Page 147 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 147

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – INS

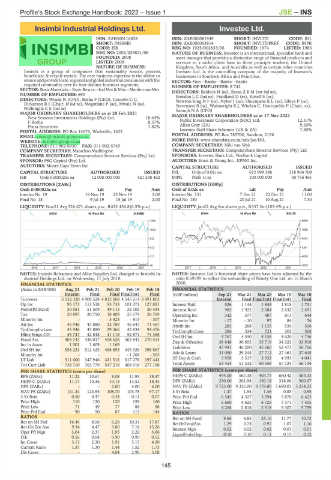

Insimbi Industrial Holdings Ltd. Investec Ltd.

INS INV

ISIN: ZAE000116828 ISIN: ZAE000081949 SHORT: INVLTD CODE: INL

SHORT: INSIMBI ISIN: ZAE000063814 SHORT: INVLTDPREF CODE: INPR

CODE: ISB REG NO: 1925/002833/06 FOUNDED: 1974 LISTED: 1986

REG NO: 2002/029821/06 NATURE OF BUSINESS: Investec is an international, specialist bank and

FOUNDED: 2008 asset manager that provides a distinctive range of financial products and

LISTED: 2008 services to a niche client base in three principle markets, the United

NATURE OF BUSINESS: Kingdom, South Africa, and Australia as well as certain other countries.

Insimbi is a group of companies that sustainably source, process, Investec Ltd. is the controlling company of the majority of Investec's

beneficiate & recycle metals. The core business expertise is the ability to businesses in Southern Africa and Mauritius.

sourceandprovidelocal,regionalandglobalindustrialconsumerswiththe SECTOR: Fins—Banks—Banks—Banks

required commodity over its four distinct business segments. NUMBER OF EMPLOYEES: 8 742

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—NonferrousMet

NUMBER OF EMPLOYEES: 690 DIRECTORS: Baldock H (ne), BassaZBM(snr ind ne),

BowdenLC(ind ne), Friedland D (ne), Koseff S (ne),

DIRECTORS: Winde N (CFO), Botha F (CEO), Coombs C C, Newton-KingNF(ne), Nyker J (ne), ShuenyaneKL(ne), Sibiya P (ne),

Dickerson R I (Chair, ld ind ne), Mogotlane P (ne), Mwale N (ne), Stevenson B (ne), Wainwright R J, Whelan C, Hourquebie P (Chair, ne),

NtshingilaCS(ind ne) Samujh N A (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021 MAJOR ORDINARY SHAREHOLDERS as at 17 Nov 2021

New Seasons Investments Holdings (Pty) Ltd. 18.64%

F Botha 8.37% Public Investment Corporation (SOC) Ltd. 12.31%

Allan Gray (ZA)

9.20%

Pruta Securities 7.82%

POSTAL ADDRESS: PO Box 14676, Wadeville, 1422 Investec Staff Share Schemes (UK & ZA) 7.80%

EMAIL: cosec@insimbi-group.co.za. POSTAL ADDRESS: PO Box 785700, Sandton, 2196

WEBSITE: insimbi-group.co.za MORE INFO: www.sharedata.co.za/sdo/jse/INL

TELEPHONE: 011-902-6930 FAX: 011-902-5749 COMPANY SECRETARY: Niki van Wyk

COMPANY SECRETARY: Matseliso Madhlophe TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSORS: Investec Bank Ltd., Nedbank Capital

SPONSOR: PSG Capital (Pty) Ltd. AUDITORS: Ernst & Young Inc., KPMG Inc.

AUDITORS: Moore Cape Town Inc CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED INL Ords of 0.02c ea 612 999 388 318 904 709

ISB Ords 0.000025c ea 12 000 000 000 421 538 462 INPR Prefs 1c ea 100 000 000 30 756 461

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [GBPp]

Ords 0.000025c ea Ldt Pay Amt Ords of 0.02c ea Ldt Pay Amt

Interim No 19 19 Nov 19 25 Nov 19 2.00 Interim No 131 7 Dec 21 22 Dec 21 11.00

Final No 18 9 Jul 19 15 Jul 19 2.00 Final No 130 20 Jul 21 10 Aug 21 7.50

LIQUIDITY: Nov21 Avg 526 671 shares p.w., R432 456.8(6.5% p.a.) LIQUIDITY: Jan22 Avg 6m shares p.w., R357.2m(103.4% p.a.)

INDM 40 Week MA INSIMBI BANK 40 Week MA INVLTD

1354 8869

1093 7666

832 6463

572 5261

311 4058

50 2855

2016 | 2017 | 2018 | 2019 | 2020 | 2021 2017 | 2018 | 2019 | 2020 | 2021

NOTES: Insimbi Refractory and Alloy Supplies Ltd. changed to Insimbi In- NOTES: Investec Ltd.'s historical share prices have been adjusted by the

dustrial Holdings Ltd. on Wednesday, 11 July 2018. ratio 0.69599 to reflect the unbundling of Ninety One Ltd. on 16 March

2020.

FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18 FINANCIAL STATISTICS

Interim Final Final Final(rst) Final (GBP million) Sep 21 Mar 21 Mar 20 Mar 19 Mar 18

Turnover 3 132 320 4 909 528 4 812 068 4 545 214 3 491 803 Interim Final Final(rst) Final(rst) Final

Op Inc 95 173 113 518 93 733 101 071 127 831 Interest Paid 526 1 144 1 845 1 815 1 731

NetIntPd(Rcvd) 30 581 51 509 49 115 32 105 30 434 Interest Rcvd 985 1 922 2 684 2 632 2 491

Tax 20 897 20 750 18 409 25 179 28 769 Operating Inc 342 377 487 611 644

Minority Int - - - 3 423 - 813 - 307 Minority Int - 17 - 10 97 84 76

Att Inc 45 946 43 880 32 789 46 647 71 467 Attrib Inc 283 268 1 135 534 506

TotCompIncLoss 45 946 43 880 29 366 45 834 94 476 TotCompIncLoss 286 524 721 303 568

Hline Erngs-CO 45 747 42 848 41 118 52 871 71 368 Ord SH Int 4 767 4 590 4 158 4 620 4 746

Fixed Ass 403 743 436 017 458 628 362 842 270 514 Dep & OtherAcc 38 648 36 853 35 719 34 323 33 918

Inv in Assoc 1 301 1 609 1 169 - -

Ord SH Int 558 221 512 425 468 893 445 926 398 867 Liabilities 47 941 46 200 45 660 52 473 50 706

Minority Int - - - - 1 268 - 565 Adv & Loans 31 050 29 244 27 712 27 461 27 645

LT Liab 311 600 347 946 421 516 317 278 197 443 ST Dep & Cash 3 958 3 517 3 932 4 993 4 041

Tot Curr Liab 738 710 763 779 547 216 404 918 277 158 Total Assets 53 454 51 532 50 558 57 724 56 134

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

EPS (ZARc) 11.22 10.61 8.08 11.93 18.47 HEPS-C (ZARc) 494.00 567.38 403.77 660.42 583.33

HEPS-C (ZARc) 11.17 10.36 10.13 13.52 18.45 DPS (ZARc) 230.00 261.98 150.18 318.06 300.67

DPS (ZARc) - - 2.00 4.00 6.00 NAV PS (ZARc) 9 723.00 9 326.00 9 178.00 5 680.03 5 234.23

NAV PS (ZARc) 141.34 123.95 108.70 103.78 97.17 3 Yr Beta 1.47 1.54 1.46 0.83 0.95

3 Yr Beta 0.50 0.47 0.44 - 0.11 0.07 Price Prd End 6 545 4 327 3 294 5 870 6 423

Price High 110 120 120 159 160 Price High 6 660 4 625 6 725 7 371 7 405

Price Low 71 49 77 88 96 Price Low 4 268 2 814 2 518 5 307 5 759

Price Prd End 90 90 87 113 144 RATIOS

RATIOS Ret on SH Fund 9.66 4.85 25.16 11.77 10.72

Ret on SH Fnd 16.46 8.56 6.26 10.31 17.87 RetOnTotalAss 1.29 0.74 0.97 1.07 1.16

Ret On Tot Ass 9.34 4.47 3.80 7.18 13.26 Interest Mgn 0.02 0.02 0.02 0.01 0.01

Oper Pft Mgn 3.04 2.31 1.95 2.22 3.66 LiquidFnds:Dep 0.10 0.10 0.11 0.15 0.12

D:E 0.56 0.68 0.90 0.90 0.52

Int Cover 3.11 2.20 1.91 3.15 4.20

Current Ratio 1.37 1.30 1.44 1.52 1.73

Div Cover - - 4.04 2.98 3.08

145