltd. 12.38% Final No 88 10 Oct 17 16 Oct 17 35.00

Public Investment Corporation (SOC) Ltd. 10.08% Interim No 87 14 Mar 17 20 Mar 17 50.00

Van Eck Associate Corporation 10.02%

LIQUIDITY: Nov21 Avg 13m shares p.w., R798.7m(109.6% p.a.)

FINANCIAL STATISTICS

MINI 40 Week MA HARMONY

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final Final(rst) Final 11650

Wrk Revenue 41 733 29 245 26 912 20 452 19 264

Wrk Pft 6 450 - 358 - 2 538 - 4 660 - 994 9716

NetIntPd(Rcd) 330 286 267 - 13 - 34

7782

Tax 1 258 255 - 139 - 234 - 510

Minority Int 37 28 - - - 5848

Att Inc 5 087 - 878 - 2 607 - 4 473 362

TotCompIncLoss 8 375 - 2 808 - 3 309 - 5 133 1 180 3914

Ord SH Int 31 160 23 371 22 614 25 382 29 291

1980

Minority Int 54 4 - - - 2016 | 2017 | 2018 | 2019 | 2020 | 2021

LT Liab 9 858 12 761 10 200 9 395 4 046

Def Inc & Tax 2 178 996 688 1 145 1 702 Recent Announcements

Cap Employed 43 250 37 132 33 502 35 922 35 039 Thursday, 11 November 2021: The operational results for the first

Mining Ass 33 597 29 186 27 749 30 969 30 044 quarter of the financial year 2022 were underpinned by a diversi-

Inv In Assoc 126 146 110 84 46 fied and de-risked portfolio. Newly acquired assets and assets

Inv & Loans 5 232 3 642 3 393 3 271 2 911 that we have reinvested in, now represent 62% of operating free

Def Tax Asset 272 531 - - - cash flow, while our surface source operations accounted for

Other Ass 660 485 574 471 344 34% of operating free cash flow this quarter. Assets which have

Tot Curr Ass 8 551 10 166 4 377 4 181 4 935 been in Harmony’s portfolio for many years accounted for only

CurLiabExclCsh 5 553 7 560 3 234 3 599 3 844 4% of the operating free cash flow this quarter, which illustrates

PER SHARE STATISTICS (cents per share) how we have transformed our portfolio through the acquisition

EPS (ZARc) 842.00 - 164.00 - 498.00 - 1 003.00 82.00 of quality ounces.

HEPS-C (ZARc) 987.00 - 154.00 204.00 171.00 298.00

Pct chng p.a. 740.9 - 175.5 19.3 - 42.6 34.8

135